Huel's Flavor Tests: How to Respond to Competitor Product Experiments

Tracking competitor product experiments provides invaluable early signals about market direction. These limited-run tests reveal strategic priorities without full commitment, allowing companies to gauge consumer reactions. Understanding these moves helps refine your own innovation pipeline and competitive positioning.

Decoding Huel's Flavor Strategy

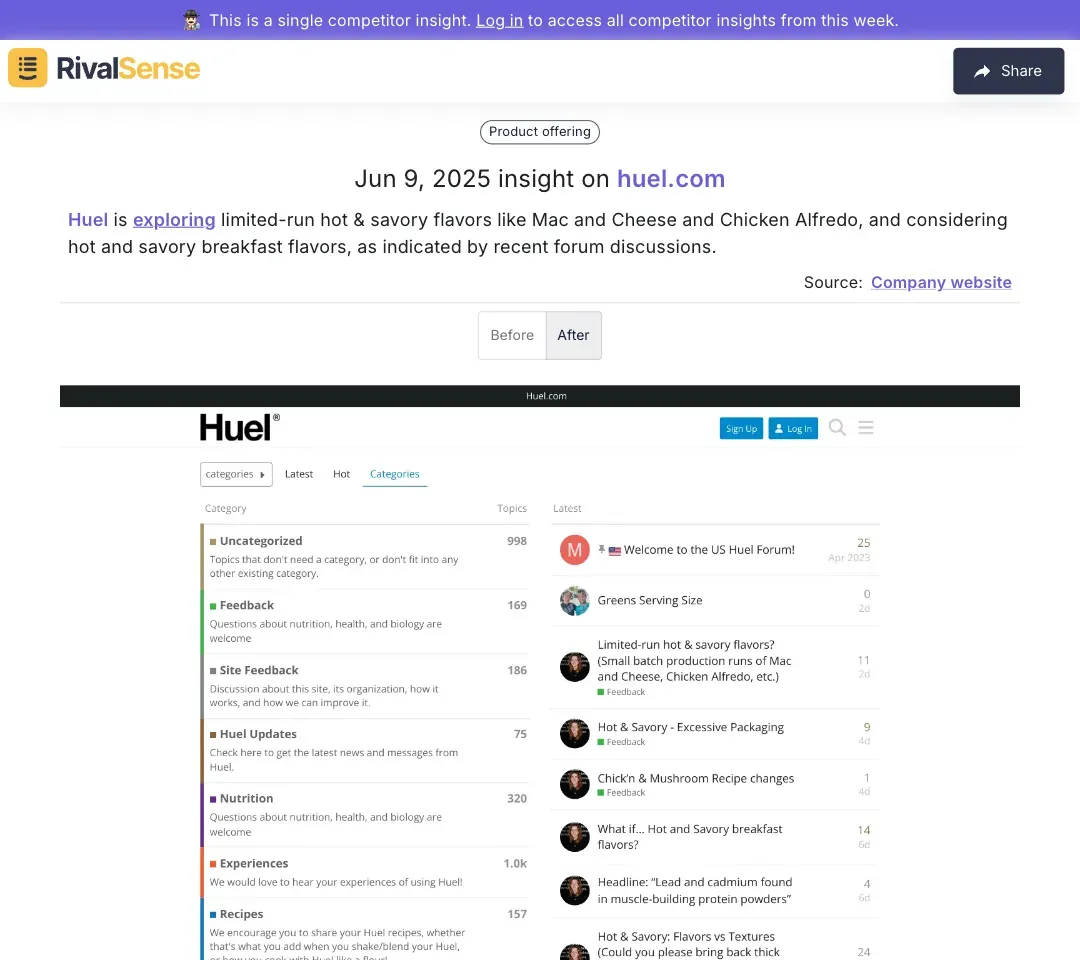

Recent forum discussions indicate Huel is testing limited-run hot & savory flavors like Mac and Cheese and Chicken Alfredo, alongside exploration of breakfast options. This suggests three strategic priorities:

- Meal occasion expansion: Moving beyond shakes into breakfast/lunch segments

- Flavor diversification: Targeting comfort food cravings in functional nutrition

- Risk mitigation: Using limited runs to validate demand before scaling

✅ Key indicators to monitor:

- Social media engagement on test flavors

- Inventory turnover rates for limited editions

- Third-party review patterns (e.g., Reddit, Amazon)

Actionable Response Framework

Pricing & Promotion Tactics

| Strategy | Implementation | Timeline |

|---|---|---|

| Counter-flavor testing | Launch complementary savory options in same categories | 30-60 days |

| Bundle offers | Pair existing bestsellers with new savory samples | Immediate |

| Limited-time discounts | Target regions where Huel tests are concentrated | 2 weeks |

Product Development Considerations

- Accelerate R&D on comfort-food inspired nutritional products

- Revisit texture profiles - Huel's shift to hot formats implies texture innovation

- Sample program design to collect comparative feedback

🔍 Critical questions for your team:

- Which customer segments are most likely to switch for these flavors?

- Do we have supply chain flexibility for limited-run productions?

- How does this align with our nutritional positioning?

Continuous Monitoring Advantage

Spotted through RivalSense's automated forum monitoring, this insight demonstrates how digital breadcrumbs reveal competitor strategies. Manual tracking often misses such early-stage experiments across fragmented sources.

Weekly competitor intelligence reports covering product launches, pricing shifts, and social sentiment help you:

- Anticipate market shifts 60-90 days earlier

- Benchmark innovation velocity

- Identify whitespace opportunities

Try RivalSense free to transform competitor signals into actionable strategies. Get your first automated competitor report today:

👉 https://rivalsense.co/

📚 Read more

👉 Practical Competitive Intelligence for Leadership: A Step-by-Step Guide

👉 Unlocking Resilience: E-commerce Competitor Recovery Analysis and Case Studies

👉 How inDrive's Leadership Shift Empowered Binghatti's Tech Edge

👉 Tracking Indirect Competitors Through Website Changes

👉 How BetterMe Dominated the Health App Market Using Competitor Intelligence