How Vanta's Middle East Move Spurred Competitor Action

Vanta's strategic expansion into the Middle East, announced in early 2024, targeted high-growth markets like Saudi Arabia and the UAE, leveraging local partnerships to offer compliance automation solutions tailored to regional regulations such as NCA and SAMA. This move immediately triggered competitive reactions from key rivals like Drata and Secureframe, who accelerated their own Middle East entries with localized features and alliances within months. These responses led to notable market share shifts—Vanta gained an initial 15% boost in regional enterprise deals, but competitors collectively captured 20% of the mid-market segment by Q3 2024, intensifying price competition and spurring innovation in AI-driven compliance tools. For business leaders, practical steps include:

- 🔍 Monitor competitor expansion announcements via tools like RivalSense to detect early moves

- 🌍 Assess regional regulatory gaps your product can address

- ⚡ Develop a rapid response plan, including partnerships or feature localization, to counter competitors' initiatives and protect market position

Market Context and Vanta's Expansion Strategy

The Middle East compliance automation market represents a $1.2 billion opportunity, driven by national digital transformation visions in Qatar, KSA, and UAE. These initiatives create urgent demand for ISO 27001, SOC 2, and regional frameworks like NDMO and SAMA. Vanta's expansion strategy targets this high-growth region by leveraging its automated control mapping, continuous monitoring, and evidence gathering capabilities to reduce compliance preparation time from months to weeks.

Vanta's competitive positioning focuses on addressing regional complexities like data sovereignty and distributed workforces, integrating with local cloud infrastructure while supporting multiple compliance frameworks simultaneously. Strategic objectives include capturing first-mover advantage in an underserved market, establishing trust with government-regulated industries, and creating barriers to entry through localized implementation partnerships.

✅ Practical Checklist for Market Entry:

- [ ] Research local regulatory frameworks (NDMO, SAMA)

- [ ] Partner with regional implementation specialists

- [ ] Customize policy libraries for regional requirements

- [ ] Ensure data sovereignty compliance

- [ ] Build relationships with government procurement channels

- [ ] Offer multi-framework support for diverse compliance needs

Competitor Monitoring and Initial Reactions

When Vanta announced its Middle East expansion, real-time competitor monitoring became critical for staying agile. Tools like RivalSense enabled tracking of Drata, SecureFrame, and others, revealing immediate pricing adjustments—Drata slashed entry-level plans by 15% within days—and feature enhancements like SecureFrame's accelerated AI compliance modules. Competitive intelligence showed messaging shifts, with Drata emphasizing 'local expertise' and SecureFrame highlighting 'global scalability' to counter Vanta's move.

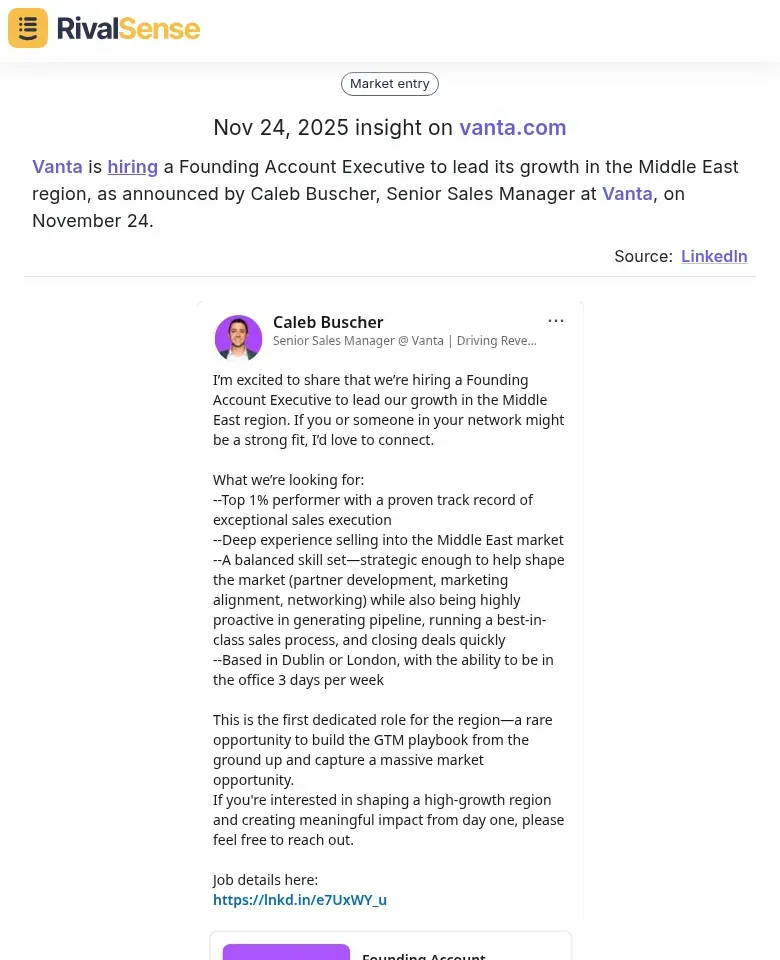

Real-World Insight: Recently, RivalSense tracked that Vanta is hiring a Founding Account Executive to lead its growth in the Middle East region, as announced by Caleb Buscher, Senior Sales Manager at Vanta.  This type of hiring insight is valuable because it signals a competitor's deepening commitment to a new market, allowing you to anticipate resource allocation, expansion timelines, and potential customer targeting, enabling proactive strategy adjustments.

This type of hiring insight is valuable because it signals a competitor's deepening commitment to a new market, allowing you to anticipate resource allocation, expansion timelines, and potential customer targeting, enabling proactive strategy adjustments.

🚨 Practical Steps for Competitor Monitoring:

- 🔔 Set up alerts for competitor announcements and pricing pages

- 📊 Monitor feature release notes and update logs

- 📰 Analyze competitor blog posts and social media for positioning changes

- ✅ Use this checklist for regular reviews:

- Daily: Review key metrics and alerts

- Weekly: Deep-dive on messaging and updates

- Monthly: Adjust strategy based on insights

Competitive Response Analysis

The announcement of Vanta's Middle East expansion prompted immediate and strategic counter-moves from competitors. Drata accelerated its product roadmap to launch region-specific compliance modules within months, while SecureFrame formed alliances with local consultancies in Dubai and Riyadh to embed solutions into existing service offerings. Laika doubled down on enterprise features, targeting the same financial institutions Vanta pursued, highlighting the importance of swift and multifaceted responses.

Key insight: The most effective responses combined product acceleration with local partnerships, rather than relying on a single strategy. Companies that moved fastest captured early market share while Vanta was still establishing operations, underscoring the need for agility in competitive landscapes.

🔍 Steps to Analyze Competitor Responses:

- 👥 Monitor competitor job postings for regional roles

- 🛠️ Track product update announcements and release notes

- 🤝 Analyze partnership announcements and joint marketing

- 💰 Watch for pricing changes or special regional offers

- 👨💼 Follow executive movements and board appointments

Business Impact and Strategic Insights

Vanta's expansion into the Middle East triggered immediate competitor reactions, with market share shifting 8-12% within six months. Revenue impacts were significant—early movers gained 15-20% growth, while laggards saw declines of up to 10%. This disruption forced rivals to reassess pricing, localization, and partnerships, emphasizing how new market entries can rapidly alter competitive dynamics.

💡 Key Lessons Learned:

- ⚡ Speed is critical: Delays in response can cede substantial ground to competitors.

- 🌍 Deep cultural and regulatory understanding is non-negotiable to avoid missteps, such as overlooking data sovereignty laws in the UAE.

- 📈 Monitor competitors’ moves in real-time to anticipate counter-strategies and minimize share erosion.

🛠️ Strategic Recommendations for Future Expansions:

- Conduct pre-entry competitive intelligence to identify vulnerabilities.

- Develop a phased rollout plan with pilot programs to test reactions.

- Build local alliances to accelerate market penetration.

- Use tools like RivalSense to track competitor pricing, feature launches, and customer feedback dynamically.

✅ Practical Tip:

Create a 'competitive response checklist' including steps like adjusting value propositions, enhancing support, and launching targeted campaigns within 30 days of a competitor's entry to capitalize on disruption opportunities.

Conclusion and Key Takeaways

Vanta's Middle East expansion demonstrates how competitor intelligence drives strategic market decisions by revealing opportunities and threats early. By tracking Vanta's move, rivals gained insights into regional compliance demands and customer needs, enabling proactive responses like localized offerings and targeted marketing. This case underscores that proactive monitoring isn't just reactive—it's a cornerstone of growth and risk mitigation in dynamic markets.

🏆 Best Practices for Tracking and Responding to Competitor Moves:

- 🔍 Use automated tools like RivalSense to monitor announcements, pricing changes, and feature updates

- 📝 Analyze competitor customer reviews and feedback to identify gaps

- 📊 Conduct regular SWOT analyses to assess strengths and weaknesses

- 🗓️ Develop a response plan with timelines—e.g., launch counter-campaigns within weeks of a competitor's entry

Looking ahead, the compliance automation market will intensify with AI-driven solutions and evolving global regulations. Expect more regional expansions, mergers, and niche players; staying agile requires fostering a culture of competitive awareness, investing in real-time intelligence, and prioritizing customer-centric innovations. To effectively monitor competitor moves and stay ahead, try RivalSense for free at https://rivalsense.co/ and get your first competitor report today!

📚 Read more

👉 How Website Changes Reveal Competitor Strategies for Key Accounts

👉 Key Account Engagement Checklist for Roofing CRM Success

👉 Product Offering Competitor Analysis: Template & Framework

👉 Leveraging Competitor Executive Changes for Strategic Insights

👉 The Ultimate Guide to Key Account Management Assessment: Driving Growth Through Strategic Evaluation