How to Track Competitor Pricing for Key Account Success: A Step-by-Step Guide

Introduction: Why Competitor Pricing Intelligence is Critical for Key Account Success

In today's hyper-competitive B2B landscape, key account success hinges on one critical factor: competitor pricing intelligence. Research shows companies with robust pricing monitoring systems achieve 15-25% higher key account retention rates compared to those operating blind. This isn't about occasional price checks—it's about systematic tracking that transforms reactive account management into proactive strategic defense.

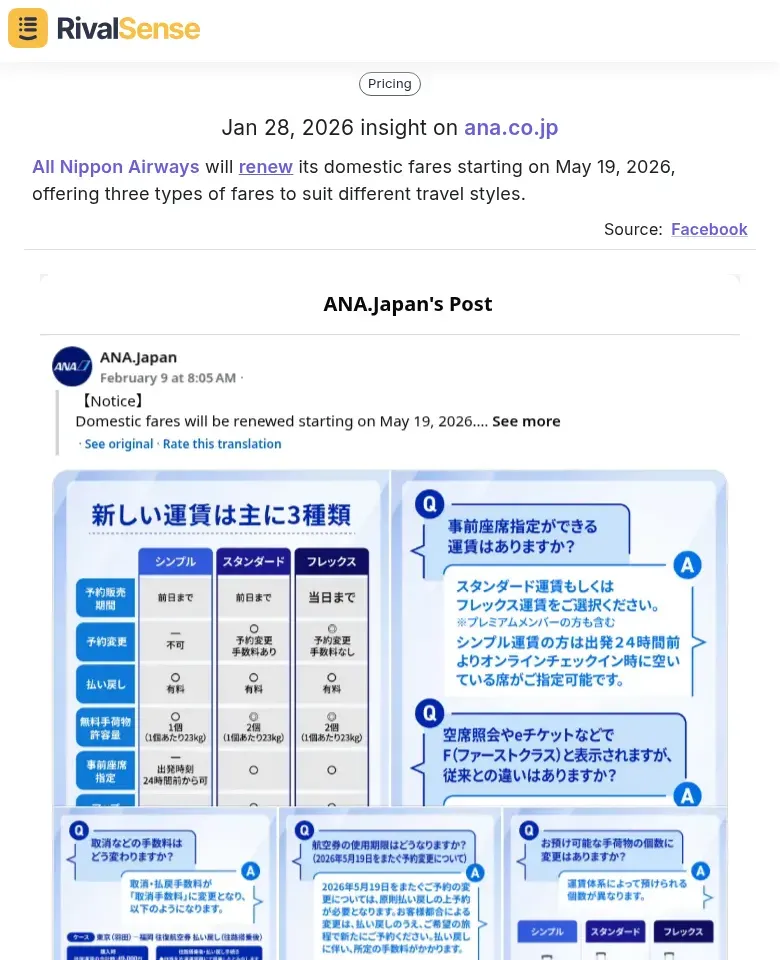

Consider this real-world scenario: When major airlines announce fare renewals, enterprise travel accounts immediately evaluate alternatives. For instance, All Nippon Airways will renew its domestic fares starting on May 19, 2026, offering three types of fares to suit different travel styles. Tracking such pricing structure changes is invaluable for business strategy as it signals market shifts and helps you prepare value-based counteroffers to maintain account control.

Without competitor pricing intelligence, you're left scrambling to respond to client demands. With it, you anticipate market shifts, prepare value-based counteroffers, and maintain account control.

Practical first steps:

- Identify 3-5 key competitors for each strategic account

- Track their pricing changes weekly (not quarterly)

- Document how competitors position price vs. value

- Create alert systems for major pricing announcements

Pro tip: Don't just track prices—analyze the patterns. Are competitors lowering prices before contract renewals? Are they offering bundled services? This intelligence transforms from data to strategic advantage, ensuring you're not just defending accounts but actively strengthening them against competitive threats.

Step 1: Identify Your Competitors' Pricing Patterns and Strategic Moves

To build a solid foundation for your pricing intelligence, begin by systematically analyzing your competitors' pricing patterns and strategic moves. This involves going beyond surface-level price checks to understand the underlying tactics and timing behind their changes. First, track seasonal pricing fluctuations - note when prices drop during holidays, back-to-school seasons, or industry-specific events. Monitor major sale announcements, especially limited-time domestic sales that indicate inventory clearance or market share grabs.

For example, Qantas Domestic CEO Markus Svensson announced on February 10 that the airline launched its biggest domestic sale in over five years, offering 1.9 million discounted Business and Economy fares. Insights like these are crucial for business strategy as they reveal aggressive market plays that can impact your key accounts, allowing you to anticipate demand shifts and adjust your offerings proactively.

Second, identify targeted promotions: track trade-in offers that appeal to existing customers, and limited-time discounts aimed at specific segments (enterprise vs. SMB). These reveal which customer groups competitors are prioritizing.

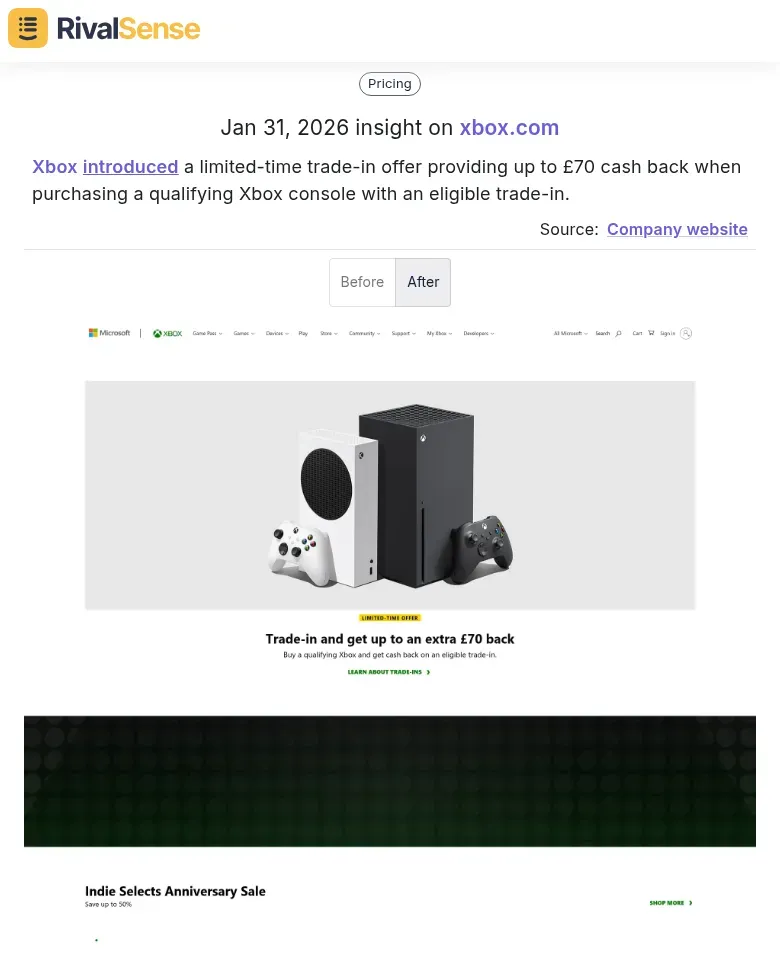

Take Xbox's limited-time trade-in offer providing up to £70 cash back when purchasing a qualifying Xbox console with an eligible trade-in. Such promotional insights help you understand competitor strategies to retain or upgrade existing customers, which is vital for defending your key accounts against similar tactics.

Third, analyze structural changes: monitor fare structure renewals and tiered pricing model updates. When competitors add premium tiers or restructure pricing, it signals strategic shifts toward higher-value services or new market segments.

Practical checklist:

- Set up alerts for competitor price changes and promotion announcements

- Document pricing patterns quarterly to identify seasonal trends

- Track which customer segments receive targeted promotions

- Note when tiered pricing models change and what new features are included

- Compare your pricing strategy against identified patterns monthly

Tip: Use competitive intelligence tools to automate tracking of pricing changes across multiple competitors simultaneously. Focus on patterns rather than individual price points - strategic intent matters more than specific numbers.

Step 2: Establish Your Competitor Pricing Monitoring Framework

Establishing a systematic competitor pricing monitoring framework transforms reactive tracking into proactive intelligence. By setting up structured processes, you ensure that pricing data flows seamlessly into your decision-making cycles. Start by setting up automated alerts across multiple channels—configure tools like RivalSense to monitor websites, social media, and email campaigns for price changes. Set critical thresholds (e.g., 5%+ price drops on key products) to filter noise and route alerts to relevant teams via Slack or email.

Create a structured approach to track diverse pricing models: monitor discounted fares for seasonal patterns, track trade-in offers for value perception shifts, and analyze tiered structures for feature-to-price mapping. Use a centralized dashboard to visualize pricing trends across competitors.

Integrate pricing intelligence with your CRM and account management systems. Sync competitor data with Salesforce or HubSpot to empower sales teams with real-time battlecards during key account negotiations. Implement automated workflows where price alerts trigger account review meetings or personalized counter-offers. This framework ensures pricing intelligence drives immediate, informed decisions rather than collecting dust in reports.

Step 3: Analyze Pricing Data for Key Account Strategy Development

Once you've gathered competitor pricing data, the real strategic work begins. Analyzing this data allows you to translate raw information into actionable strategies for key account success. Start by mapping pricing changes to specific key accounts—identify which accounts face new threats or opportunities based on competitor moves. For example, if a competitor lowers prices for enterprise clients in Q4, your key accounts in that segment now face budget pressure.

Develop response strategies by analyzing patterns: Are competitors offering seasonal discounts? Do they drop prices before contract renewals? Create a response matrix with three options: match, differentiate, or ignore. Match only when you can maintain margins; differentiate by highlighting superior features; ignore when the move targets a different customer segment.

Create value-based counteroffers that address pricing concerns while protecting profitability. Instead of matching a 15% discount, offer a 10% discount plus premium support or early access to new features. Use a tiered approach: basic (price match), standard (value-add), and premium (bundled solutions).

Practical checklist:

- Map each competitor price change to affected key accounts

- Identify the strategic intent behind competitor moves

- Calculate your margin thresholds for different response levels

- Develop 2-3 value-add options for each pricing scenario

- Time your responses to align with account renewal cycles

Tip: Track competitor promotional timing for 3-6 months to predict future moves. The most effective responses combine competitive intelligence with deep account knowledge.

Step 4: Implement Proactive Pricing Defense for Key Accounts

Don't wait for competitors to poach your key accounts—anticipate their moves with pricing intelligence. Proactive defense means staying ahead of market shifts to safeguard your most valuable relationships. Monitor competitor price changes, discount patterns, and promotional offers in real-time to identify threats before they impact your most valuable clients. For example, if a rival lowers prices for enterprise plans, you can proactively adjust your value proposition or offer strategic discounts to retain key accounts.

Develop tiered response strategies based on account importance:

- Tier 1 (Critical Accounts): Immediate, personalized defense with custom pricing, enhanced support, or bundled services.

- Tier 2 (High-Value Accounts): Pre-emptive offers or loyalty incentives when competitor activity is detected.

- Tier 3 (Growth Accounts): Standardized responses like price matching or feature highlights.

Create early warning systems by setting up alerts for competitor pricing changes that could trigger churn. Use tools to track price drops, new discount campaigns, or contract renewals in your market. Tip: Integrate this data with your CRM to flag at-risk accounts automatically.

Checklist:

- Define pricing thresholds for alerts

- Assign response owners for each tier

- Regularly review and update defense strategies based on market shifts

This proactive approach ensures you safeguard revenue and strengthen key account relationships.

Step 5: Measure and Optimize Your Pricing Intelligence Program

Effective pricing intelligence requires continuous measurement and optimization. Without tracking performance, you can't refine your strategies or demonstrate ROI. Track these key metrics quarterly:

Key Metrics to Monitor:

- Account Retention Rates: Calculate retention improvements attributed to competitive pricing insights. Companies with mature pricing intelligence see 23% higher revenue growth.

- Win Rates Against Competitor Pricing: Measure deal conversion improvements when armed with competitor pricing data. Target 8-18% win rate increases in competitive situations.

- Revenue Protection: Quantify revenue saved through early detection of competitive threats. Track at-risk customer value × retention rate improvement × CI attribution.

Practical Implementation Checklist:

- Establish baseline metrics before implementing monitoring

- Implement automated tracking systems with CRM integration

- Conduct quarterly pricing strategy reviews with stakeholders

- Use attribution confidence levels (80-95% for direct pricing adjustments, 40-70% for strategic positioning)

Regular Review Framework:

- Monthly: Review competitor pricing pattern analysis to identify trends

- Quarterly: Conduct competitive positioning assessments using fresh market data

- Bi-annually: Refine monitoring parameters based on pattern analysis

Optimization Tips:

- Start with high-impact products (50-100 SKUs) before scaling

- Match monitoring frequency to category dynamics (hourly for fast-moving goods, daily for durable goods)

- Use control group analysis to compare decisions made with/without pricing intelligence

- Implement stakeholder surveys to validate ROI calculations

Continuous Improvement: Refine your monitoring parameters based on competitor pricing pattern analysis. Companies that systematically optimize their pricing intelligence see 10-25% revenue lifts within six months and 5-8% margin improvements. Remember: The most successful programs evolve based on data, not assumptions.

Conclusion: Turn Pricing Intelligence into Competitive Advantage

Mastering competitor pricing tracking is no longer optional—it's essential for key account success. By following this step-by-step guide, you can build a robust system that protects revenue, strengthens client relationships, and drives growth.

To implement these strategies effectively, consider leveraging automated tools. For instance, RivalSense tracks competitor product launches, pricing updates, event participations, partnerships, regulatory aspects, management changes, and media mentions across company websites, social media, and various registries, delivering all in a weekly email report.

Ready to transform your approach? Try RivalSense for free today at https://rivalsense.co/ and get your first competitor report to start defending your key accounts with confidence.

📚 Read more

👉 Turning Competitor Events into Your Strategic Edge

👉 SEO Agency Benchmarking: Track Key Account Interactions for Growth

👉 How Tet's HBO Removal Enabled Competitors to Capture Premium Content Market

👉 Twitter Intelligence: Extract Competitor Insights for Key Account Success