How to Leverage Strategic Market Intelligence in Accounting

Strategic market intelligence in accounting refers to the systematic gathering, analysis, and interpretation of data about market trends, competitors, and client needs to inform business decisions. Unlike traditional accounting practices, which focus on historical financial data, market intelligence provides forward-looking insights, enabling firms to anticipate changes and stay competitive. For accounting professionals, leveraging this intelligence is crucial for identifying growth opportunities, mitigating risks, and enhancing client satisfaction.

Market intelligence differs from traditional accounting by emphasizing external factors—such as industry trends, regulatory changes, and competitor strategies—rather than internal financial reporting. This shift allows firms to adopt a proactive approach, aligning their services with market demands.

Benefits for accounting firms include improved decision-making, increased client retention, and the ability to offer tailored solutions. For professionals, it fosters career growth by developing expertise in high-demand areas like advisory services.

Practical steps to leverage market intelligence:

- Identify Key Data Sources: Utilize industry reports, competitor websites, and client feedback.

- Analyze Trends: Regularly review market data to spot emerging opportunities or threats.

- Integrate Insights: Align findings with business strategies, such as expanding service offerings.

- Train Staff: Equip your team with skills to interpret and apply market intelligence.

- Monitor Competitors: Track competitors’ moves to stay ahead.

By adopting these practices, accounting firms can transform data into actionable strategies, driving long-term success.

Real-World Examples: Turning Competitor Insights into Strategic Advantage

Competitor intelligence provides actionable signals for refining pricing, products, and positioning. Real-time tracking of rival activities helps anticipate market shifts and identify gaps in your own strategy. Consider how these recent updates could inform accounting advisory services:

-

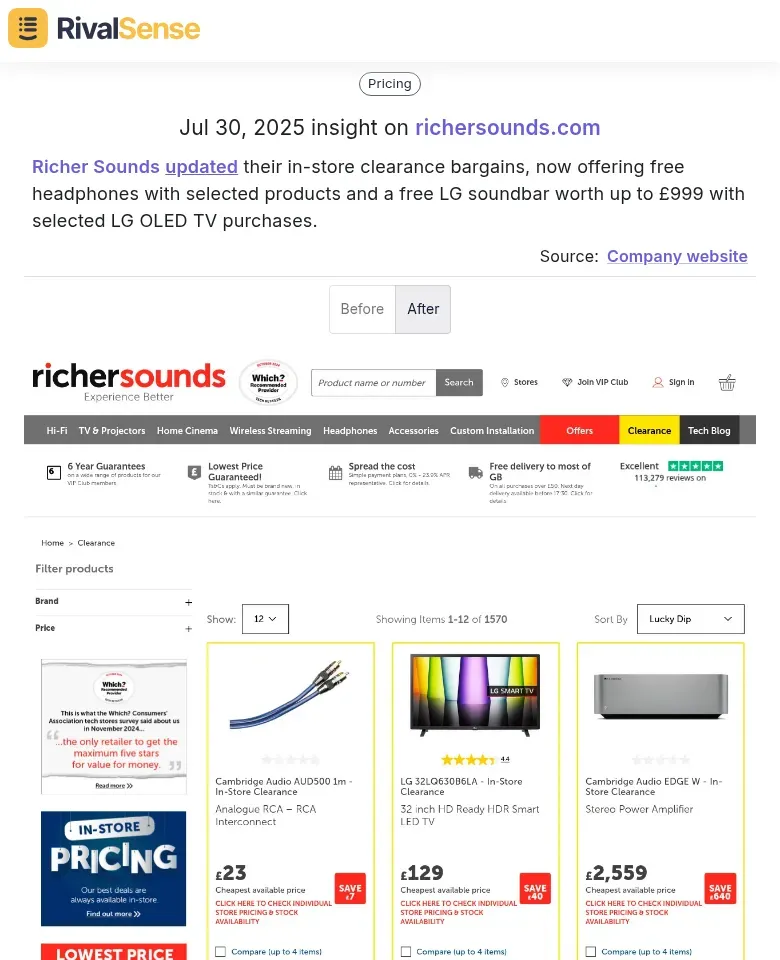

Pricing & Promotion Alert

Richer Sounds updated clearance bargains, offering free headphones with select products and a £999 LG soundbar with OLED TVs.

💡 Strategic Value: Spotting such promotions early helps clients benchmark discounts, optimize pricing strategies, and forecast revenue impacts. For accounting firms, this intelligence supports advisory on profit margins and competitive positioning. -

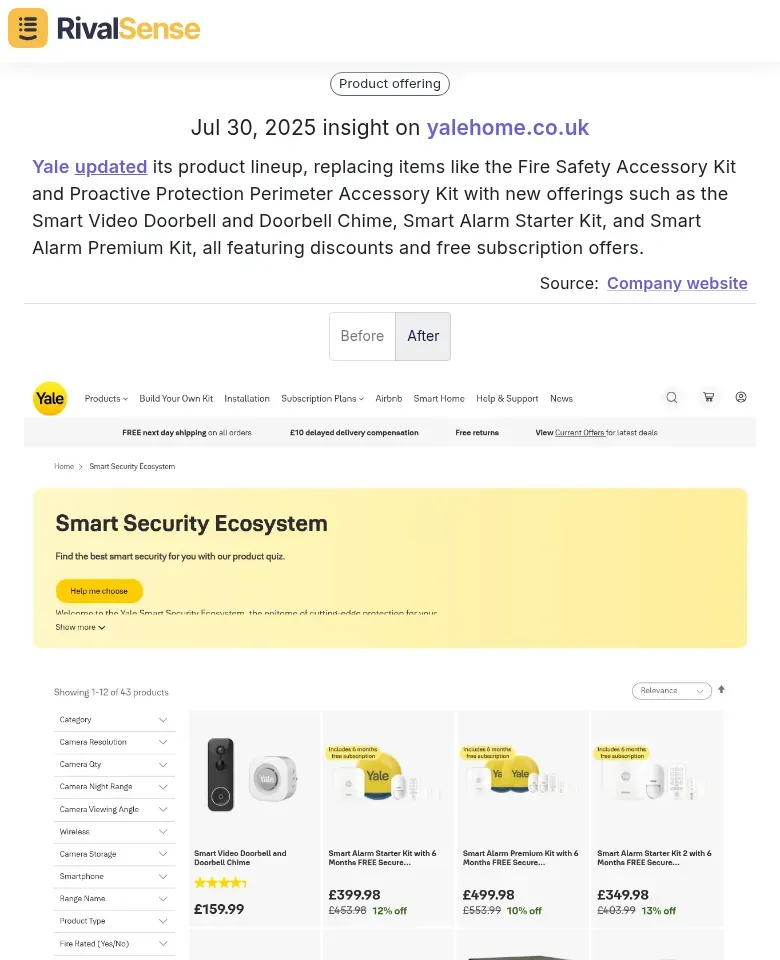

Product Line Transformation

Yale replaced legacy kits with Smart Video Doorbells and Alarm Kits, adding discounts and free subscriptions.

💡 Strategic Value: Tracking product shifts reveals market priorities (e.g., subscription models). Accounting professionals can advise clients on R&D tax credits, inventory valuation, and lifecycle costing for similar transitions. -

New Market Entry

LEGO launched Hibiscus and Bonsai Botanicals sets for pre-order (shipping August 2025).

💡 Strategic Value: Early awareness of launches aids in forecasting demand and resource allocation. For accountants, this signals opportunities to help clients model production costs or assess market saturation.

Identifying Key Market Trends and Data Sources

In the accounting sector, staying ahead means keeping a pulse on key market trends such as regulatory changes, technological advancements like AI and blockchain, and shifts in client expectations. Regulatory updates, for instance, can significantly impact compliance requirements, while tech innovations may offer new efficiencies or disrupt traditional practices. Proactively monitoring these elements ensures your firm remains agile and client-relevant.

For reliable market intelligence, tap into industry reports from firms like Deloitte or PwC, financial news outlets such as Bloomberg or The Financial Times, and regulatory bodies' announcements. These sources provide timely insights into trends affecting the accounting landscape.

Leveraging tools like RivalSense can streamline the tracking and analysis of market data. Such platforms offer real-time alerts on competitors and industry shifts, enabling proactive strategy adjustments. Additionally, accounting software with built-in analytics can help interpret data trends relevant to your practice.

Practical Steps:

✅ Subscribe to industry newsletters and regulatory updates

✅ Use competitive intelligence tools to monitor market movements

✅ Review financial news weekly for emerging trends

✅ Implement software with advanced analytics (e.g., multi-entity reporting)

Pro Tip: Create a monthly checklist to audit your intelligence sources—eliminate low-value inputs and prioritize real-time data streams.

Integrating Market Intelligence into Accounting Strategies

Integrating market intelligence into accounting strategies transforms raw data into actionable insights, driving smarter business decisions. This requires aligning intelligence with core objectives like client retention or service diversification. Here’s how to operationalize it effectively:

- Identify Key Metrics: Focus on competitor pricing, regulatory timelines, and client industry trends. Tools like RivalSense track these dynamically.

- Align with Business Goals: Map insights directly to targets—e.g., use competitor service gaps to expand your advisory offerings.

- Train Your Team: Host quarterly workshops on interpreting market signals for client consultations.

- Leverage Technology: Automate data collection with AI tools to reduce manual effort.

Case Study: A mid-sized firm used competitor analysis to identify underserved niches in crypto accounting, boosting client acquisition by 20%.

⚠️ Pitfalls to Avoid:

- Data Overload: Curate only high-impact metrics (e.g., top 3 competitors).

- Static Monitoring: Update intelligence frameworks quarterly.

- Isolated Analysis: Contextualize trends with client feedback.

Leveraging Technology for Enhanced Market Intelligence

In accounting, leveraging technology for market intelligence is a strategic imperative, not an option. AI and automation tools process vast datasets faster than manual methods, uncovering patterns humans might miss. These technologies also enable real-time response to market fluctuations, giving firms a critical edge.

Key applications include:

- AI-Driven Analysis: Tools like Sage Intacct use ML to flag anomalies in financial data, predicting regulatory risks.

→ Action Step: Pilot AI tools for compliance monitoring. - Real-Time Intelligence Platforms: Cloud solutions (e.g., Docyt) deliver instant insights on competitor moves or industry shifts.

→ Checklist for Selection:- Multi-source data aggregation

- Customizable alerts

- Integration with existing accounting systems

- Automated Reporting: Tools like HighRadius automate reconciliation, freeing 15-20 hours monthly for strategic analysis.

Impact Example: Firms using automated competitor tracking reduce response time to pricing changes by 65%.

Measuring the Impact of Market Intelligence on Business Performance

Quantifying the ROI of market intelligence justifies investments and refines tactics. Start by linking intelligence initiatives to tangible outcomes like client acquisition cost (CAC) or competitive win rates. For instance, if intelligence reveals a rival’s pricing shift, measure how matching/adjusting your fees affects revenue within 90 days.

Key Frameworks:

📊 ROI Calculation: (Revenue uplift from intelligence - Tool costs) / Tool costs. Example: $50K revenue gain from a $10K RivalSense subscription = 400% ROI.

📊 Long-Term Metrics: Track annual client retention or market share growth to gauge strategic positioning.

📊 Benchmarking: Compare KPIs against industry averages (e.g., 15% client growth YoY).

Execution Tips:

- Visualize KPIs in dashboards (e.g., Tableau).

- Conduct quarterly intelligence audits.

- Tie team bonuses to intelligence-driven outcomes.

Conclusion and Next Steps for Accounting Professionals

Strategic market intelligence empowers accounting firms to transition from reactive number-crunching to proactive advising. By mastering competitor tracking, trend analysis, and tech integration, you’ll unlock opportunities for differentiation and growth. Implement these steps immediately:

- Prioritize Competitors: Identify 3-5 key rivals to monitor.

- Automate Tracking: Use tools like RivalSense for real-time alerts.

- Embed Insights: Weave intelligence into client reports and quarterly planning.

- Upskill Continuously: Attend webinars on AI in accounting (e.g., AICPA events).

As AI evolves, expect predictive analytics to forecast regulatory changes or client churn risks—position your firm at the forefront.

Ready to transform insights into action?

Try RivalSense free today—get your first competitor report and discover hidden opportunities in your market!

📚 Read more

👉 How Oliver Bonas' Beauty Expansion Strategy Can Inspire Your Competitive Edge

👉 Unlock Competitive Edge: Mastering Twitter Competitor Insights

👉 Strategic Insights: Benchmarking Zoom's Competitor Promotions in Video Communications

👉 Beginner’s Guide to Tracking Competitor Hiring & Layoffs

👉 Spotify's Audiobook & Video Push: What Competitors Need to Know