How to Conduct Competitor Research in 2026: A Step-by-Step Guide

When was the last time you took a deep dive into what your competitors are doing? If you want 2026 to be your breakthrough year, competitor research isn't just a nice-to-have—it's essential for survival and growth. In today's hyper-competitive landscape, understanding your competition is the foundation of strategic decision-making and sustainable advantage.

What is Competitor Research?

Competitor research is the systematic process of identifying, analyzing, and understanding your direct and indirect competitors to inform your business strategy. It goes beyond simply listing who your competitors are—it's about understanding their strategies, market positions, customer relationships, and operational approaches.

Direct competitors offer similar products or services to the same target audience. Indirect competitors solve the same customer problems but through different means or alternatives.

For example, if you're a specialized SaaS company, your direct competitors are other SaaS platforms in your niche, while your indirect competitors might include traditional software solutions, consulting services, or even in-house development teams that could solve the same problems.

Why Competitor Research Matters More Than Ever in 2026

The business landscape is evolving at an unprecedented pace. To stay ahead, you need a clear understanding of your competition. In 2026, competitor research is critical because:

- AI-driven market shifts happen faster than ever

- Customer expectations evolve rapidly based on competitor innovations

- Market gaps appear and disappear within months, not years

- Strategic positioning requires real-time awareness of competitive moves

The 7-Step Competitor Research Framework for 2026

This framework provides a structured approach to competitor research. By following these steps, you can gather comprehensive insights and turn them into actionable strategies.

Step 1: Identify and Categorize Your Competitors

Start with comprehensive identification:

Practical Checklist:

- Search your core product/service + location or niche

- Use SEO tools (Semrush, Ahrefs) to find competitors ranking for your keywords

- Ask customers: "Who else were you considering before choosing us?"

- Monitor industry reports and startup databases

- Check social media conversations about similar solutions

Categorization Framework:

- Direct competitors (same solutions, same audience)

- Indirect alternatives (different solutions, same problems)

- Emerging challengers (new entrants with disruptive potential)

- Aspirational benchmarks (larger companies you aim to compete with)

Pro Tip: Build a list of 8-12 competitors for better market signal detection. Three competitors won't give you the full picture.

Step 2: Map Their Digital Ecosystem

Analyze how competitors show up where customers discover them:

Website Analysis:

- User experience and conversion paths

- Pricing structures and packaging

- Content strategy and messaging

- Technical SEO implementation

Social Media Presence:

- Platform selection and engagement patterns

- Content cadence and themes

- Community building approaches

- Customer service responsiveness

Search & SEO Analysis:

- Keyword rankings and content gaps

- Backlink profiles and authority

- Local search presence (if applicable)

Paid Advertising:

- Ad copy and creative testing

- Landing page optimization

- Retargeting strategies

Step 3: Benchmark Marketing and Growth Strategies

Go beyond surface observation to understand their acquisition engines:

Questions to Answer:

- How are they acquiring customers at scale?

- What channels drive their growth?

- What partnerships or integrations do they leverage?

- How do they position themselves against alternatives?

Tools for Deeper Insights:

- Facebook/Meta Ad Library for ad strategy analysis

- LinkedIn Campaign Insights for B2B approaches

- Email marketing monitoring tools

- Partnership announcement tracking

Step 4: Analyze Customer Sentiment and Feedback

Understanding who their customers are and what they think reveals market positioning:

Sources to Monitor:

- Review platforms (G2, Trustpilot, Capterra)

- Social media conversations and mentions

- Community forums and Q&A sites

- Customer support interactions

- Case studies and testimonials

Key Metrics to Track:

- Net Promoter Score (NPS) trends

- Common pain points and complaints

- Feature requests and suggestions

- Customer retention patterns

Step 5: Conduct Strategic SWOT Analysis

Turn raw data into actionable insights with SWOT analysis for each key competitor:

SWOT Framework Template:

| Strengths | Weaknesses |

|---|---|

| What they do exceptionally well | Where they consistently struggle |

| Brand loyalty and recognition | Service or support gaps |

| Unique technology or IP | Pricing or packaging issues |

| Strong partnerships | Limited market presence |

| Opportunities | Threats |

|---|---|

| Market trends they're missing | Emerging technologies |

| Customer segments they ignore | New market entrants |

| Geographic expansion potential | Regulatory changes |

| Partnership opportunities | Economic shifts |

Step 6: Monitor Operational and Growth Signals

Look beyond marketing to understand their business health. Operational and growth signals provide early indicators of strategic shifts and market movements.

Growth Indicators:

- Hiring activity and job postings

- Funding announcements and investor updates

- Office expansions or new locations

- Leadership team changes

- Product roadmap announcements

Operational Signals:

- Pricing changes and packaging updates

- Service level changes

- Technology stack updates

- Partnership announcements

- Regulatory compliance updates

Step 7: Implement Continuous Monitoring

Competitor research is not a one-time project—it's an ongoing process. Consistent monitoring ensures you stay ahead of market changes.

Monitoring Framework:

- Weekly: Social media and news monitoring

- Monthly: SEO and traffic analysis

- Quarterly: Comprehensive strategy review

- Annually: Full competitive landscape assessment

The Modern Competitor Research Toolkit for 2026

Essential Tools by Category

| Research Goal | Recommended Tools | How RivalSense Complements |

|---|---|---|

| SEO & Keyword Analysis | Semrush, Ahrefs, Moz | Tracks competitor ranking changes and content updates automatically |

| Social Media Monitoring | Sprout Social, Hootsuite | Monitors competitor social activity across all platforms |

| Website & Traffic Analysis | SimilarWeb, BuiltWith | Provides context for traffic changes with competitor updates |

| Review & Sentiment Analysis | Trustpilot, G2, Capterra | Aggregates customer feedback trends across competitors |

| Ad Strategy Monitoring | Meta Ad Library, SpyFu | Alerts you to new competitor campaigns and messaging |

| News & Media Tracking | Google Alerts, Mention | Captures media coverage and PR announcements |

The RivalSense Advantage: Automated Competitive Intelligence

While traditional tools help you analyze competitors manually, RivalSense automates the most time-consuming aspects of competitor research. Our platform tracks 80+ sources including:

- Product launches and updates across competitor websites

- Pricing changes and packaging updates

- Event participations and conference appearances

- Partnership announcements and integrations

- Regulatory compliance updates and certifications

- Management changes and leadership updates

- Media mentions across news and social platforms

All delivered in a weekly email report that keeps you informed without manual effort.

Practical Example: Instead of spending hours each week checking competitor websites, social media, and news sources, RivalSense users receive a consolidated report every Monday morning with all relevant competitor updates from the previous week.

Real-World Insights from RivalSense:

Regulatory Update Example:

Tesla's vision-only Cybercab has not secured full US approval for unsupervised operations as of January 2026, with production eyed for April.

Why it matters: Tracking regulatory approvals helps anticipate product launches and market entry timelines, allowing you to adjust your strategy for competitive positioning.

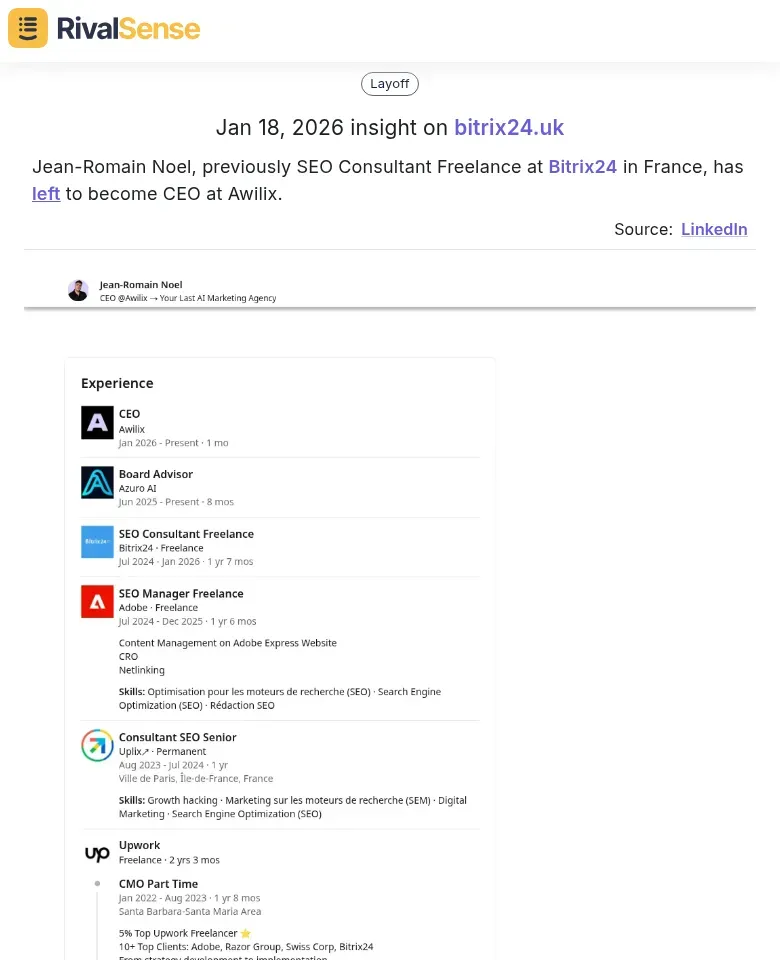

Management Change Example:

Jean-Romain Noel, previously SEO Consultant Freelance at Bitrix24 in France, has left to become CEO at Awilix.

Why it matters: Monitoring leadership changes can signal strategic pivots or new initiatives, giving you insights into potential competitor directions.

Partnership Announcement Example:

Cisco, Pure Storage, and NVIDIA teamed up to deliver AI Factories for enterprises using the FlashStack Cisco Validated Design to help businesses transition from AI pilots to large-scale deployments.

Why it matters: Partnership tracking reveals collaboration trends and market alliances, helping you identify emerging competitive threats or opportunities for collaboration.

Turning Insights into Action: Your 2026 Playbook

Strategic Actions Based on Competitor Research

-

Differentiate Your Messaging:

- Identify gaps in competitor positioning

- Highlight your unique value propositions

- Address customer pain points competitors ignore

-

Optimize Your Product Roadmap:

- Prioritize features competitors lack

- Improve areas where competitors receive negative feedback

- Innovate beyond competitor capabilities

-

Refine Your Pricing Strategy:

- Position against competitor pricing tiers

- Identify value gaps in the market

- Test pricing models competitors haven't explored

-

Enhance Your Marketing Strategy:

- Target keywords competitors rank poorly for

- Create content addressing gaps in competitor coverage

- Develop campaigns that highlight competitor weaknesses

-

Improve Customer Experience:

- Address common complaints about competitors

- Implement features competitors' customers request

- Build stronger support and onboarding processes

Common Pitfalls to Avoid in 2026 Competitor Research

- Analysis Paralysis: Don't get stuck collecting data without acting on it

- Copycat Syndrome: Don't blindly copy competitors—learn from them

- Outdated Information: Competitor landscapes change rapidly

- Ignoring Indirect Competitors: Disruption often comes from unexpected places

- Forgetting Your Unique Value: Stay focused on what makes you different

The Future of Competitor Research: AI and Automation

In 2026, the most successful companies will leverage advanced technologies to stay competitive. AI and automation are transforming how we gather and analyze competitive data.

- AI-powered insights that predict competitor moves

- Automated monitoring that frees up strategic thinking time

- Real-time alerts for immediate response opportunities

- Predictive analytics that anticipate market shifts

Tools like RivalSense represent this next generation of competitive intelligence—moving from reactive research to proactive strategy.

Getting Started: Your 30-Day Competitor Research Plan

Week 1: Foundation

- Identify your top 10 competitors

- Set up basic monitoring (Google Alerts, social follows)

- Create your competitor tracking spreadsheet

Week 2: Deep Dive

- Analyze competitor websites and messaging

- Review customer feedback across platforms

- Conduct initial SWOT analysis

Week 3: Strategy Development

- Identify 3-5 strategic opportunities

- Develop action plans for each opportunity

- Set up automated monitoring systems

Week 4: Implementation & Optimization

- Implement your highest-priority actions

- Set up regular review cadence

- Consider automated tools like RivalSense for ongoing monitoring

Frequently Asked Questions

Q: How often should we conduct competitor research in 2026?

A: Competitor research should be continuous, not periodic. Set up automated monitoring for daily updates, conduct weekly reviews of key metrics, and perform comprehensive quarterly assessments. Tools that provide regular reports (like RivalSense's weekly email updates) make this sustainable.

Q: What's the biggest mistake companies make in competitor research?

A: The most common mistake is treating competitor research as a one-time project rather than an ongoing process. In 2026, competitors can launch new products, change pricing, or pivot strategies within weeks. Continuous monitoring is essential.

Q: How do we balance competitor research with focusing on our own business?

A: The key is automation and focus. Use tools to handle the monitoring burden, then dedicate strategic thinking time to analyzing insights and making decisions. Aim for 80% automation, 20% strategic analysis.

Q: What metrics matter most in competitor analysis?

A: Focus on leading indicators: product update frequency, hiring patterns, funding announcements, and customer sentiment trends. These often predict future competitive moves before they impact market share.

Q: How can small businesses compete with larger companies' research capabilities?

A: Automation levels the playing field. While large companies might have dedicated competitive intelligence teams, small businesses can use automated tools like RivalSense to get similar insights at a fraction of the cost and time investment.

Conclusion: Make 2026 Your Competitive Advantage Year

Competitor research in 2026 isn't about copying what others are doing—it's about understanding the market landscape so you can make smarter strategic decisions. By implementing a systematic approach to competitor analysis, leveraging modern tools, and turning insights into action, you can identify growth opportunities, avoid competitive threats, and build sustainable advantages.

Remember: The goal isn't to become your competitors—it's to understand them well enough to beat them at their own game while playing yours better.

Ready to streamline your competitor research? Try RivalSense for free at https://rivalsense.co/ and get your first competitor report today to start transforming insights into actionable strategy.

📚 Read more

👉 Beginner's Guide to Key Account Health Dashboards for Commercial Laundry Services

👉 How Bentley Systems Accelerated BIM Adoption by Learning from Autodesk's Content Catalog

👉 Competitor Benchmarking Mastery: Track Funding Signals for Strategic Insights

👉 Performance Marketing Competitor Analysis: A Beginner's Guide to Boosting ROI

👉 Optimizing Product Offerings with Win-Loss Analysis and Competitor Insights