How to Conduct Competitor Research: A Practical Guide for Business Leaders

- Summary

- What is Competitor Research?

- When Do You Need Competitor Research?

- Competitor Research Frameworks and Examples

- Practical Steps to Conduct Competitor Research

- Tips for Effective Competitor Research

- How RivalSense Simplifies Competitor Tracking

- Conclusion

Summary

In today's fast-paced business environment, staying ahead of competitors is crucial for survival and growth. This comprehensive guide provides actionable steps to help you systematically analyze your rivals and turn insights into strategic advantages.

You'll learn:

- ✅ How to identify and categorize your competitors effectively

- ✅ Practical frameworks for analyzing competitive landscapes

- ✅ Step-by-step process for gathering competitor intelligence

- ✅ Tools and methods for continuous competitor monitoring

- ✅ How to turn competitor insights into actionable business strategies

- ✅ Ways to automate competitor tracking for ongoing advantage

What is Competitor Research?

Competitor research involves systematically gathering and analyzing data about your business rivals to understand their strategies, strengths, and market position. It's not just about monitoring their actions but interpreting them to inform your own strategic decisions and stay competitive in the marketplace.

Key Components of Effective Competitor Research:

1. Competitor Identification

- Direct Competitors: Companies offering similar products/services to the same target audience

- Indirect Competitors: Businesses providing alternative solutions to the same customer needs

- Potential Entrants: Companies that could enter your market space

2. Market Positioning Analysis

- Pricing strategies and value propositions

- Target customer segments and demographics

- Brand identity and messaging

- Market share and growth patterns

3. Strengths and Weaknesses Assessment

- Product quality and feature comparisons

- Customer service and support capabilities

- Marketing effectiveness and channel presence

- Operational efficiencies and scalability

4. Opportunities and Threats Identification

- Market gaps and underserved segments

- Emerging trends and technological shifts

- Regulatory changes and compliance requirements

- Economic factors affecting the industry

When Do You Need Competitor Research?

Competitor research should be an ongoing process, but it becomes especially critical during pivotal business moments. Regularly updating your insights ensures you're always prepared to adapt to market changes and competitor moves.

Product Development and Launch

When building new products or features, understanding competitor offerings helps you:

- Identify feature gaps and opportunities

- Set competitive pricing strategies

- Define your unique value proposition

- Avoid reinventing existing solutions

Marketing Strategy Creation

For marketing teams, competitor research provides insights into:

- Competitor messaging and positioning

- Effective marketing channels and tactics

- Customer acquisition strategies

- Content marketing approaches

Market Expansion

When entering new markets or segments, research helps you:

- Identify local competitors and market dynamics

- Understand cultural nuances and customer preferences

- Assess barriers to entry and regulatory requirements

- Develop localized strategies

Strategic Planning and Pivots

During business strategy reviews, competitor intelligence ensures:

- Current market positioning accuracy

- Awareness of competitive threats and opportunities

- Data-driven decision making

- Proactive rather than reactive strategies

Competitor Research Frameworks and Examples

Using structured frameworks can streamline your analysis and provide clear insights. These tools help organize data and highlight key areas for strategic focus, making your research more efficient and actionable.

SWOT Analysis

Practical Application Checklist:

- [ ] List 3-5 key competitors

- [ ] Identify their core strengths (product, team, funding)

- [ ] Document their weaknesses (customer complaints, gaps)

- [ ] Note market opportunities they're pursuing

- [ ] Identify threats they pose to your business

Porter's Five Forces

Industry Analysis Framework:

- Competitive Rivalry: How intense is competition?

- Threat of New Entrants: How easy is market entry?

- Threat of Substitutes: Are there alternative solutions?

- Buyer Power: How much influence do customers have?

- Supplier Power: How much influence do suppliers have?

Strategic Group Mapping

Visual Positioning Exercise:

- Map competitors on two key dimensions (price vs. quality, features vs. ease of use)

- Identify clusters and gaps in the market

- Position your company relative to competitors

- Spot underserved market segments

Feature Comparison Matrix

Product Analysis Tool:

- Create a spreadsheet comparing key features across competitors

- Rate each feature (present/absent, quality level)

- Identify your competitive advantages

- Spot opportunities for differentiation

Practical Steps to Conduct Competitor Research

Following a systematic approach ensures you cover all bases and derive meaningful insights. These steps are designed to be straightforward and repeatable, even for busy executives managing multiple priorities.

Step 1: Define Your Research Objectives

Actionable Checklist:

- [ ] What specific decisions will this research inform?

- [ ] Which competitors are most relevant to your goals?

- [ ] What time frame are you analyzing?

- [ ] What metrics will indicate success?

Step 2: Identify Your Competitors

Comprehensive Approach:

- Primary Research: Industry reports, customer interviews

- Secondary Research: Market analysis, news articles

- Digital Tools: Search engines, social media monitoring

- Customer Feedback: Who do customers compare you to?

Step 3: Gather Competitive Intelligence

Data Collection Methods:

Website and Digital Presence:

- [ ] Analyze competitor websites and landing pages

- [ ] Review their blog content and thought leadership

- [ ] Study their SEO strategy and keyword targeting

- [ ] Monitor their social media activity and engagement

Product and Pricing:

- [ ] Sign up for free trials or demos

- [ ] Analyze feature sets and user experience

- [ ] Document pricing models and packages

- [ ] Review customer support and onboarding

Market and Customer Intelligence:

- [ ] Read customer reviews and testimonials

- [ ] Analyze case studies and success stories

- [ ] Monitor press releases and media coverage

- [ ] Track executive movements and hiring trends

Step 4: Analyze and Synthesize Findings

Structured Analysis Framework:

- Categorize Information: Group data by competitor, theme, or time period

- Identify Patterns: Look for trends, gaps, and anomalies

- Assess Impact: Determine which findings matter most to your business

- Generate Insights: Translate data into actionable intelligence

Step 5: Communicate and Act on Insights

Effective Reporting Structure:

- Executive summary of key findings

- Detailed competitor profiles

- Strategic recommendations

- Action plan with owners and timelines

Tips for Effective Competitor Research

Implementing these best practices can enhance the quality and impact of your research efforts. They help ensure that your insights are reliable, relevant, and readily applicable to your business strategy.

1. Stay Objective and Data-Driven

- Base conclusions on evidence, not assumptions

- Use multiple data sources to validate findings

- Avoid confirmation bias in your analysis

2. Focus on Actionable Insights

- Prioritize information that impacts your decisions

- Connect competitor actions to potential responses

- Identify immediate opportunities and threats

3. Maintain Regular Cadence

- Set up ongoing monitoring systems

- Schedule quarterly deep-dive analyses

- Establish alert systems for significant changes

4. Involve Cross-Functional Teams

- Include perspectives from marketing, product, sales

- Share findings across the organization

- Collaborate on response strategies

5. Balance Quantitative and Qualitative Data

- Combine metrics (market share, revenue) with context (customer sentiment, brand perception)

- Use both structured data and observational insights

- Validate numbers with real-world examples

How RivalSense Simplifies Competitor Tracking

Manual competitor research can be time-consuming and inconsistent, making it challenging to stay updated. Automated tools like RivalSense address this by providing real-time insights, allowing you to focus on strategic decision-making rather than data collection.

Automated Intelligence Gathering

RivalSense monitors 80+ data sources across:

- Product Intelligence: Track competitor product launches, updates, and feature changes

- Pricing Strategy: Monitor pricing updates and package changes in real-time

- Market Activity: Follow event participations, partnerships, and expansion moves

- Regulatory Compliance: Stay updated on regulatory filings and compliance requirements

- Leadership Changes: Track management changes and executive movements

- Media Presence: Monitor media mentions and press coverage across the internet

Real-World RivalSense Insights

Here are examples of competitor insights tracked by RivalSense, illustrating how they can inform your business strategy:

-

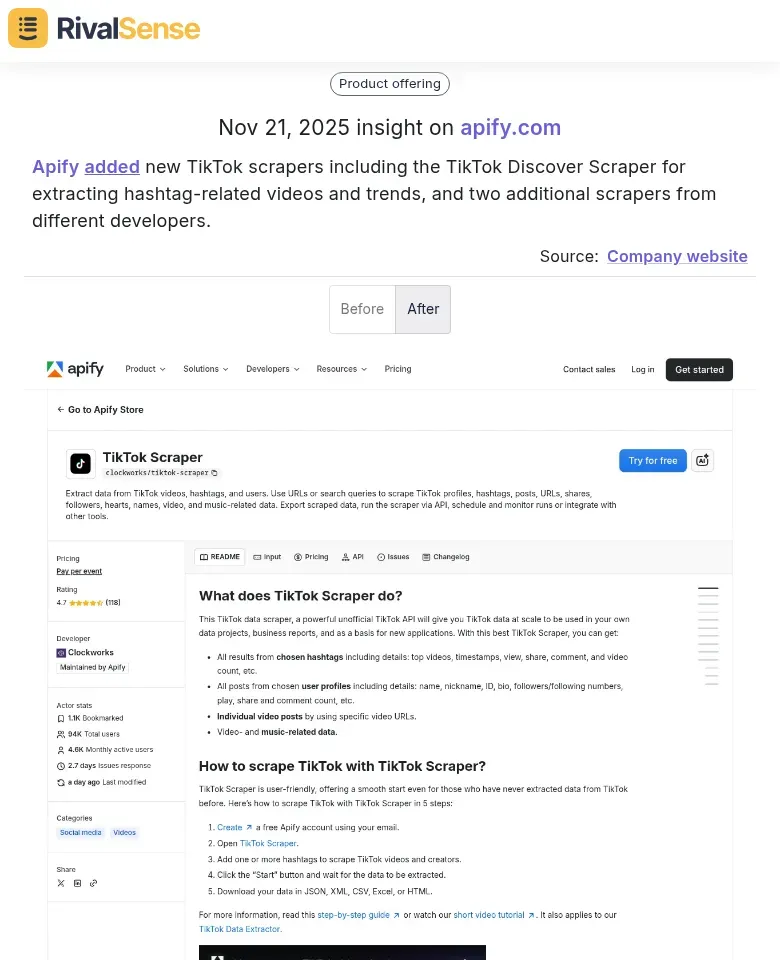

Product Launch Insight:

Apify added new TikTok scrapers including the TikTok Discover Scraper for extracting hashtag-related videos and trends. This type of insight is valuable because it helps you identify emerging product trends early, allowing you to adapt your offerings or explore similar innovations to stay competitive. -

Leadership Change Insight:

Kadence welcomed Tracy Hawkins, VP of Real Estate and Workplace at OpenAI, to its Advisory Board on November 20. Tracking such leadership changes is crucial as it can signal shifts in company strategy, new market focuses, or enhanced expertise, helping you anticipate competitive moves. -

Partnership and Product Collaboration Insight:

Materialise and Renishaw introduced a new next-generation build processor for advanced metal AM users. Insights like this are valuable because they reveal competitor partnerships and technological advancements, enabling you to assess potential threats or collaboration opportunities in your industry.

Practical Benefits for Business Leaders:

Time Efficiency

- Instead of spending hours manually researching competitors each week, RivalSense delivers comprehensive competitor intelligence in a weekly email report

- Automated monitoring ensures you never miss important competitive moves

Comprehensive Coverage

- Track multiple competitors simultaneously across diverse data sources

- Get insights from company websites, social media, regulatory registries, and industry publications

Actionable Insights

- Receive structured reports that highlight the most relevant competitive developments

- Identify patterns and trends that might be missed with manual research

Strategic Advantage

- Stay ahead of market shifts and competitor strategies

- Make data-driven decisions based on comprehensive competitive intelligence

- Focus your team's efforts on strategic response rather than data collection

Getting Started with Automated Competitor Tracking

For businesses serious about maintaining competitive advantage, setting up systematic competitor monitoring is essential. RivalSense makes this process seamless by:

- Easy Setup: Configure your competitor list and monitoring preferences

- Comprehensive Monitoring: Automatically track 80+ data sources

- Weekly Intelligence: Receive curated reports with the most important developments

- Strategic Insights: Turn competitor data into actionable business strategies

Conclusion

Effective competitor research is essential for making informed decisions and sustaining growth in competitive markets. By adopting systematic approaches and leveraging automation, you can transform raw data into strategic advantages that drive your business forward.

- Make informed strategic decisions based on comprehensive market intelligence

- Identify opportunities for differentiation and competitive advantage

- Anticipate market shifts and competitor moves

- Allocate resources more effectively

- Build sustainable competitive positioning

Remember: The goal of competitor research isn't to copy what others are doing, but to understand the competitive landscape so you can make better strategic decisions for your business. With the right frameworks, processes, and tools in place, you can turn competitor intelligence into a sustainable competitive advantage.

Ready to streamline your competitor research? Try RivalSense for free at https://rivalsense.co/ to get your first competitor report today and start turning insights into action without the manual hassle.

📚 Read more

👉 Solving Healthcare IT's Key Account Management Challenges Proactively

👉 How AU10TIX's Microsoft Partnership Drove Competitor Action

👉 Beginner's Guide: Track Competitor Insights from Twitter

👉 How to Monitor Competitor Partnerships in Mobility Services

👉 Beginner's Guide: Track Competitor Hiring & Layoffs for Key Account Wins