How Sacombank's Digital Shift Forced Competitors to Innovate (And What You Can Learn)

In today's rapidly evolving financial sector, digital transformation isn't just advantageous—it's essential for survival. Sacombank's journey stands as a powerful case study in how technological innovation can redefine industry standards and trigger competitive responses. Before their digital pivot, traditional banking models dominated with limited digital offerings, but Sacombank's strategic overhaul compelled rivals to accelerate their own initiatives or risk obsolescence. This analysis explores three critical dimensions: the drivers behind Sacombank's transformation, its ripple effects across the banking landscape, and actionable takeaways for business leaders. Practical steps include conducting gap analyses in digital capabilities, investing in customer-centric technologies, and fostering cultures of innovation.

✅ Digital Transformation Checklist:

- Assess current digital capabilities

- Set clear transformation goals

- Measure progress against industry benchmarks

Sacombank's Digital Strategy: A Closer Look

Sacombank's transformation provides a masterclass in strategic tech adoption, blending customer-centric solutions with operational efficiency. Their approach integrated mobile banking with AI features, blockchain security, and cloud infrastructure—setting new benchmarks for user experience. Behind the scenes, robotic process automation streamlined back-end operations while data analytics enabled hyper-personalized services.

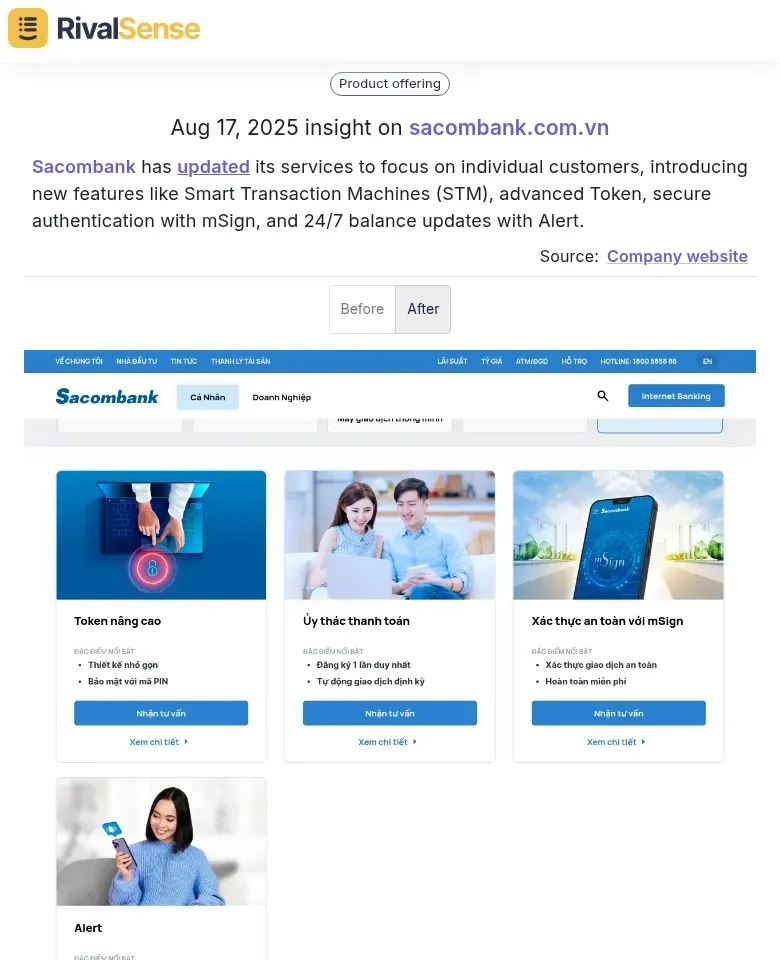

Example: Turning Feature Updates into Strategic Intelligence

When Sacombank shifted focus to individual customers through features like Smart Transaction Machines and mSign authentication, RivalSense detected these updates immediately. Why does this matter? Tracking competitor feature launches helps you:

- Spot emerging customer preferences (e.g., demand for 24/7 services)

- Identify security trends before they become industry standards

- Benchmark your own roadmap against market leaders

Overcoming internal resistance required cultural shifts—Sacombank invested heavily in training and fintech partnerships. Key implementation steps include:

- Diagnose capability gaps in tech stacks and workforce skills

- Prioritize training to bridge digital literacy gaps

- Forge strategic partnerships with complementary tech providers

Impact on Competitors: A Ripple Effect

Sacombank's digital leap created immediate pressure across Vietnam's banking sector, forcing competitors into reactive innovation cycles. Major players like Vietcombank and BIDV accelerated mobile app deployments, while others like Techcombank replicated blockchain solutions within months. This domino effect highlights a critical lesson: competitor moves directly influence market expectations and customer acquisition costs.

Three strategic implications emerged:

- Accelerated timelines: Competitors compressed 18-month roadmaps into 6-month sprints to retain market share

- Feature-based differentiation: VPBank countered with gamified savings products targeting younger demographics

- Customer segment shifts: Sacombank captured 15% more millennial users, forcing rivals to overhaul targeting strategies

🔥 Actionable Response Framework:

- Monitor competitor launches through automated tracking tools

- Identify service gaps in competitors' offerings for differentiation opportunities

- Survey customers after competitor innovations to detect expectation shifts

Customer Response and Market Dynamics

Sacombank's transformation fundamentally reset customer expectations, with mobile banking adoption surging 60% in six months. While 75% of users praised enhanced convenience, initial friction points emerged around feature complexity—prompting Sacombank to deploy educational campaigns and 24/7 support, boosting satisfaction by 20%.

This shift created lasting market changes: customers now prioritize seamless digital experiences, personalized services, and real-time transaction capabilities. Competitors responded by embedding these expectations into their own development cycles, proving that customer feedback directly shapes innovation priorities.

📈 Practical Response Tactics:

- Track digital adoption metrics religiously to gauge feature resonance

- Implement continuous feedback loops via in-app surveys and user testing

- Develop onboarding tutorials for complex features

- Allocate 20% of R&D budgets to iteration based on usage data

Lessons Learned and Best Practices

Sacombank's journey crystallizes essential digital transformation principles: customer-centricity beats technology novelty, agility trumps perfectionism, and cultural readiness determines implementation velocity. Their experience proves that successful transformations balance technological investment with human adaptation strategies.

Replicating this success requires methodical execution:

- Start with digital maturity assessments to identify capability gaps

- Prioritize CX in digital channel development

- Implement agile methodologies for rapid iteration

- Partner with fintechs to access specialized expertise

💡 Sustained Innovation Tactics:

- Host quarterly internal hackathons to source employee ideas

- Dedicate resources to competitive intelligence gathering

- Adopt test-and-learn pilots for emerging technologies

Conclusion: The Future of Banking in a Digital Age

Sacombank's transformation illustrates how digital leadership creates competitive cascades, permanently raising industry standards. While cybersecurity and regulatory challenges persist, the trajectory points toward AI-driven hyper-personalization, embedded finance, and blockchain integration as next frontiers. For business leaders, the imperative is clear: continuous innovation fueled by competitor intelligence is non-negotiable.

Immediate Action Steps:

- Systematically track competitor digital initiatives and feature releases

- Analyze adoption patterns to anticipate market shifts

- Convert competitor insights into differentiated offerings

- Embed customer feedback mechanisms into development cycles

🔍 Ready to decode competitor moves? Try RivalSense free and get your first automated competitor report today: https://rivalsense.co/

📚 Read more

👉 Competitor Promotion Insights: Boost Your Business Strategy

👉 How to Analyze Banking Product Documentation Like a Pro

👉 How Event Participation Insights Can Track Industry Disruptors

👉 Mobilly's EV Payment Expansion: How to Analyze Competitor Moves

👉 Competitor Website Teardown Techniques: A Step-by-Step Guide for B2B Leaders