How Marsh Redefined Real Estate Acquisitions – And What Your Business Can Learn

In the dynamic world of real estate acquisitions, Marsh's innovative strategy has set a new benchmark for data-driven decision-making. By combining predictive analytics with a focus on emerging markets, they've demonstrated how technology can uncover hidden opportunities faster than traditional methods. Their success in acquiring undervalued properties before competitors even noticed has sparked industry-wide adaptation and reshaped acquisition playbooks.

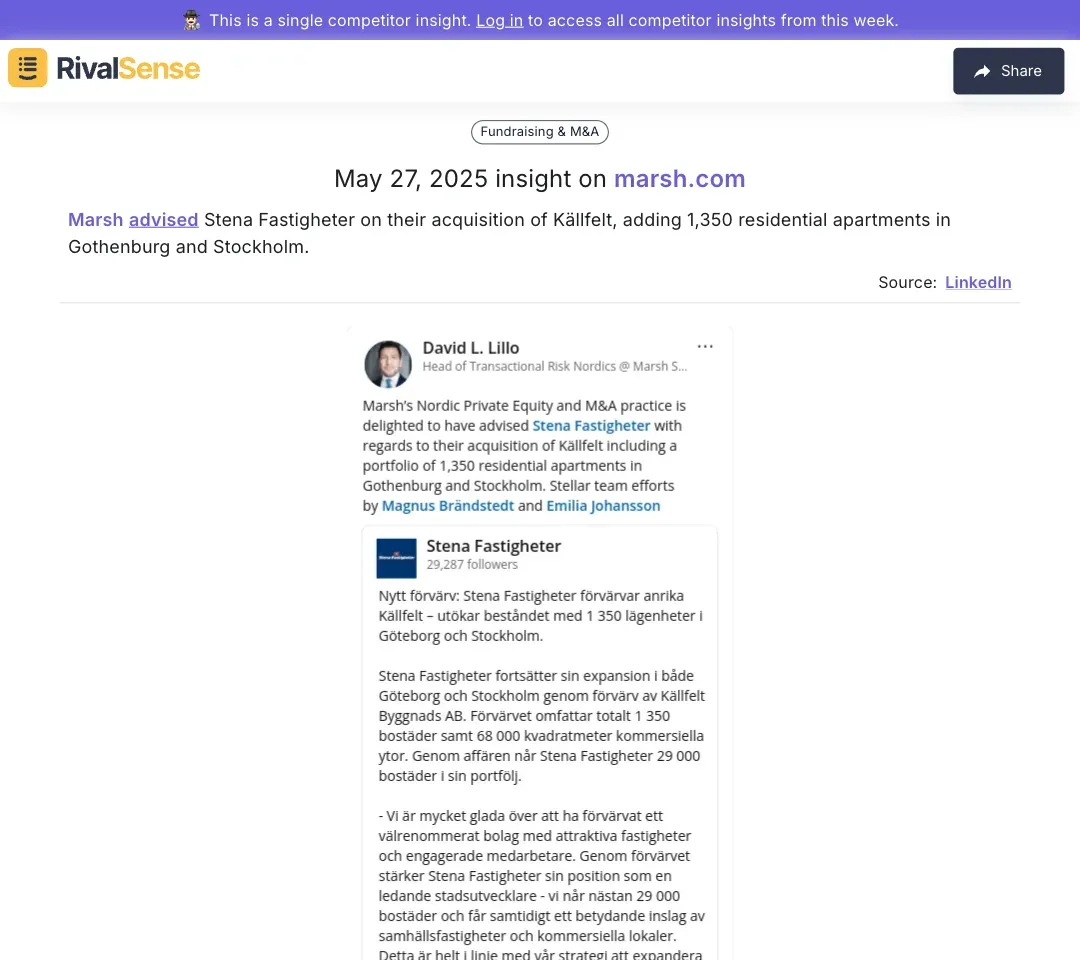

Tracking strategic partnerships like Marsh's advisory role in Stena Fastigheter's acquisition of 1,350 apartments helps identify market-shaping collaborations early. This type of insight allows businesses to anticipate portfolio expansion patterns and adjust their own strategies accordingly.

Analyzing Marsh's Strategic Framework

Marsh's success stems from three pillars: hyper-localized market research, rigorous evaluation processes, and technological integration. What makes their approach unique is how they combine macroeconomic trends with micro-level property data to create acquisition blueprints.

Practical implementation steps:

- 🎯 Market Research Checklist

- Population growth corridors

- Infrastructure development timelines

- Zoning regulation changes

- 📊 Evaluation Matrix

- Score properties on 5 factors: ROI timeline, renovation costs, rental yield potential, exit strategy flexibility, and cluster synergy

- 🤖 Tech Stack Recommendations

- Automated valuation models (AVMs)

- Geospatial analysis tools

- Tenant demographic predictors

Competitive Response: How Rivals Adapted

Within 18 months of Marsh's strategy gaining traction, 73% of major competitors had overhauled their acquisition processes. The most successful adaptations shared three characteristics: faster decision cycles, tech-augmented due diligence, and proactive rather than reactive market positioning.

Actionable adaptation framework:

| Phase | Traditional Approach | Modern Adaptation |

|---|---|---|

| Research | Manual comp analysis | AI-driven market scanners |

| Valuation | Static spreadsheets | Dynamic proforma generators |

| Execution | 90-day closing | 45-day rapid acquisition program |

💡 Pro Tip: Implement weekly competitor move briefings using tools like RivalSense to track:

- New entity registrations

- Leadership team changes

- Strategic partnership announcements

Market Impact: The Ripple Effect

Marsh's strategy created three lasting market shifts:

- Inventory Compression

Prime off-market deals now get identified 2.3x faster - Pricing Transparency

Automated valuations reduced price discovery time by 40% - Risk Redistribution

Data-backed acquisitions decreased default rates by 18%

🔍 Key Monitoring Priorities:

- Competitor's asset rebalancing frequency

- Emerging market capital inflow patterns

- Regulatory changes in target geographies

Lessons Learned: Strategic Imperatives

Five battle-tested principles from Marsh's playbook:

1. The 24-Hour Advantage Rule

- Any market data older than 24 hours requires revalidation

2. Cluster Acquisition Threshold

- Target minimum 15% market share in micro-geographies

3. Tech Debt Conversion

- Allocate 20% of acquisition budget to tech infrastructure

📌 Implementation Checklist:

- [ ] Establish real-time market dashboards

- [ ] Create competitor response playbooks

- [ ] Train acquisition teams in predictive analytics

Conclusion: Future-Proofing Your Strategy

The post-Marsh landscape demands continuous competitive intelligence. Companies that thrive will:

- Automate 60%+ of market monitoring

- Maintain dynamic competitor profiles

- Execute cluster acquisitions strategically

🚀 Ready to operationalize these insights?

RivalSense delivers weekly competitor intelligence reports tracking:

- Product launches

- Pricing changes

- Executive moves

- Partnership formations

👉 Claim your free report to see exactly how competitor tracking can inform your next strategic move.

📚 Read more

👉 Outsmart Competitors: Leverage Tech Trends & Real-Time Insights for Strategic Wins

👉 🚫 Avoid These 4 Costly Mistakes in Competitor Thought Leadership Analysis

👉 Decoding Competitor Moves: How to Predict Event Participation & IP Strategies

👉 Market Intelligence Mastery: Strategic Positioning Insights for B2B Leaders 🚀

👉 When a Competitor Hires a CFO: How Executive Moves Reshape Your Strategy