How Cebu Pacific's Competitor Benchmarking Strategy Dominates Low-Cost Air Travel (And What Your B2B Business Can Learn)

In the fiercely competitive low-cost aviation sector, systematic competitor benchmarking transforms market positioning from reactive to strategic. Cebu Pacific’s dominance in the Philippines demonstrates how continuous competitive intelligence enables businesses to anticipate market shifts, optimize offerings, and refine strategies. For B2B companies, this approach is equally critical: by benchmarking against competitors, you can identify gaps, leverage opportunities, and maintain a competitive edge. Cebu Pacific’s ‘low fare, great value’ approach succeeds by benchmarking against both direct competitors like Philippine Airlines and AirAsia, and indirect threats such as regional carriers and alternative transportation modes.

Practical steps for effective benchmarking:

- Monitor competitor pricing daily using automated tools to identify market gaps

- Track product or service expansions to capture underserved markets

- Analyze customer feedback across platforms to benchmark service improvements

- Benchmark operational metrics like efficiency and cost structures

Real-world examples show how competitive intelligence drives dominance: Southwest Airlines saved $300M through fuel efficiency benchmarking, while JetBlue pioneered free Wi-Fi by analyzing competitor technology gaps. Cebu Pacific’s recent Riyadh-Manila route launch exemplifies strategic market entry based on competitor analysis. By systematically tracking competitors across pricing, routes, and customer experience, businesses can maintain cost advantages while capturing market share.

🧠 Strategic Partnership Intelligence: Learning from Training and Technology Alliances

Cebu Pacific’s partnership intelligence reveals how to decode competitor alliances for strategic advantage. For any business, understanding partner networks can unveil innovation priorities and cost-saving opportunities. Start by mapping competitor partnerships with key suppliers, technology providers, and service allies. Analyze their adoption patterns – which companies partner with which software platforms, maintenance services, or training providers? This reveals strategic directions you can benchmark against.

Example from RivalSense: Cebu Pacific Air extended its training services agreement with CAE during the Singapore Airshow 2026 to continue using simulation technology for pilot training on A320 and ATR platforms.

This type of insight is valuable for business strategy because it highlights long-term commitments and investment in core competencies. By monitoring such partnerships, you can anticipate industry trends, identify potential partners, and negotiate better terms for your own agreements.

Practical steps:

- Create a partnership matrix tracking competitors’ training, technology, and service agreements

- Analyze contract durations and renewal patterns to understand commitment levels

- Benchmark technology adoption timelines – who adopts new systems first vs. who waits?

- Calculate potential cost savings from similar long-term service agreements

💡 Key insight: Cebu Pacific studies how competitors structure maintenance agreements with engine manufacturers. By analyzing contract terms, they identify opportunities to negotiate better rates or bundled services. Similarly, examining training partnerships with flight schools reveals talent pipeline strategies and crew development costs.

✅ Tip: Focus on partnerships that directly impact operational efficiency – maintenance agreements, fuel supply contracts, and crew training alliances offer the clearest cost management insights. Track partnership announcements and contract renewals to anticipate market shifts before they affect pricing or service levels.

✈️ Route Expansion Intelligence: Decoding Market Penetration Strategies

Cebu Pacific’s route expansion intelligence reveals how competitor benchmarking drives market penetration. For B2B companies, this translates to monitoring competitor market entries, product launches, and geographic expansions. By analyzing rival businesses’ new market launches, you can identify underserved segments where demand exceeds supply. For example, when competitors enter a new region, examine their customer adoption and pricing strategies to determine if targeting adjacent markets presents better opportunities.

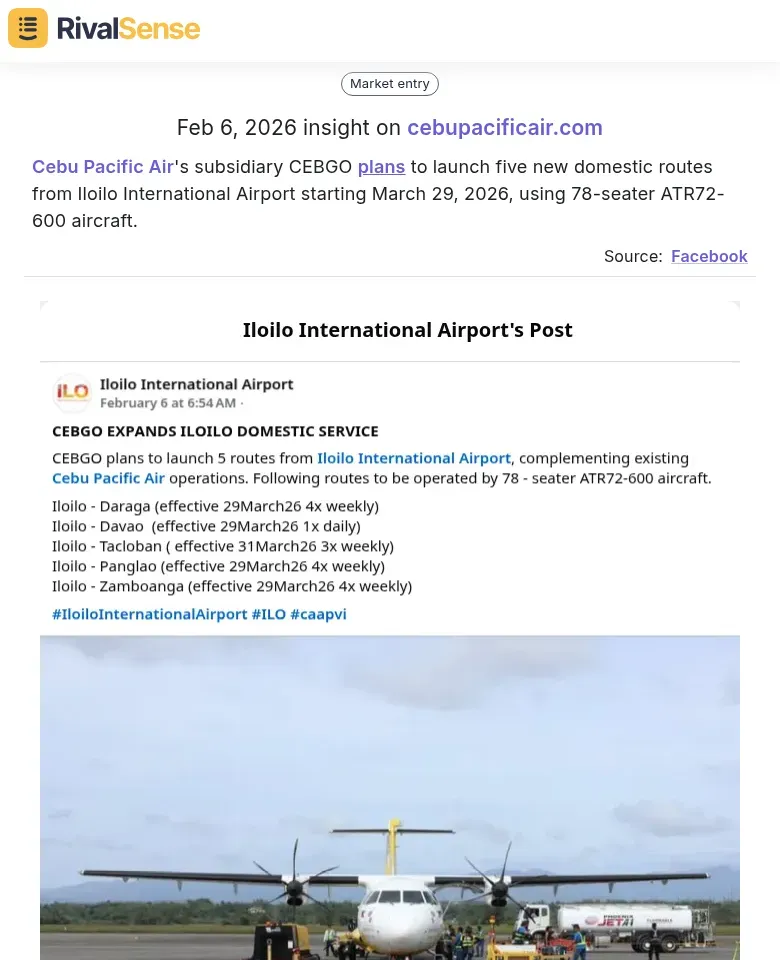

Example from RivalSense: Cebu Pacific Air's subsidiary CEBGO plans to launch five new domestic routes from Iloilo International Airport starting March 29, 2026, using 78-seater ATR72-600 aircraft.

This insight is valuable for business strategy as it signals market growth areas and competitive moves. Tracking such expansions helps you anticipate market saturation, identify gaps, and plan your own growth initiatives proactively.

Practical steps for route intelligence:

- Track competitor route announcements via aviation databases and regulatory filings

- Analyze load factors and pricing on new routes for 3-6 months

- Identify geographic gaps where your fleet type offers competitive advantage

- Monitor seasonal variations in competitor scheduling

Fleet deployment analysis shows how Cebu Pacific optimizes its Airbus A320neo and A321neo aircraft for regional coverage. They benchmark against AirAsia’s narrow-body utilization to maximize aircraft rotation efficiency. The key insight: match capacity to market demand density rather than simply following competitor movements.

Hub-and-spoke optimization lessons include:

- Analyze competitor connecting patterns at major hubs

- Identify underserved connecting city pairs

- Calculate optimal turn-around times based on competitor benchmarks

- Balance point-to-point vs connecting route economics

Actionable checklist:

- [ ] Map competitor route networks quarterly

- [ ] Calculate market share changes after competitor expansions

- [ ] Benchmark utilization rates against industry leaders

- [ ] Identify 2-3 underserved markets for potential expansion

- [ ] Test pricing strategies on parallel routes before full launch

🌍 International Market Entry Intelligence: Mastering Global Expansion

Cebu Pacific’s international expansion success stems from systematic competitor benchmarking. When entering new markets, businesses must analyze competitor strategies to optimize their entry. Cebu Pacific’s practical approach includes monitoring competitor moves, assessing demand patterns, and timing their entry strategically.

Example from RivalSense: Cebu Pacific Air will launch direct flights between Riyadh and Manila starting March 1, 2026.

This insight is crucial for business strategy as it reveals timing and scale of market entries. By tracking such launches, you can gauge competitor confidence, assess market readiness, and plan your own expansion with reduced risk.

Competitor Route Intelligence Checklist:

- Monitor competitor route announcements 6-12 months before launch

- Analyze their aircraft utilization, seat capacity, and pricing tiers

- Track passenger demand patterns and seasonal variations

- Evaluate regulatory approvals and airport slot allocations

Market Entry Timing Framework:

- Early Entry: Follow within 3-6 months if competitor shows >70% load factors

- Strategic Delay: Wait 9-12 months if competitor faces operational issues

- Resource Allocation: Start with 3-4 weekly flights, scale based on competitor performance

Direct Flight Optimization:

Cebu Pacific studied Emirates’ Dubai-Manila operations to implement efficient turnaround times and crew scheduling. Their benchmarking revealed that direct flights require 30% more ground staff but generate 40% higher margins than connecting routes. Key metrics to track: competitor on-time performance, baggage handling efficiency, and customer satisfaction scores on new international routes.

✅ Actionable Tip: Use competitor route failures as learning opportunities. When a rival airline withdraws from a market within 12 months, analyze their operational data to identify avoidable pitfalls before launching your own service.

⚙️ Operational Excellence Benchmarking: Building Sustainable Competitive Advantage

Cebu Pacific builds sustainable competitive advantage through systematic operational excellence benchmarking. For businesses, this means tracking core efficiency metrics against industry leaders to identify improvement areas. First, monitor key performance indicators like utilization rates, turnaround times, cost efficiency, and customer satisfaction. Use tools like RivalSense to track competitor initiatives, technology adoptions, and operational partnerships.

Second, analyze sustainability initiatives: benchmark adoption rates of green technologies, carbon offset programs, and waste reduction strategies. Cebu Pacific’s APU OFF program and sustainable aviation innovations demonstrate how to learn from global leaders while adapting to local markets.

Third, leverage financial performance data: compare revenue per available seat kilometer (RASK), cost per available seat kilometer (CASK), and load factors. Set realistic growth targets by analyzing competitor quarterly reports and market trends.

Practical checklist:

- Identify 3-5 key operational metrics relevant to your industry

- Monitor competitor sustainability announcements monthly

- Benchmark financial ratios quarterly

- Implement at least one efficiency improvement annually based on competitor insights

📊 Actionable Competitive Intelligence Framework for Business Leaders

Cebu Pacific’s success stems from a systematic competitive intelligence framework that transforms data into strategic advantage. Here’s how to implement it in your B2B business:

-

Build Your Monitoring System: Create a centralized dashboard tracking 5-7 key competitors across pricing, product launches, promotions, customer sentiment, and operational metrics. Use automated tools for real-time alerts on changes, announcements, and marketing campaigns. Assign team members to monitor specific competitors weekly.

-

Translate Insights into Action: When competitors launch new products or enter new markets, analyze their strategy and customer feedback within 48 hours. Use this intelligence to adjust your own pricing, enhance offerings, or launch targeted promotions. Cebu Pacific famously matched competitor fares while maintaining superior on-time performance.

-

Foster Competitive Culture: Implement monthly competitor review meetings where teams present key findings and strategic recommendations. Create a ‘competitor playbook’ documenting successful counter-strategies. Reward employees who identify competitive threats or opportunities first.

Practical Checklist:

- [ ] Set up automated price monitoring for key products or services

- [ ] Track competitor social media sentiment daily

- [ ] Analyze quarterly financial reports for strategic shifts

- [ ] Document competitor weaknesses in your market positioning

- [ ] Test competitor services quarterly for firsthand insights

This framework ensures competitive intelligence drives every strategic decision, maintaining market leadership through proactive rather than reactive positioning.

🚀 Conclusion: Leverage Competitor Intelligence for Your Business

Competitor benchmarking, as demonstrated by Cebu Pacific, is not just for airlines—it's a critical strategy for any B2B company aiming to dominate its market. By systematically tracking competitor moves, partnerships, expansions, and operational efficiencies, you can make informed decisions that drive growth and sustainability.

To implement such strategies effectively, consider using a tool like RivalSense. RivalSense tracks competitor product launches/updates, pricing changes, event participations, partnerships, regulatory aspects, management changes, and media mentions across company websites, social media, and various registries. It delivers all this intelligence in a weekly email report, helping you stay ahead without manual effort.

Ready to transform your competitive intelligence? Try RivalSense for free at https://rivalsense.co/ and get your first competitor report today!

📚 Read more

👉 5 Event Participation Mistakes That Sabotage Your Competitor Intelligence

👉 Competitor Analysis in Action: Learning from Reddit's $1B Share Buyback

👉 The Ultimate 2026 Guide to Key Account Management Certification: Free vs Paid Programs Compared

👉 Custom Key Account Tracking: PR Firm Productivity Techniques

👉 How Langdock's Company Knowledge Launch Forced Cross-Platform AI Innovation