Healthcare AI Scribe Competitive Analysis: Gaining Strategic Advantage

The healthcare AI scribe market is experiencing explosive growth, with over $1.5 billion invested in 2025 alone according to PitchBook data. This represents a dramatic acceleration from $800 million in 2024 and $390 million in 2023, driven by physician burnout, documentation burdens, and efficiency demands. Major players like Abridge, Microsoft's Nuance DAX, Ambience, and Suki are competing in this rapidly expanding space.

📈 Practical Tip: Start your competitive analysis by tracking these key metrics: funding rounds (17 deals in 2025), market share distribution, and adoption rates. Create a competitive matrix comparing integration capabilities, accuracy rates, and customization features. Monitor consolidation trends—health system leaders predict the market will consolidate to 2-3 major players within 3-5 years. This analysis will help you identify strategic positioning opportunities and differentiation points in this crowded but high-growth market.

Analyzing Competitor Leadership and Talent Acquisition Strategies

Understanding how competitors manage their leadership and talent acquisition is crucial for anticipating market moves. These strategies often reveal hidden priorities and future directions before they are publicly announced, especially in clinical domains. When healthcare AI scribe companies hire clinical experts, they signal expansion into new specialties or deeper enterprise penetration, building credibility with providers.

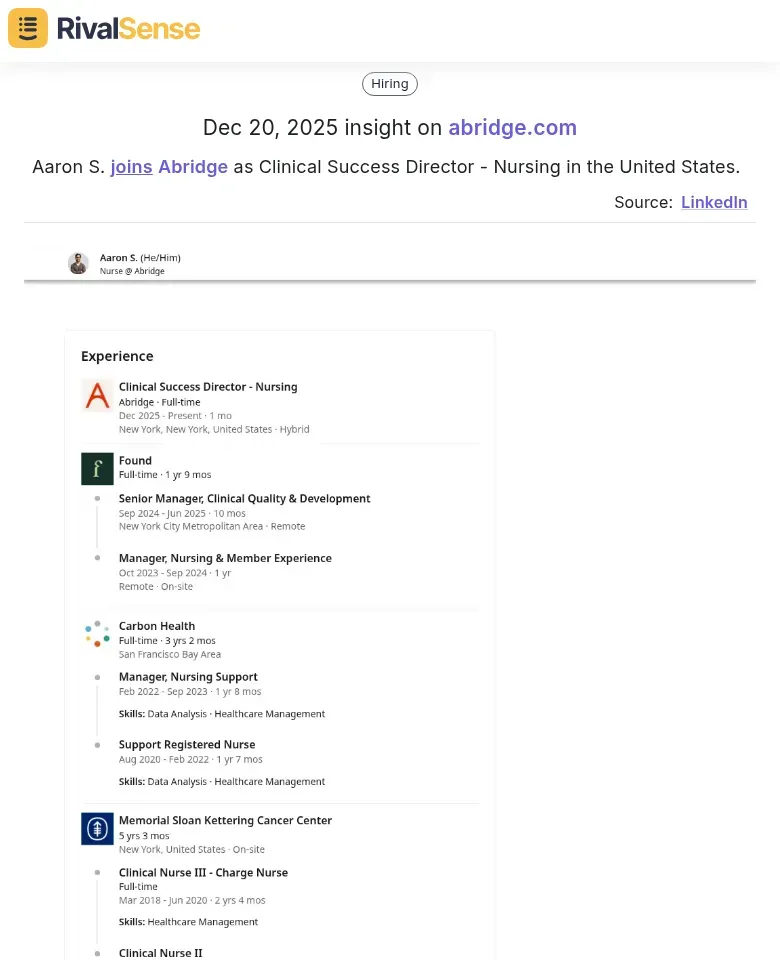

For instance, competitive intelligence tools like RivalSense can provide real-time insights into competitor hires. Consider this example: "Aaron S. joins Abridge as Clinical Success Director - Nursing in the United States."

This type of insight is valuable for business strategy because it signals a competitor's investment in specific clinical roles, indicating a push into nursing specialties. By monitoring such hires, you can adjust your own talent strategy and identify emerging market segments.

🔍 Practical Analysis Steps:

- Monitor LinkedIn for new executive hires with clinical backgrounds.

- Track job postings for specialized roles like clinical informatics or healthcare integration.

- Analyze leadership team composition changes quarterly.

- Note which clinical specialties are represented in new hires to predict market focus.

🚀 Strategic Insights: Companies hiring cardiology or oncology experts likely target high-value specialties. Those adding multiple clinical success roles may be preparing for enterprise-wide deployments. Use hiring patterns to anticipate EHR integration priorities and assess whether competitors are building for niche specialties or broad applicability.

Evaluating Technology Performance and Accuracy Metrics

Accurate and reliable technology is the backbone of any healthcare AI scribe solution. Evaluating performance metrics helps you understand where competitors excel and where opportunities for differentiation exist, directly impacting clinical workflow efficiency and user adoption. Start by benchmarking against industry standards like GPT-4o comparisons—DeepScribe's 59% accuracy advantage over GPT-4 demonstrates how domain-specific training creates meaningful differentiation.

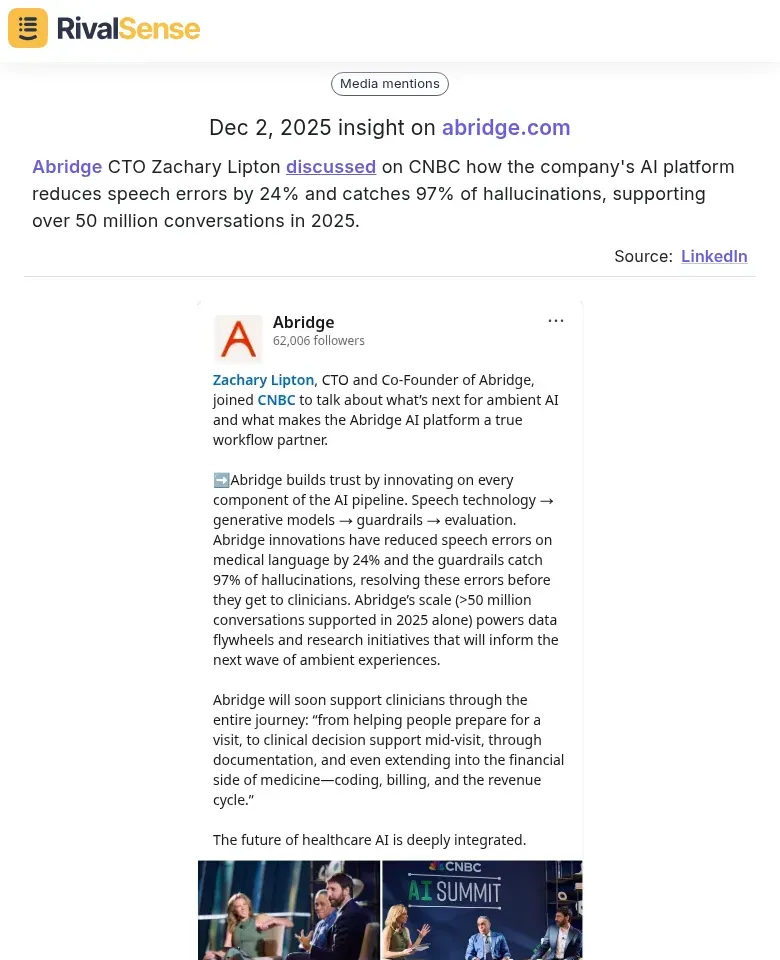

RivalSense insights can highlight key performance claims. For example: "Abridge CTO Zachary Lipton discussed on CNBC how the company's AI platform reduces speech errors by 24% and catches 97% of hallucinations, supporting over 50 million conversations in 2025."

Such insights provide concrete benchmarks for technology performance. Understanding these metrics allows you to compare your own solutions and prioritize areas for improvement, ensuring you stay competitive by focusing on real-world clinical value.

✅ Practical Evaluation Checklist:

- Verify hallucination detection claims (e.g., 97% accuracy) through independent testing.

- Analyze speech error reduction metrics (e.g., 24% relative reduction) in clinical contexts.

- Request vendor-provided blinded head-to-head trial results.

- Examine medical term recall rates across diverse patient populations.

- Assess performance in multilingual and accented speech scenarios.

💡 Key Insight: Accuracy metrics become competitive differentiators when they translate to clinical value. Always correlate technical metrics with workflow impact—what matters isn't just the percentage improvement, but how it affects physician burnout, patient safety, and administrative burden reduction.

Assessing Market Penetration and Scale Indicators

Market penetration and scale are critical indicators of a competitor's success and stability. By analyzing deployment numbers and usage volumes, you can gauge their market reach and customer adoption levels, which informs your own growth strategies and competitive positioning. Deployment statistics like "200+ health systems" reveal market dominance, but look deeper for regional or health system type concentrations.

Competitive intelligence tools like RivalSense capture valuable scale indicators. For example: "Abridge CEO Shiv Rao said at the 2025 Forbes Healthcare Summit that the company's AI technology is deployed in over 200 health systems and handles nearly 100 million clinical encounters annually, with its models outperforming GPT-4o by catching 97% of hallucinated content."

This insight is valuable for business strategy as it demonstrates a competitor's established presence and operational scale. It helps you benchmark your own growth, identify potential partnerships or acquisition targets, and assess credibility in the market.

📊 Practical Tip: Calculate the average encounters per deployment by dividing total encounters by deployment count. A higher ratio indicates deeper adoption within existing customers, signaling stronger customer loyalty and product fit.

📝 Checklist for Analysis:

- Track which competitors present keynote sessions vs. exhibit hall presence at major events like HIMSS or HLTH.

- Note partnerships announced with major EHR vendors or health systems.

- Monitor media coverage following announcements to gauge market perception.

Strategic Positioning and Competitive Differentiation

Strategic positioning defines how competitors are perceived in the market, and analyzing their messaging and differentiation tactics can reveal gaps where your product can stand out. Start by creating a positioning matrix comparing value propositions across accuracy, workflow integration, and cost savings to identify underserved areas.

Clinical validation is your credibility currency. Map how competitors showcase real-world evidence through peer-reviewed studies, clinical trials, or user testimonials. Evaluate evidence quality based on sample size, study duration, outcome measures, and publication venues to ensure robustness.

🛠️ Practical Steps:

- Create an integration compatibility matrix to assess how competitors connect with EHR systems, clinical workflows, and billing platforms.

- Evaluate API documentation quality and implementation timelines for ease of adoption.

- Track regulatory compliance like FDA clearances, HIPAA certifications, and data security frameworks across competitors.

🎯 Key Differentiation Opportunities: Often emerge at workflow intersections. Map how competitors handle specialty-specific documentation, multi-provider collaboration, and post-visit processing. The most defensible advantages combine seamless integration with specialty-specific customization and robust clinical evidence.

Actionable Competitive Intelligence for Strategic Decision-Making

Turning competitive intelligence into actionable strategies is key to maintaining an edge in the healthcare AI scribe market. By implementing structured frameworks, you can systematically leverage insights for better decision-making across product development, go-to-market, and proactive monitoring.

Product Development & Feature Prioritization

- Feature Gap Analysis: Map competitor features against your roadmap. Prioritize gaps where you can differentiate (e.g., if competitors lack real-time EHR integration, make it your USP).

- User Pain Point Mapping: Analyze competitor reviews for recurring complaints. Address these in your product (e.g., invest in better NLP models if accuracy is a common issue).

- Innovation Radar: Track emerging features like ambient listening to decide whether to follow, leapfrog, or ignore trends.

Go-to-Market & Pricing Strategy

- Positioning Matrix: Plot competitors on axes like price vs. accuracy or ease-of-use vs. customization. Find your unique quadrant to avoid direct competition.

- Pricing Intelligence: Monitor competitor pricing pages, freemium models, and enterprise contracts. Use this to position your tiers competitively while maintaining margins.

- Channel Analysis: Identify where competitors are winning deals (e.g., direct sales, partnerships) and adjust your channel strategy accordingly.

Proactive Monitoring Framework

- Competitor Dashboard: Track key metrics monthly: feature releases, pricing changes, funding rounds, leadership hires, and customer reviews.

- Alert Triggers: Set up alerts for competitor website updates, job postings (hinting at new initiatives), and regulatory filings.

- Quarterly Deep Dives: Conduct comprehensive analysis every quarter to identify strategic shifts before they impact your market position.

⚡ Actionable Tip: Create a "Competitor Response Playbook" with predefined actions for common scenarios (e.g., if a competitor lowers prices by 20%, execute a counter-strategy within 48 hours).

Leveraging Competitive Intelligence for Success

In the fast-paced healthcare AI scribe market, staying ahead requires continuous monitoring and analysis of competitors. By applying the strategies outlined—from talent acquisition insights to technology benchmarks and scale indicators—you can identify opportunities, mitigate threats, and position your company for sustainable growth.

To streamline your competitive analysis, consider using a tool like RivalSense. It tracks competitor product launches, pricing updates, event participations, partnerships, regulatory aspects, management changes, and media mentions across company websites, social media, and various registries, delivering all in a weekly email report. This saves time and ensures you never miss a critical move.

Try RivalSense for free today at https://rivalsense.co/ and get your first competitor report to start gaining strategic advantage.

📚 Read more

👉 The Essential Guide to Tracking Competitor Media Mentions and Content Strategy

👉 How Executive Moves Like Rebecca Kaplan's Reveal Competitive Strategies

👉 The Strategic Guide to Tracking Key Account Milestones: A B2B Leader's Playbook

👉 Case Study: How Project Governance Unlocks Competitor Pricing Advantages

👉 How Import.io's Managed Web Scraping Service Enables Competitor Innovation