Founder Tip of the Day: Prepare for Startup Fundraising

Understanding Different Types of Investors

You might have heard about Venture Capital Funds but in reality, there is a multitude of sources you can raise capital from. Here are some of the most popular ones:

Angel Investors: Individuals who invest their personal funds into private companies. You can either approach successful entrepreneurs one-by-one or you can look for local business angel associations or business anger syndicates.

Venture Capital (VC) Funds: Organizations that pool external capital to invest in private companies, typically focusing on early-stage high-growth startups. Examples include funds like Sequoia Capital, Benchmark, Balderton Capital. Your region should also have many VC funds - google for them.

Accelerators and Incubators: Programs designed to guide, mentor, and assist startups in fundraising in exchange for an equity stake and sometimes a cash investment. Examples include programs like Techstars, Y Combinator, Startup Wise Guys, Entrepreneur First.

Grants: Chances are that your local municipality or country has organisations that are in the business of providing grants for early stage companies that fit their criteria. Your business might not qualify, but it is always worth looking at these options - this is by far the cheapest form of capital.

Bootstrapping: The practice of using personal savings, revenue, and other low-cost resources to build a business without external investment.

Connect with other founders

Reach out to other successful founders and mentors to learn from their experiences with timely milestone achievements and capital raising. Ask them about their learnings from their fundraising efforts, their milestone definitions, the amount of cash required to reach their next round, and whether their fundraising goals were accurately set.

Prepare your data room and your metrics

Ensure you have the right metrics to demonstrate your company's growth and profit potential. You need to convincingly show investors why your company is a worthy investment and how you will manage their funds responsibly by explaining your spending costs, estimated runway, and funding needs.

If you already have traction, make sure you can demonstrate it with user numbers, retention numbers, acquisition cost numbers. This can either be presented in a simple spreadsheet, in BI tools or in industry-specific tools like ChartMogul.

If your company has a data room, make sure it is cleaned up and can be made easily accessible to a potential investor.

Develop your pitch

Create a compelling pitch deck before you begin fundraising. This deck should clearly explain who you are, the problem your company solves, and why investors should be interested. Key elements to cover include:

Identify the Problem: Start by outlining the specific problem your startup aims to solve.

Identify Your Solution: Explain how your startup will address the problem and its unique value proposition.

Explain Your Business Idea: Describe your product or service, its design, functionality, and why it's the best solution.

Describe Your Customers: Outline your current customer base or identify your target market and acquisition strategy.

Detail Your Go-to-Market Strategy: Present your plan for launching the product, building a customer base, and gaining a competitive edge. Include market size and research.

Present Your Team: Highlight the strengths and expertise of your team members and leaders.

Identify the Competition: Show your awareness of the competitive landscape and how you plan to stand out. Here you might also want to prepare a bit in advance by using tools like RivalSense to monitor your competitors. This might give you better insights into the operations of your competitors that you can then present to the investors.

Present Your Finances: Provide detailed financial metrics, models, valuations, and future projections.

Tell Investors How You’ll Use Their Money: Explain your plan for using new capital, such as increasing headcount, R&D spending, or financing acquisitions.

Target Appropriate Investors

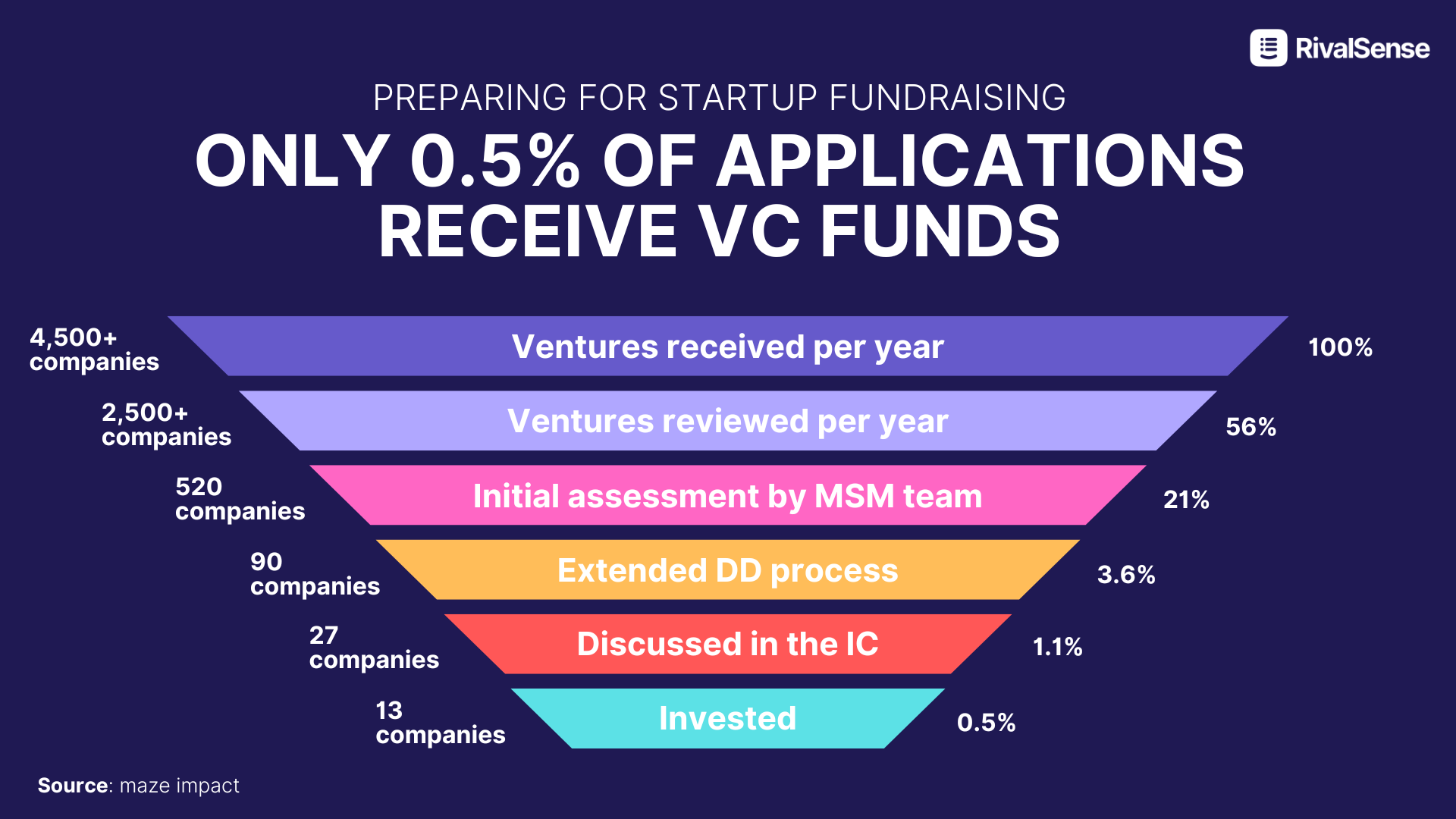

A typical investment rate of a venture capital fund is around 0.5%. In other words, out of 200 funding applications, only 1 company receives the investment. Fortunately, warm intros increase your chances for an investment by quite a bit. If you can get warm intros to around 50 investors, there is a good chance that at least one of them will choose to fund you.

Focus on investors who have experience in your industry and a track record of supporting founders with similar backgrounds and missions. Be cautious, though: some investors might have conflicts of interest if they are invested in your competitors and could misuse your information to benefit their portfolio companies.

Special Tip: By using RivalSense, you can follow investor communities and VC funds to get the latest news about new fundraising rounds, investor lists, new incubator opportunities, and other insights to boost your chances of getting capital.