Essential Competitor Analysis Strategies for Investment & Wealth Management

In today's hyper-competitive wealth management landscape, competitor analysis is no longer optional—it's essential for survival and growth. By systematically tracking rivals' investment strategies, fee structures, client acquisition tactics, and digital presence, firms can anticipate market shifts and evolving client expectations before they become industry standards. This proactive intelligence enables you to refine your value proposition, identify service gaps, and position your firm as a market leader rather than a follower.

Practical steps to get started:

- ✅ Create a competitor matrix tracking key metrics like AUM growth, client retention rates, and digital engagement

- ✅ Monitor quarterly earnings calls and regulatory filings for strategic insights

- ✅ Analyze competitors' marketing campaigns and client testimonials to understand their messaging

- ✅ Track technology adoption and digital platform features across the industry

This disciplined approach directly impacts business growth by uncovering new revenue opportunities, enhances client retention through improved service differentiation, and strengthens strategic positioning in a crowded marketplace. Start with 3-5 key competitors and expand your analysis as you build competitive intelligence capabilities.

Identifying Your Competitors and Market Position

Systematically identifying competitors in wealth management is the foundation of effective analysis. Categorize them as direct (similar services, same target market) and indirect (different services, overlapping client needs) to gain a comprehensive view. Use industry databases, client feedback, and market research tools to compile a thorough list and track key metrics like assets under management (AUM), market share, and client segmentation.

Actionable checklist:

- 🔍 Create a competitor matrix with AUM, services, and target segments

- 🔍 Analyze annual reports and regulatory filings for performance data

- 🔍 Use surveys to understand client perceptions and competitive positioning

- 🔍 Focus on firms with overlapping geographies or specialties for relevance

Regularly update your analysis to adapt to market shifts, ensuring you stay agile and informed in this dynamic industry.

Analyzing Competitor Strengths and Weaknesses

Analyzing competitor strengths and weaknesses requires a systematic approach to uncover actionable insights. Start by evaluating their product offerings, such as investment vehicles (e.g., ETFs, mutual funds), fee structures, and strategies like active vs. passive management. This helps identify gaps where your firm can excel, such as offering transparent, low-cost options if rivals charge high fees.

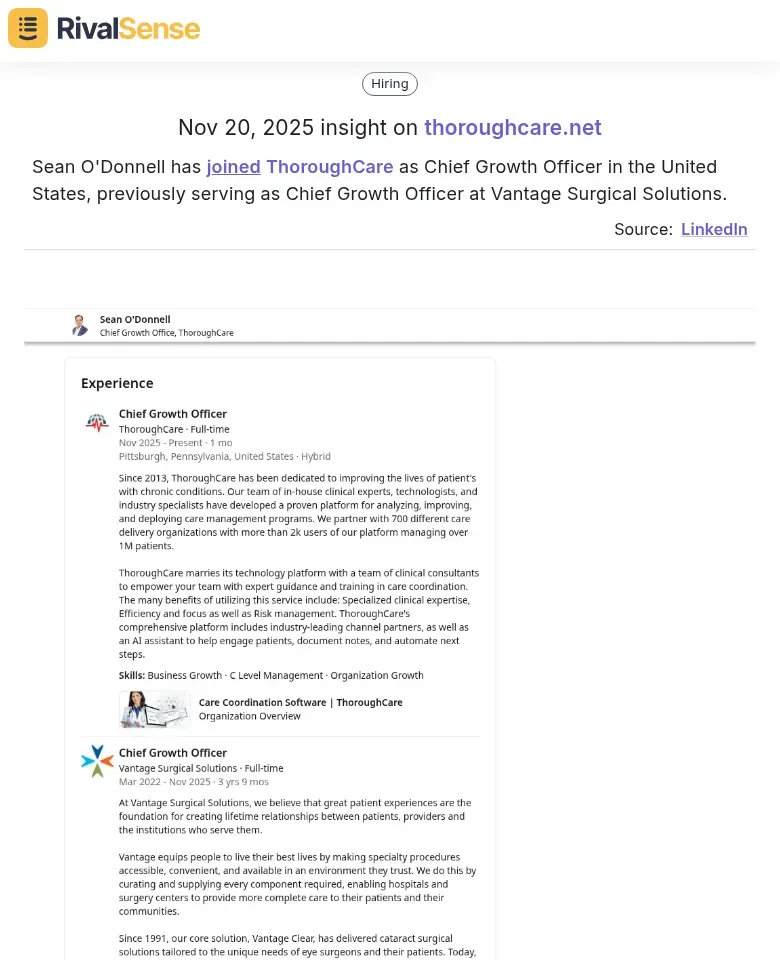

For example, monitoring management changes can signal strategic shifts. When RivalSense tracked that Sean O’Donnell joined ThoroughCare as Chief Growth Officer, it highlighted how leadership moves indicate growth focuses and potential expansions. This type of insight is valuable because it allows you to anticipate competitor moves and identify weaknesses in their current strategy.

Use this checklist to spot opportunities:

- 📊 Map competitor products and fees in a comparative table

- 📊 Analyze online reviews and client testimonials for service gaps

- 📊 Monitor content for thought leadership voids, like underserved niches (e.g., ESG investing)

- 📊 Spot areas where hybrid human-digital advisory services could differentiate you

Leveraging Competitive Intelligence for Strategic Advantage

In investment and wealth management, competitive intelligence transforms raw data into strategic foresight that drives decision-making. Use competitor data to anticipate market shifts, regulatory changes, and emerging trends by monitoring their product launches, fee updates, and compliance activities. For instance, if rivals introduce ESG-focused products, it signals growing client demand and potential regulatory scrutiny.

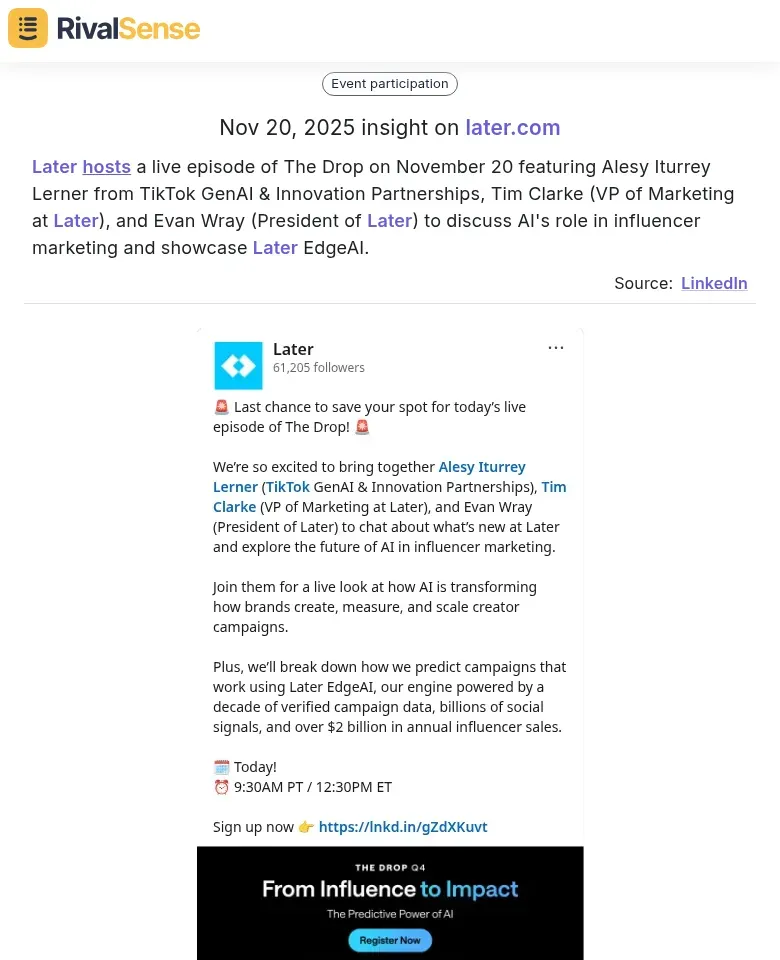

Tracking events and partnerships can reveal innovation efforts and market positioning. RivalSense identified that Later hosted a live episode discussing AI's role in influencer marketing, showcasing their EdgeAI product. This type of event insight is valuable because it uncovers competitors' tech adoption and marketing strategies, helping you benchmark your own initiatives and stay ahead of industry curves.

Practical steps to implement:

- 🚀 Create a competitor dashboard with key metrics like client retention and AUM growth

- 🚀 Subscribe to regulatory news feeds and set up alerts for competitor activities

- 🚀 Conduct SWOT analyses biannually to refine your value proposition

- 🚀 Use tools like RivalSense to automate tracking and generate actionable reports

Best Practices for Implementation and Continuous Improvement

Establishing a structured framework for competitor analysis ensures ongoing relevance and impact in your wealth management firm. Schedule quarterly deep-dives and monthly quick scans to keep pace with market dynamics, and create a standardized template covering essential metrics like AUM growth, fee structures, and digital presence.

Integrate competitive insights directly into business development and marketing strategies through monthly strategy sessions. For example, if a rival launches a successful ESG product, adapt your messaging to highlight your sustainable options. Assign clear ownership to team members for tracking specific competitors and measure ROI by tracking win rates, client acquisition costs, and market share changes.

Implementation checklist:

- 📅 Hold regular strategy sessions to align findings with campaigns

- 📅 Use automated tools to maintain competitive awareness and adjust resources based on data

- 📅 Create a feedback loop where sales teams report competitive encounters

- 📅 Update your analysis focus areas quarterly to stay proactive

Case Studies and Real-World Applications

Real-world examples demonstrate how competitor analysis drives tangible results in wealth management. In ESG investment strategies, one firm analyzed competitors' fund performances and client engagement, then launched a proprietary scoring system that attracted 20% more institutional clients. This shows the power of benchmarking offerings against rivals to capture market share.

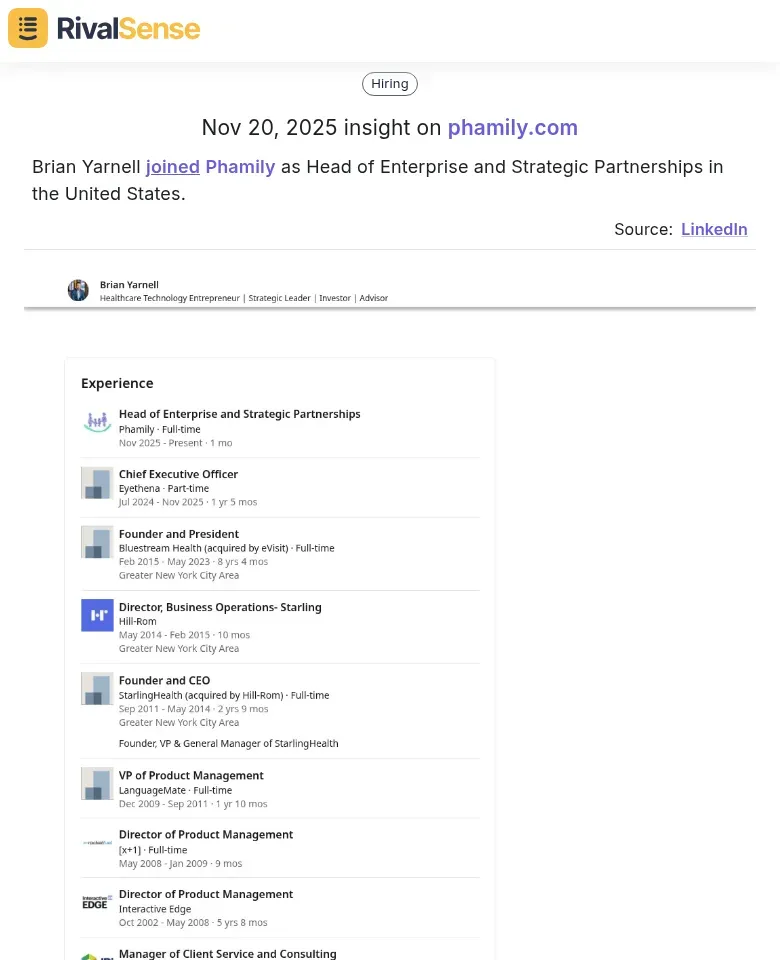

Partnership and hiring insights can reveal expansion strategies. For instance, RivalSense tracked Brian Yarnell joining Phamily as Head of Enterprise and Strategic Partnerships, indicating a push into new markets. This type of intelligence is crucial for understanding competitor moves into enterprise segments, allowing you to preemptively strengthen your own partnerships or highlight expertise in underserved areas.

Actionable tips from case studies:

- 💡 Use competitor tracking to monitor ESG fund launches and client feedback

- 💡 Assess digital features and retention rates monthly to respond to fintech disruptors

- 💡 Review competitors' marketing materials to spot unmet needs, like in alternative investments

- 💡 Capitalize on gaps by highlighting your firm's unique strengths in pitches

Streamline Your Analysis with RivalSense

Ready to take your competitor analysis to the next level? Try RivalSense for free at https://rivalsense.co/ and get your first competitor report today! Our tool tracks product launches, pricing updates, events, partnerships, and more, delivering weekly insights to keep you ahead in the competitive wealth management landscape.

📚 Read more

👉 How RivalSense Helps Counter Talent Loss: A føtex Case Study

👉 Turn Competitor Website Changes into Key Account Wins

👉 Master Mystery Shopping: A Step-by-Step Guide to Outmaneuvering Trust Management Competitors

👉 Win-Loss Analysis: Boost Productivity with Financial Competitor Insights

👉 Mastering Competitor Analysis: Insights from Global Events