Decoding Competitor Hiring and Layoffs: A Strategic Guide for Business Leaders

Introduction: Why Competitor Hiring and Layoffs Are Strategic Goldmines

Workforce changes are the most transparent window into competitor strategy. When rivals hire specialized talent or announce layoffs, they're revealing unannounced business priorities in real-time. These patterns expose which market segments they're doubling down on, which technologies they're investing in, and where they're retreating—intelligence that directly informs your strategic decisions.

Practical steps to decode these signals:

- Monitor hiring patterns: Track when competitors post roles for emerging technologies (AI, cybersecurity, sustainability). This signals market entry or capability building before official announcements.

- Analyze layoff announcements: When competitors cut specific departments, identify which business units are affected. This reveals strategic weaknesses you can exploit.

- Connect talent movements to market opportunities: If a competitor lays off their AI ethics team while hiring AI engineers, they're prioritizing development over compliance—creating regulatory vulnerability.

- Build proactive intelligence systems: Set up alerts for competitor job postings, LinkedIn team changes, and industry news about workforce adjustments. Don't wait for quarterly reports—act on real-time signals.

Proactive workforce intelligence transforms you from reactive follower to strategic leader. While others analyze last quarter's results, you're identifying next quarter's opportunities based on current competitor movements.

🎯 Decoding Strategic Direction Through Executive Hiring Patterns

Executive hiring patterns reveal more than just organizational growth—they're a window into strategic direction. When competitors hire senior talent from adjacent industries, they're signaling expansion into new markets. For example, a SaaS company hiring retail executives likely indicates a move into e-commerce solutions.

Practical steps for decoding these patterns:

- Track C-suite and VP-level hires across your competitive landscape

- Analyze their previous industries and functional expertise

- Map hiring clusters to identify strategic priority shifts

- Monitor role creation patterns—new Chief AI Officer positions signal AI investment

Executive background transitions predict business model evolution. When a fintech competitor hires healthcare compliance experts, anticipate moves into regulated healthcare payments. Similarly, consumer tech executives joining B2B companies often precede enterprise market expansion.

Key indicators to watch:

- Cross-industry talent acquisition = market expansion

- Senior role creation = strategic priority shifts

- Executive background transitions = business model evolution

Create a tracking matrix: list competitors, track executive hires monthly, note industry transitions, and correlate with product launches. This intelligence helps anticipate competitor moves 6-12 months before they materialize in the market.

🔧 Operational Insights from Supply Chain and Finance Leadership Moves

Supply chain and finance leadership moves reveal critical operational insights that competitors often overlook. When you see specialized hiring like a VP of Supply Chain Optimization or Director of Financial Process Automation, these signal imminent operational efficiency initiatives. Track these hires to anticipate cost reduction strategies or margin improvement targets.

Regional leadership appointments in emerging markets often precede international expansion. A new APAC Finance Director or Latin America Supply Chain Head typically indicates market entry within 6-12 months. Monitor these moves to predict competitor geographic priorities.

Functional expertise transitions reveal capability building. When a competitor hires a logistics leader from Amazon or a finance executive from a Six Sigma background, they're importing specific operational methodologies.

Create a tracking checklist:

- Document specialized operational roles being filled

- Map regional leadership appointments to expansion timelines

- Analyze functional backgrounds for methodology imports

- Connect hiring patterns to quarterly financial results

Practical tip: Focus on hires with 'optimization,' 'transformation,' or 'efficiency' in titles – these signal active operational improvement projects. Also track when operational leaders move between competitors – this often indicates industry-wide capability shifts.

📊 Real-World Examples: How RivalSense Insights Reveal Strategy

Tracking leadership moves through tools like RivalSense provides concrete examples of how workforce changes signal strategic shifts. Here are recent insights that highlight the value of monitoring these patterns:

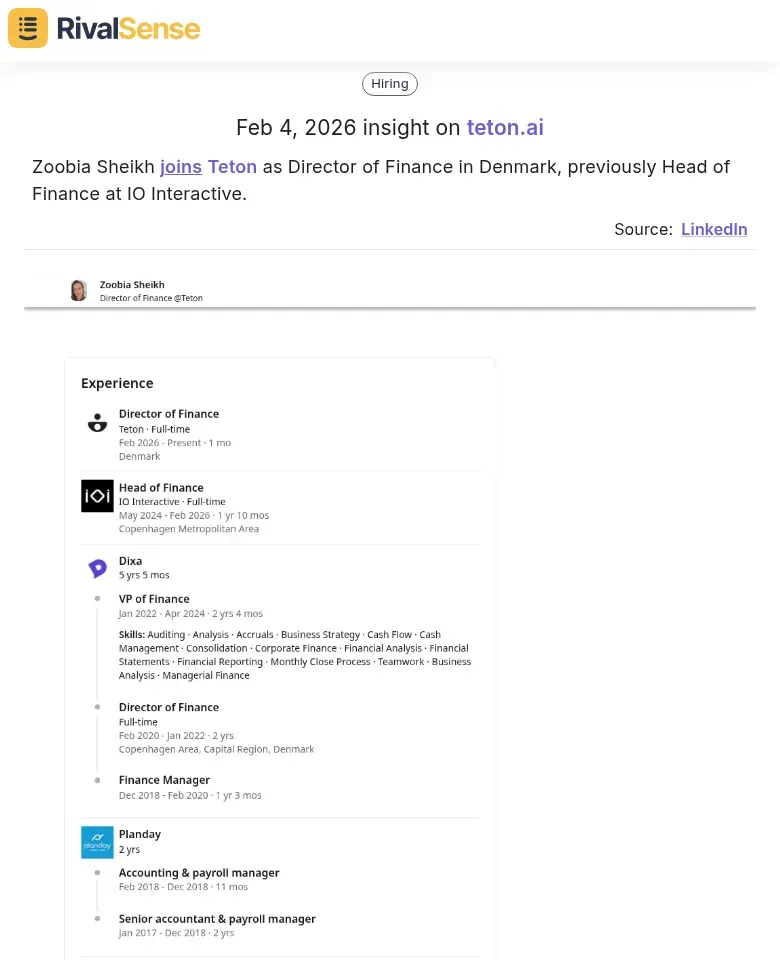

Finance Leadership Hire: International Expansion Signal

Why it matters: When Zoobia Sheikh joined Teton as Director of Finance in Denmark, previously Head of Finance at IO Interactive, it signaled Teton's commitment to strengthening financial operations in Denmark. This move often precedes increased investment or market expansion in the region, giving you early warning to adjust your strategy.

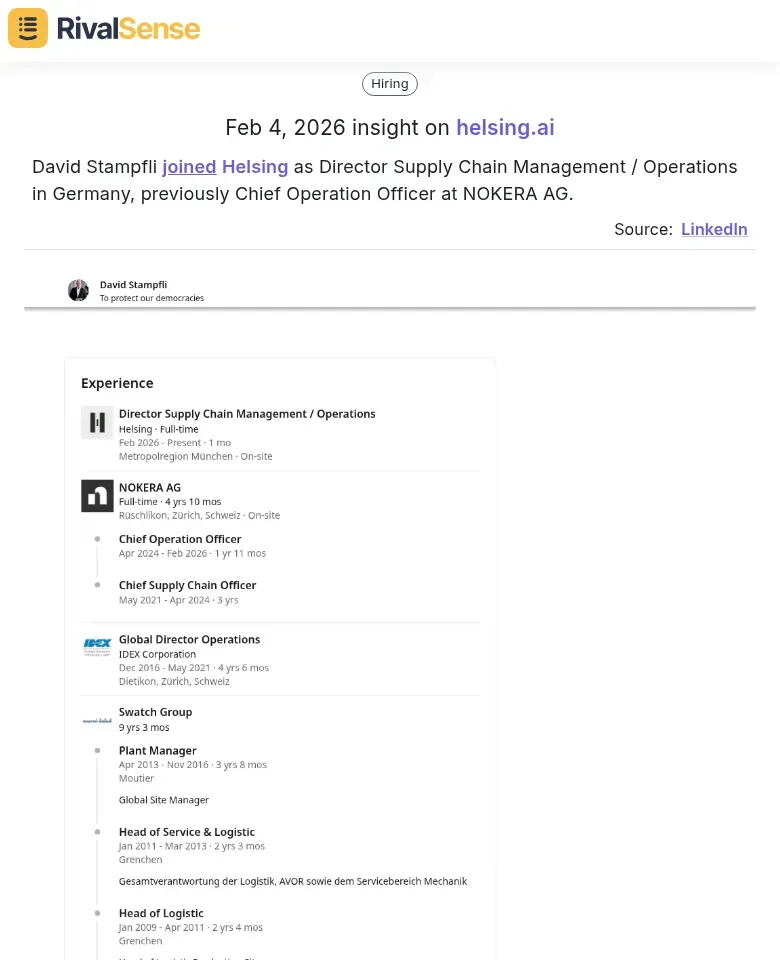

Supply Chain Leadership Hire: Operational Efficiency Focus

Why it matters: David Stampfli's appointment as Director of Supply Chain Management at Helsing in Germany, with a background as COO at NOKERA AG, indicates Helsing's focus on enhancing supply chain capabilities. Such hires reveal investments in operational efficiency and geographic prioritization, allowing you to anticipate competitor cost structures and market focus.

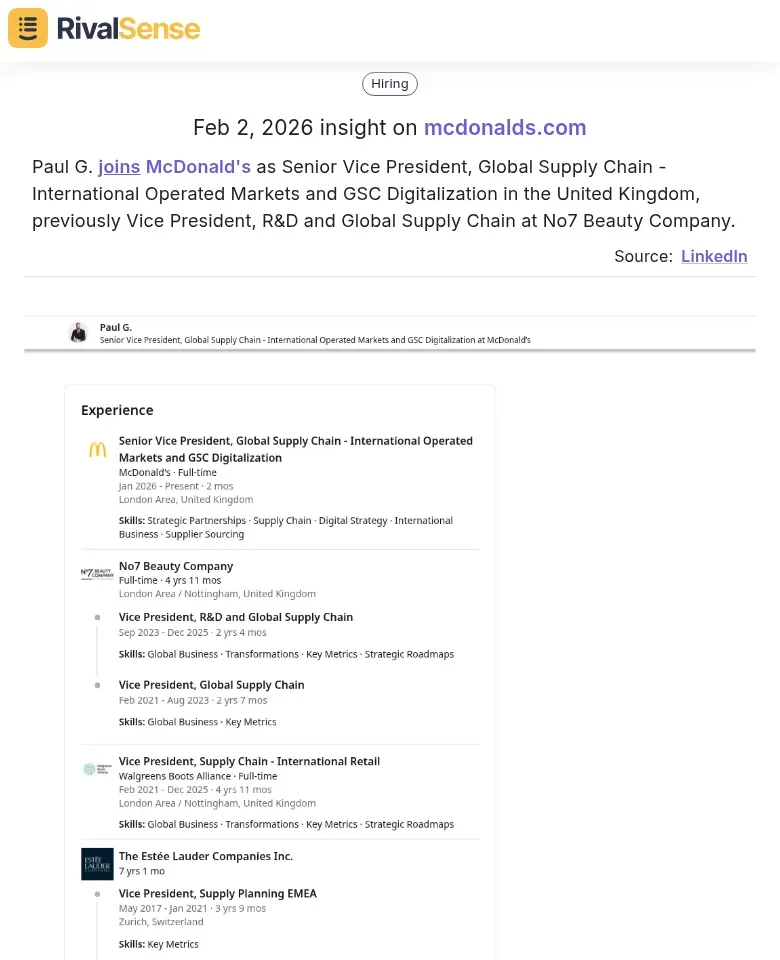

Global Executive Hire: Digital Transformation Priority

Why it matters: Paul G. joining McDonald's as SVP for Global Supply Chain Digitalization in the UK highlights McDonald's push for digital transformation in international markets. Tracking such high-level hires helps you understand competitor priorities in technology adoption and global market strategies, enabling you to identify gaps or opportunities in your own approach.

These insights demonstrate how automated tracking of leadership moves can provide actionable intelligence for your business strategy.

📉 Layoff Patterns as Reverse Indicators of Strategic Focus

Layoff patterns reveal what competitors are de-prioritizing. When analyzing cuts, focus on three key areas:

- Departmental Cuts = De-prioritized Initiatives: Track which teams face reductions. Marketing layoffs suggest reduced customer acquisition; R&D cuts signal slowed innovation. Example: A SaaS company cutting sales teams may be shifting from direct sales to self-service models.

- Regional Concentrations = Market Signals: Geographic layoff clusters indicate market exits or restructuring. Mass layoffs in a specific country often precede market withdrawal. Example: Tech layoffs concentrated in Europe could signal retreat from EU markets.

- Timing Patterns = Strategic Indicators: Layoffs coinciding with earnings reports suggest financial pressures. Post-funding layoffs may indicate strategic pivots. Example: Layoffs following a new product launch could signal resource reallocation.

Practical Checklist:

- Monitor layoff announcements on LinkedIn, company blogs, and news sites

- Categorize layoffs by department, location, and timing

- Cross-reference with competitor's recent product launches and funding rounds

- Look for patterns across multiple competitors in your industry

- Use layoff data to anticipate market gaps you can fill

Remember: Layoffs aren't just about cost-cutting—they're strategic signals revealing what competitors are abandoning, creating opportunities for your business to step in.

🛠️ Building Your Competitor Workforce Intelligence System

Building a systematic competitor workforce intelligence system requires three key components. First, establish automated tracking of competitor hiring and departure patterns using tools like RivalSense to monitor job postings, LinkedIn updates, and Glassdoor reviews. Create a dashboard tracking key metrics: hiring velocity by department, seniority levels of new hires, and departure patterns among leadership teams.

Second, develop analytical frameworks to translate talent movements into business insights. For example, when a competitor hires multiple AI engineers, analyze their product roadmap implications. When key executives depart, assess potential strategic shifts. Create a scoring system to evaluate the significance of each talent movement.

Third, integrate workforce intelligence into your regular competitive analysis cadence. Add a 'talent intelligence' section to your monthly competitor reviews. Use workforce data to validate or challenge assumptions about competitor strategies. When you see a competitor scaling their sales team, anticipate increased market aggression.

Practical checklist:

- Identify 3-5 key competitors to track

- Set up automated alerts for leadership changes

- Create a talent movement impact matrix

- Schedule monthly workforce intelligence reviews

- Correlate hiring patterns with competitor announcements

Pro tip: Track not just who competitors hire, but where they hire from – poaching from specific companies reveals strategic priorities.

🎯 Turning Insights into Action: Strategic Responses to Competitor Moves

When competitors hire or lay off staff, it reveals strategic vulnerabilities you can exploit. Here's how to turn these insights into action:

Proactive Talent Acquisition:

- Monitor competitor job postings for skill gaps they're trying to fill

- When competitors lay off specialized talent, create targeted recruitment campaigns

- Example: If a competitor cuts their AI team, accelerate your own AI hiring to capture market advantage

Market Positioning Adjustments:

- Map competitor capability changes to your value proposition

- If competitors reduce customer support staff, emphasize your superior service in marketing

- Update sales collateral to highlight areas where competitors are weakening

Strategic Timing:

- Launch new products/services when competitors are distracted by internal transitions

- Schedule major announcements during competitor layoff periods when media attention is high

Checklist for Action:

- Set up alerts for competitor job postings and layoff announcements

- Create a "talent opportunity" dashboard showing competitor skill gaps

- Develop contingency plans for different competitor transition scenarios

- Train sales teams on competitor weakness messaging during transition periods

Key Insight: Competitor organizational changes create 3-6 month windows of vulnerability. The most successful companies don't just observe these shifts—they actively exploit them through coordinated talent, marketing, and product initiatives.

🚀 Put These Insights into Practice with RivalSense

Decoding competitor hiring and layoff patterns manually can be time-consuming and prone to missing key signals. Tools like RivalSense automate this process by tracking competitor product launches, pricing updates, event participations, partnerships, regulatory aspects, management changes, and media mentions across company websites, social media, and various registries—delivering all in a weekly email report.

To start leveraging workforce intelligence for your business strategy, try out RivalSense for free at https://rivalsense.co/ and get your first competitor report today.

📚 Read more

👉 Competitor Insight: Decoding Rivan Industries' Latest Filings

👉 The Ultimate Guide to Key Account Tracking Data Export: Practical Strategies for 2026

👉 Real-World SEO Mystery Shopping: How Top Agencies Outperform Competitors

👉 How Life360's No-Show Alert Insight Drove a Competitor's Proactive Safety Feature

👉 LinkedIn Competitor Intelligence Workflow: Cost-Effective Key Account Tracking for B2B Leaders