Competitor Thought Leadership Analysis: The Ultimate 2025 Guide to Uncover Hidden Opportunities

Recent research from Momentum ITSMA's Value of Thought Leadership 2025 report reveals that 99% of B2B buyers consider thought leadership critical in their decision-making process, with 66% refusing to work with providers who produce poor content. This isn't just about brand building—it's about securing trust, driving differentiation, and actively influencing purchase decisions throughout the entire buying cycle.

The 4-Step Framework for Effective Competitor Thought Leadership Analysis

Step 1: Identify Key Competitors and Content Channels

Start by mapping your competitive landscape beyond direct rivals. Include:

- Direct competitors in your immediate space

- Indirect competitors solving similar customer problems

- Emerging players with innovative approaches

- Cross-industry disruptors entering your market

Actionable Checklist:

- [ ] Create competitor matrix with 8-12 key players

- [ ] Track their websites, blogs, and resource centers

- [ ] Monitor social media channels (LinkedIn, Twitter, industry forums)

- [ ] Subscribe to their newsletters and content updates

- [ ] Set up Google Alerts for their company names + "thought leadership"

Step 2: Analyze Content Themes and Positioning

Based on the ITSMA research, buyers value:

- Originality (49% prefer fresh perspectives)

- Actionable advice (75% need solutions to complex challenges)

- Authenticity (43% value expertise demonstration)

Practical Analysis Framework:

- Theme Mapping: Categorize competitor content into themes (e.g., AI transformation, sustainability, customer experience)

- Gap Identification: Note where competitors are silent—these represent opportunities

- Tone Analysis: Assess whether content is educational, provocative, or practical

- Format Evaluation: Track what works best (whitepapers, webinars, case studies)

Example: When analyzing Expivi's thought leadership, RivalSense detected their shift toward manufacturing customization themes, signaling market positioning changes before official announcements.

Step 3: Track Engagement and Impact Metrics

Move beyond vanity metrics to meaningful KPIs:

Essential Metrics to Track:

- Social engagement rates (shares, comments, meaningful interactions)

- Content download patterns (what resonates most with audiences)

- Media mentions and coverage (earned authority signals)

- Partnership announcements (strategic alignment indicators)

- Executive visibility (speaking engagements, industry recognition)

Pro Tip: Tools like RivalSense automate this tracking across 80+ sources, delivering weekly reports on competitor activities without manual monitoring.

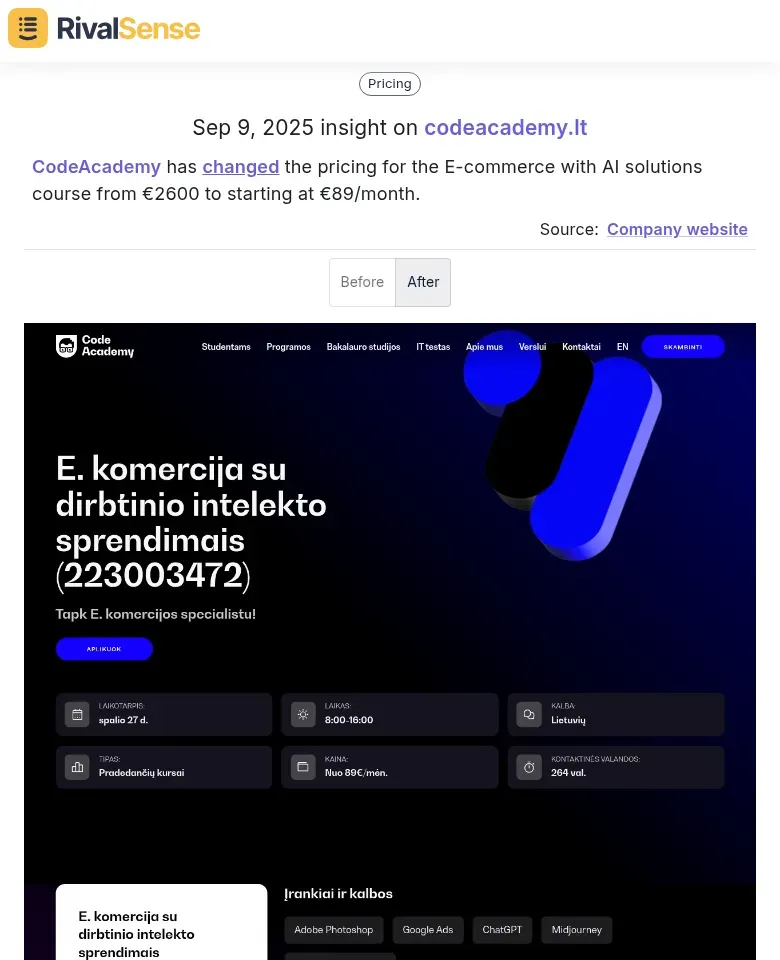

Pricing Strategy Insight: Understanding how competitors adjust their pricing can reveal their market positioning and target audience shifts. For example, when RivalSense detected that CodeAcademy changed pricing for their E-commerce with AI solutions course from €2600 to starting at €89/month, it signaled a strategic move toward accessibility and subscription models that competitors could learn from.

Step 4: Identify Strategic Patterns and Opportunities

Look for patterns that reveal competitor strategy:

Warning Signs to Monitor:

- Sudden partnership shifts (e.g., SaaS company partnering with logistics firm)

- Content theme pivots (indicating market response or new focus areas)

- Executive hiring patterns (new expertise areas being built)

- Regulatory compliance content (responding to industry changes)

- Innovation signaling (AI integration, new technology adoption)

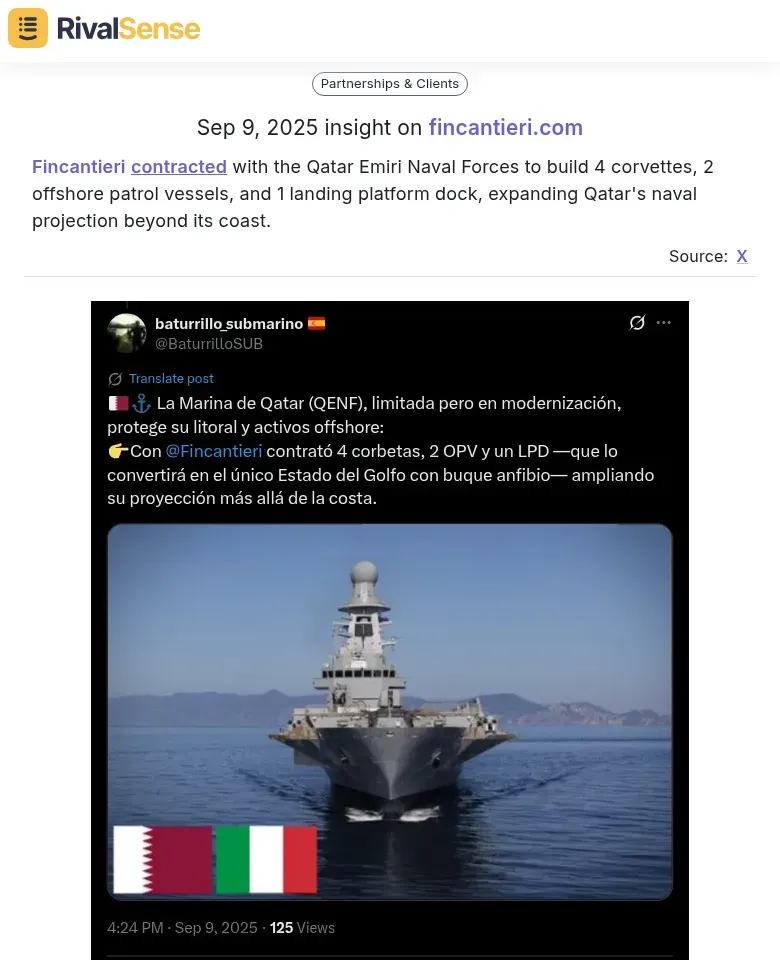

Strategic Partnership Insight: Major contract wins and partnerships often indicate new market focus areas and competitive positioning. For instance, when Fincantieri contracted with the Qatar Emiri Naval Forces to build 4 corvettes, 2 offshore patrol vessels, and 1 landing platform dock, it revealed their expansion into international defense projects and naval projection capabilities—valuable intelligence for competitors in the maritime and defense sectors.

Case Study: When RivalSense detected a competitor's increased focus on sustainability compliance content, clients anticipated regulatory changes and adjusted their own content strategy 3 months ahead of market shifts.

Common Mistakes to Avoid (Based on Real Data)

Mistake 1: Focusing on Quantity Over Quality

41% of buyers say thought leadership is often unoriginal and unstimulating. Don't just track volume—analyze depth, originality, and actionable value.

Mistake 2: Ignoring Partnership Signals

Strategic partnerships reveal priorities. Track collaborations, terminations, and new alliances for early warning signs of market shifts.

Mistake 3: Neglecting Industry Context

38% of buyers say content lacks direct relevance. Analyze competitors within industry trends, regulatory changes, and customer pain points.

Local Market Expansion Insight: Even local infrastructure developments can signal broader strategic moves. When Rīgas satiksme extended tram line 7 by nearly two kilometers to Višķu iela near T/C Dole, adding new public transport interchange with stops, bike path, and tree plantings, it demonstrated their commitment to urban development and sustainability—key themes competitors could leverage in their own positioning.

Mistake 4: Underestimating New Entrants

Startups often disrupt with niche solutions. Monitor funding rounds, hiring spikes, and unconventional partnerships.

Practical Implementation: Your 30-Day Action Plan

Week 1: Foundation Setup

- [ ] Identify top 5 competitors for deep analysis

- [ ] Set up monitoring systems (tools like RivalSense can automate this)

- [ ] Create content theme tracking spreadsheet

Week 2: Initial Analysis

- [ ] Map competitor content themes and gaps

- [ ] Analyze top-performing content formats

- [ ] Identify 3 strategic opportunities

Week 3: Engagement Tracking

- [ ] Monitor social engagement patterns

- [ ] Track media mentions and coverage

- [ ] Analyze partnership announcements

Week 4: Strategy Development

- [ ] Develop content gaps to exploit

- [ ] Create differentiation strategy

- [ ] Set up ongoing monitoring system

How Technology Enhances Your Analysis

Manual competitor tracking is time-consuming and often incomplete. Automated tools like RivalSense track:

- Product launches and updates across competitor websites

- Pricing changes and packaging evolution

- Event participation and speaking engagements

- Partnership announcements and strategic alliances

- Regulatory compliance content and responses

- Management changes and hiring patterns

- Media mentions across 80+ sources

These insights are delivered in weekly email reports, saving dozens of hours manually scouring the internet for competitive intelligence.

Turning Insights into Competitive Advantage

Thought leadership analysis isn't just about knowing what competitors are doing—it's about understanding why they're doing it and how you can do it better. The ITSMA research shows that thought leadership influences every stage of the buying process, from initial awareness (38% use it to evaluate expertise) to final decision-making (81% say it helps buying groups align).

Final Checklist for Success:

- [ ] Focus on quality and originality, not just volume

- [ ] Track partnerships and alliances for strategic signals

- [ ] Analyze within industry context and trends

- [ ] Monitor new entrants and disruptors

- [ ] Use automation to maintain consistent monitoring

- [ ] Translate insights into actionable content strategy

Ready to streamline your competitor thought leadership analysis? Try RivalSense for free and get your first competitor report today. Our automated tracking across websites, social media, and registries delivers comprehensive weekly reports that turn competitive intelligence into strategic advantage.

For more practical competitive intelligence strategies, explore our guide on Mastering Competitor SWOT Analysis or Decoding Competitor Moves through Event Tracking.

📚 Read more

👉 Predictive Monitoring: How Insurance Brokers Can Anticipate Competitor Moves

👉 Actionable Internet Monitoring Strategies for Competitor Press Releases

👉 Toy Industry CRM Benchmarking: How to Track Key Accounts and Outperform Competitors

👉 Advanced Tactics: Uncover Competitor Product Secrets via Backlink Analysis