Competitor Benchmarking Mastery: Track Funding Signals for Strategic Insights

Competitor benchmarking provides a real-time window into your rivals' strategic moves, offering unparalleled insights into their market positioning and resource allocation. As competitors increasingly use various channels to announce funding rounds, showcase product launches, and signal strategic priorities, these platforms become rich sources of competitive intelligence.

Funding signals reveal critical strategic intent—when competitors announce new investments, they're telegraphing their growth ambitions, expansion plans, and resource allocation patterns. Track these announcements to understand where they're doubling down, which markets they're targeting, and how they're positioning themselves against you.

Practical steps for effective competitor benchmarking:

- Create a monitoring list of key competitors' official websites and social media pages

- Set up alerts for funding announcements, partnership reveals, and major product launches

- Analyze engagement metrics on announcements to gauge market reception

- Track hiring patterns following funding announcements

- Monitor how competitors position themselves post-funding (new messaging, target markets)

Connect these insights to your business strategy by identifying gaps in your own positioning, anticipating competitor moves before they happen, and adjusting your resource allocation to counter emerging threats. This proactive approach transforms monitoring from passive observation into active competitive advantage.

🎯 Decoding Leadership Signals: What Executive Announcements Reveal

Executive announcements reveal more than personnel changes—they signal strategic pivots and vision shifts. By analyzing leadership communications, you can anticipate where competitors are heading and adjust your strategy accordingly.

When decoding leadership signals, track three key areas:

- Thought Leadership Analysis: Monitor executive interviews and published content for recurring themes. When leaders emphasize specific topics repeatedly, it signals resource allocation priorities. Create a keyword tracking system for leadership statements to identify emerging strategic narratives.

- Industry Presence Mapping: Track which executives speak at which events. Sudden appearances at new types of conferences can indicate market expansion plans. Maintain a spreadsheet of leadership appearances with event themes, audience demographics, and presentation topics to decode market positioning shifts.

- Founder Narrative Evolution: Analyze founder or CEO public communications for subtle shifts. When narratives transition, expect organizational restructuring. Set up alerts for founder/CEO interviews and extract verbatim quotes quarterly to track vision evolution.

Example from RivalSense: CTM360 CEO & Founder Mirza Asrar discusses a new vision of cybersecurity in an interview with Alayam Newspaper. This type of insight is valuable because it reveals the strategic direction and thought leadership of a competitor, helping you understand their focus areas and potential market moves.

Practical Checklist:

- ✅ Subscribe to leadership LinkedIn/Twitter accounts

- ✅ Create a shared document for executive quote analysis

- ✅ Track speaking engagement patterns monthly

- ✅ Compare leadership narratives against hiring trends

- ✅ Set alerts for "executive interview" + strategic keywords

These signals often precede official announcements by 3-6 months, giving you competitive foresight into competitors' next strategic moves.

🤝 Partnership and Sponsorship Signals: Tracking Strategic Alliances

Partnership and sponsorship signals reveal critical strategic insights about competitors' market positioning and expansion plans. Monitoring these alliances helps identify go-to-market strategies and target audience segments.

Analyze sponsorship activities to understand competitive differentiation efforts; event sponsorships indicate market priorities and audience targeting. Here’s a practical checklist for tracking strategic alliances:

- Create a partnership announcement calendar tracking depth (strategic vs. superficial)

- Categorize by strategic intent: market entry, feature expansion, or audience acquisition

- Evaluate integration levels—API integrations signal deeper commitment than marketing partnerships

- Track timing relative to industry events and competitor product launches

- Monitor partnership longevity and renewal patterns

- Analyze sponsorship tiers at industry events to gauge market positioning

Example from RivalSense: BDO USA sponsors the IFA Hall of Fame Award for Greg Flynn, Founder, Chairman, and CEO of Flynn Group LP, to be honored at the IFA Convention 2026, February 23-25. This sponsorship insight is valuable because it shows BDO USA's commitment to the franchise industry and their strategic alignment with key players, indicating market focus and relationship-building efforts.

💡 Tip: Heavy partnership activity often precedes market expansion, while frequent sponsorship renewals indicate successful audience targeting. Use tools like RivalSense to automate tracking of these signals across company websites and social media for comprehensive competitive intelligence.

🚀 Product and Platform Signals: Learning from Innovation Patterns

Product and platform signals reveal how competitors innovate and scale, providing insights into their development velocity and market traction. Tracking these signals helps you stay ahead of industry trends and adjust your own product roadmap.

Analyze user adoption metrics to understand market traction and monitor award recognition for industry validation. Here’s how to effectively track these signals:

- Enhancement Frequency: Track product enhancement frequency and scale to gauge innovation velocity. For example, monitor monthly feature releases versus quarterly major updates. Higher frequency suggests agile development, while larger-scale enhancements indicate strategic pivots.

- User Adoption: Monitor active users, retention rates, and platform growth patterns. A competitor with rapid user growth but high churn may have acquisition issues. Use tools like RivalSense to track these metrics weekly.

- Industry Recognition: Awards signal product maturity and competitive differentiation. Track wins in categories like "Best UX" or "Innovation Awards" to validate market position and attract talent.

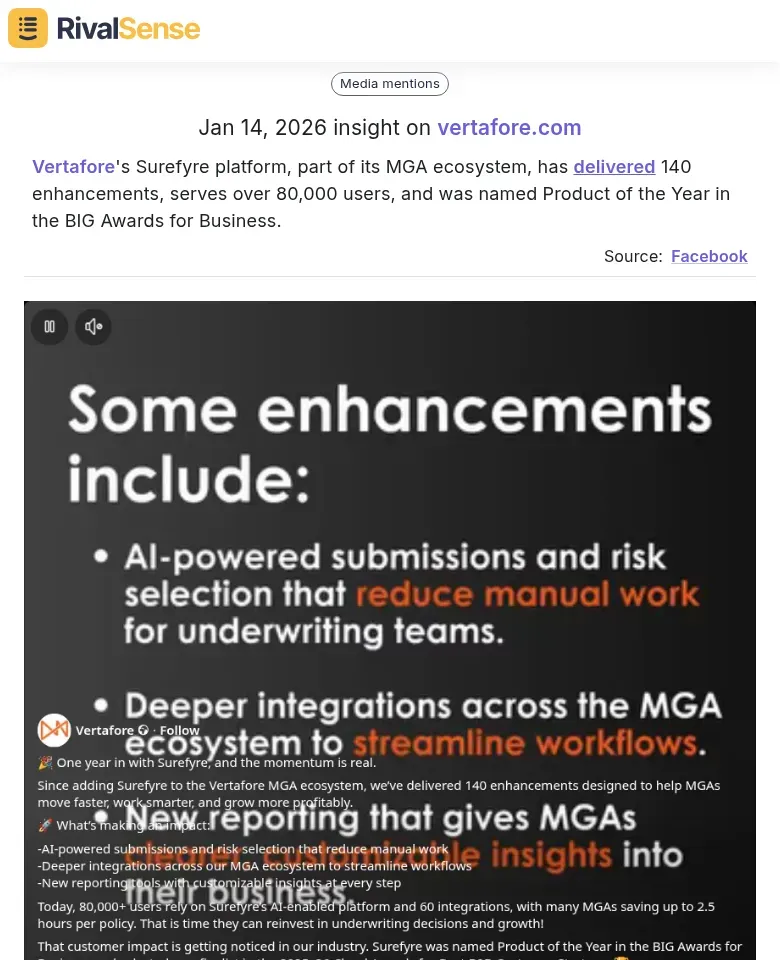

Example from RivalSense: Vertafore's Surefyre platform, part of its MGA ecosystem, has delivered 140 enhancements, serves over 80,000 users, and was named Product of the Year in the BIG Awards for Business. This insight is valuable because it combines product enhancement data, user adoption metrics, and industry awards, giving a comprehensive view of a competitor's product strength and market acceptance.

Checklist for Product Signals:

- ✅ Track MAU/DAU ratios and feature adoption rates

- ✅ Monitor geographic expansion patterns

- ✅ Set up alerts for competitor press releases and industry award announcements

- ✅ Create a competitor feature matrix tracking release dates, scope, and user feedback

Combine these signals: Frequent enhancements + high adoption + industry awards = dominant market position. Adjust your strategy accordingly—accelerate innovation or strengthen differentiation.

📊 Building Your Competitor Signal Tracking Framework

To build an effective competitor signal tracking framework, start by identifying key signal categories: leadership announcements, strategic partnerships, product updates, and industry recognition. Establishing a systematic approach ensures you capture all relevant intelligence.

Set up automated alerts for competitor mentions across news sites, social media, and industry publications. Create a centralized dashboard to consolidate signals, tagging each by category, competitor, and date. Schedule weekly reviews to ensure consistent intelligence gathering.

Transform raw signals into actionable insights using this analysis framework:

- Quantify Signal Frequency: Track patterns over time to identify trends.

- Assess Signal Strength: Evaluate the implications, such as funding rounds or leadership changes.

- Map to Opportunities/Threats: Relate signals to strategic implications for your business.

- Create a Scoring System: Categorize signals as high-impact (immediate action), medium-impact (monitor closely), or low-impact (archive for trend analysis).

Practical Tip: Maintain a competitor signal log with columns for date, signal type, competitor, potential impact, and your response plan. This creates a living document that evolves with market changes and informs strategic decisions.

🎯 Turning Signals into Strategy: Actionable Applications for Business Leaders

When you spot a competitor securing funding or making strategic moves, don't just note it—act on it. Here's how to turn competitor signals into strategic advantage:

Immediate Response Framework:

- Assess Threat Level: Determine if signals indicate growth, expansion, or distress.

- Timeline Analysis: Estimate when resources will be deployed, typically within 6-12 months post-funding.

- Resource Allocation Patterns: Track hiring and spending to predict focus areas.

Strategic Applications:

- Market Gap Identification: If competitors are focusing on certain features but ignoring others, identify opportunities.

- Resource Reallocation: Shift your budget to counter likely competitor moves.

- Timing Advantage: Launch initiatives before competitors deploy new resources to capture attention.

Practical Checklist:

✓ Monitor announcements weekly

✓ Analyze investor backgrounds for specialization

✓ Track post-move hiring patterns

✓ Update competitive positioning quarterly

✓ Create "what-if" scenarios for different outcomes

Pro Tip: Don't just track the amount—analyze the context. Down rounds signal weakness; up rounds with strategic investors signal strength. Use these insights to adjust your own strategic timing.

🔍 Conclusion: Streamline Your Competitor Tracking with RivalSense

Competitor benchmarking is an ongoing process that requires diligence and the right tools. By systematically tracking leadership, partnership, product, and funding signals, you can gain a competitive edge and make informed strategic decisions.

To streamline your competitor tracking and gain comprehensive insights, try RivalSense for free. RivalSense automates the monitoring of competitor product launches, pricing updates, event participations, partnerships, regulatory changes, management shifts, and media mentions across various sources, delivering a weekly email report directly to you.

Get your first competitor report today at https://rivalsense.co/ and start transforming signals into strategy.

📚 Read more

👉 Performance Marketing Competitor Analysis: A Beginner's Guide to Boosting ROI

👉 Optimizing Product Offerings with Win-Loss Analysis and Competitor Insights

👉 Mastering Competitor Analysis with Real-World Insights

👉 Key Account Management Best Practices 2024: The Strategic Playbook for B2B Growth

👉 Cloud Infrastructure Competitive Intelligence: A Strategic Guide for B2B Leaders