Competitor Analysis in Action: Learning from Reddit's $1B Share Buyback

Competitor analysis is a vital practice for businesses aiming to thrive in competitive markets. By systematically monitoring rivals' actions, companies can uncover strategic shifts and adapt accordingly. A recent example is Reddit's fourth quarter and full year 2025 results reported on February 5, 2026, which included a $1 billion share repurchase program, signaling strong financial health and a focus on shareholder value.

Decoding such financial announcements requires going beyond surface-level news to extract actionable intelligence. These moves often reflect deeper corporate strategies that can influence market dynamics. Here are practical steps to analyze competitor financial updates effectively:

- Examine Key Metrics: Scrutinize revenue growth, profit margins, and cash flow details to assess performance trends.

- Interpret Strategic Signals: Share buybacks may indicate management confidence or a strategy to boost earnings per share.

- Benchmark Against Peers: Compare the announcement with similar actions by industry competitors to gauge relative positioning.

Turning these insights into action involves integrating them into your business planning processes. It's not enough to just collect data; you must apply it to drive decisions. Consider these actionable tips to leverage competitor financial insights:

- Update Competitive Intelligence Reports: Incorporate new financial data into regular reviews to keep strategies aligned.

- Conduct Impact Analysis: Model how competitor moves might affect your market share or pricing strategies.

- Engage Cross-Functional Teams: Share findings with sales, marketing, and finance departments to foster collaborative responses.

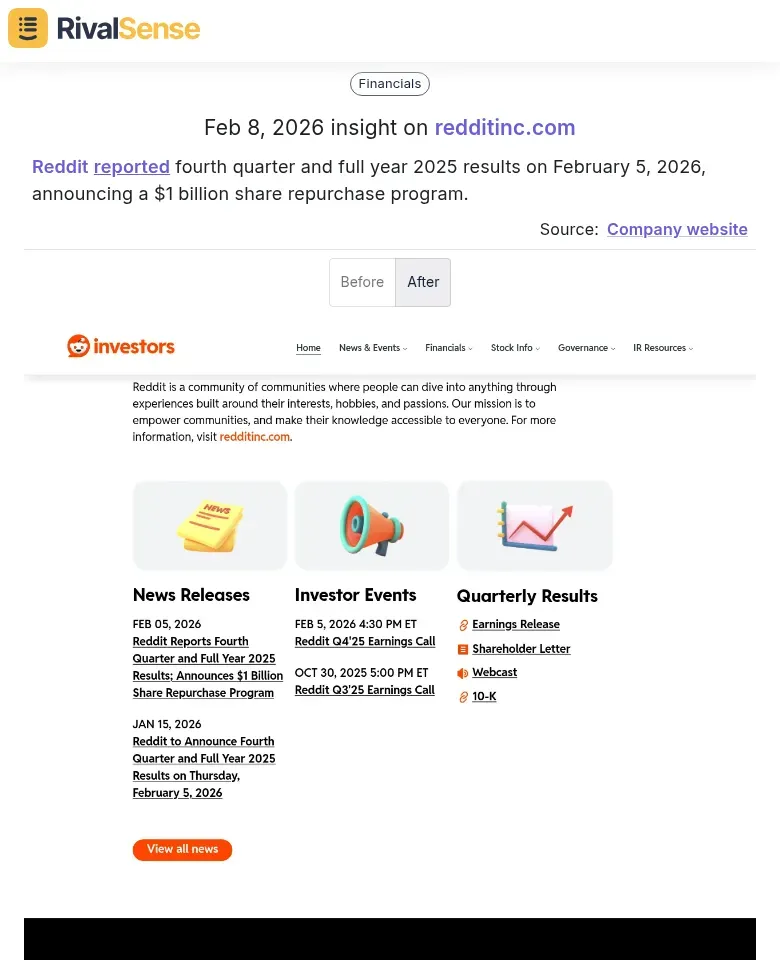

For instance, tools like RivalSense can automate the tracking of such insights, as shown in this example monitoring Reddit's activities:

Leveraging automation for competitor analysis saves time and enhances accuracy, allowing you to focus on strategic interpretation. RivalSense aggregates data from company websites, social media, and registries to provide comprehensive reports on product launches, pricing updates, events, and more. Here’s how it can help:

✅ Timely Alerts: Get notified of key competitor announcements as they happen.

✅ Historical Tracking: Analyze trends over time to predict future moves.

✅ Holistic View: Monitor multiple aspects like partnerships, regulatory changes, and media mentions in one place.

Staying ahead in competitive landscapes requires proactive monitoring and analysis of rivals' financial maneuvers. By adopting structured approaches and tools, you can transform raw data into strategic advantages. To simplify this process, try out RivalSense for free at https://rivalsense.co/ and get your first report today to start gaining actionable insights effortlessly.

📚 Read more

👉 The Ultimate 2026 Guide to Key Account Management Certification: Free vs Paid Programs Compared

👉 Custom Key Account Tracking: PR Firm Productivity Techniques

👉 How Langdock's Company Knowledge Launch Forced Cross-Platform AI Innovation

👉 Facebook Competitor Insights for Key Account Contract Tracking: A Strategic Guide

👉 2026 Web Intelligence Trends: Key Account KPIs for Competitive Edge