Competitive Edge in Professional Services: A Practical Guide to Monitoring Regulatory Filings

In professional services, regulatory filings are more than just compliance paperwork—they're strategic intelligence goldmines. 🏆 Understanding these documents can provide early warnings of market shifts and strategic moves by your rivals. SEC Form D filings, for instance, reveal competitor expansion plans through capital raises for new offices or service lines. When a consulting firm files for $10M in funding, you can track where they're expanding geographically and what services they're scaling.

Hiring patterns in regulatory disclosures signal strategic shifts. If a legal firm suddenly lists multiple AI compliance specialists, they're pivoting to tech regulation services. Monitor job titles in Form 10-K filings—new 'ESG Strategy Director' roles indicate sustainability consulting expansion. Product/service category changes in annual reports show strategic pivots; when an accounting firm adds 'cybersecurity advisory' to their offerings, they're entering a new market segment.

Practical Tip: Create a quarterly filing review checklist including SEC EDGAR searches for key competitors, tracking new service categories in annual reports, and monitoring executive team changes in proxy statements. Set up alerts for Form D filings to catch expansion moves before competitors announce them publicly.

Step 1: Identifying Key Regulatory Sources and Filing Types

Effective monitoring begins with mapping essential regulatory databases specific to your professional services niche. 📚 For accounting firms, the SEC's EDGAR database is crucial for monitoring 10-K, 10-Q, and 8-K filings. Law firms should track state bar association filings and court docket systems, while consulting firms need to monitor industry-specific bodies like FINRA for financial services consultants.

Differentiate between mandatory compliance filings and strategic disclosure documents. Mandatory filings, such as annual reports or license renewals, follow strict deadlines, while strategic disclosures—like merger announcements or leadership changes—reveal competitive positioning. This distinction helps prioritize your monitoring efforts.

Practical Checklist:

- SEC EDGAR for public company disclosures

- FINRA CRD for broker-dealer registrations

- State professional licensing databases

- Court and arbitration filing systems

- Industry association compliance portals

Monitoring Frequency Tips:

- Daily: SEC 8-K filings (material events) 📅

- Quarterly: 10-Q financial reports

- Annually: 10-K reports and license renewals

- Real-time: Court dockets and arbitration filings

- Monthly: State regulatory updates

Set up automated alerts for competitor names in key databases to stay ahead. Remember that regulatory cycles vary by industry—financial services have quarterly reporting, while legal filings follow litigation timelines.

Step 2: Setting Up Your Monitoring System and Tools

Once you've identified key regulatory bodies, establish a systematic monitoring approach for efficiency. 🔧 Choose between automated tools for real-time alerts or manual tracking for budget constraints, but prioritize consistency to avoid missing critical updates.

Create a structured competitor watchlist to focus your efforts:

- Primary competitors (direct service providers)

- Secondary threats (adjacent service firms)

- Emerging players (new market entrants)

Set up alert systems for:

✅ New filings (10-K, 10-Q, 8-K)

✅ Regulatory actions or investigations

✅ License renewals or disciplinary actions

✅ Ownership changes or M&A activity

Integration Strategy: Combine regulatory data with other intelligence sources for deeper insights. For example, cross-reference SEC filings with Glassdoor reviews for staffing insights, or map regulatory compliance against pricing strategy changes.

Practical Tip: Start with 3-5 key competitors and 2-3 critical filing types, then expand as your system matures. Use RSS feeds for manual monitoring or API integrations for automated tools, and set weekly review cadences.

Step 3: Analyzing Personnel Changes and Hiring Patterns

Personnel changes reveal strategic shifts long before they're publicly announced, offering a window into competitor priorities. 👥 Start by tracking executive appointments—a new CTO often signals tech investment, while a Chief Strategy Officer suggests market expansion. Analyzing hiring patterns can uncover emerging service lines or capability gaps.

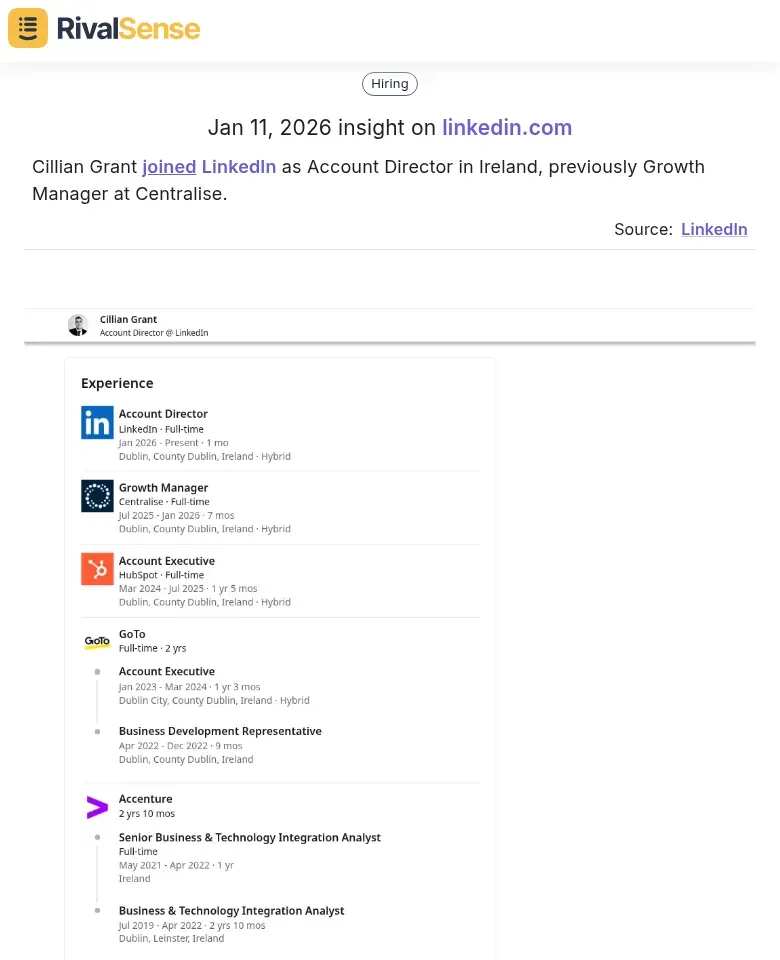

For instance, monitoring tools like RivalSense provide valuable insights into personnel movements. Consider this example where RivalSense tracked a key hire:

Why this insight matters: Tracking senior hires like Cillian Grant's move to LinkedIn as Account Director in Ireland signals the company's focus on strengthening its leadership in specific regions, hinting at market expansion strategies you might need to counter.

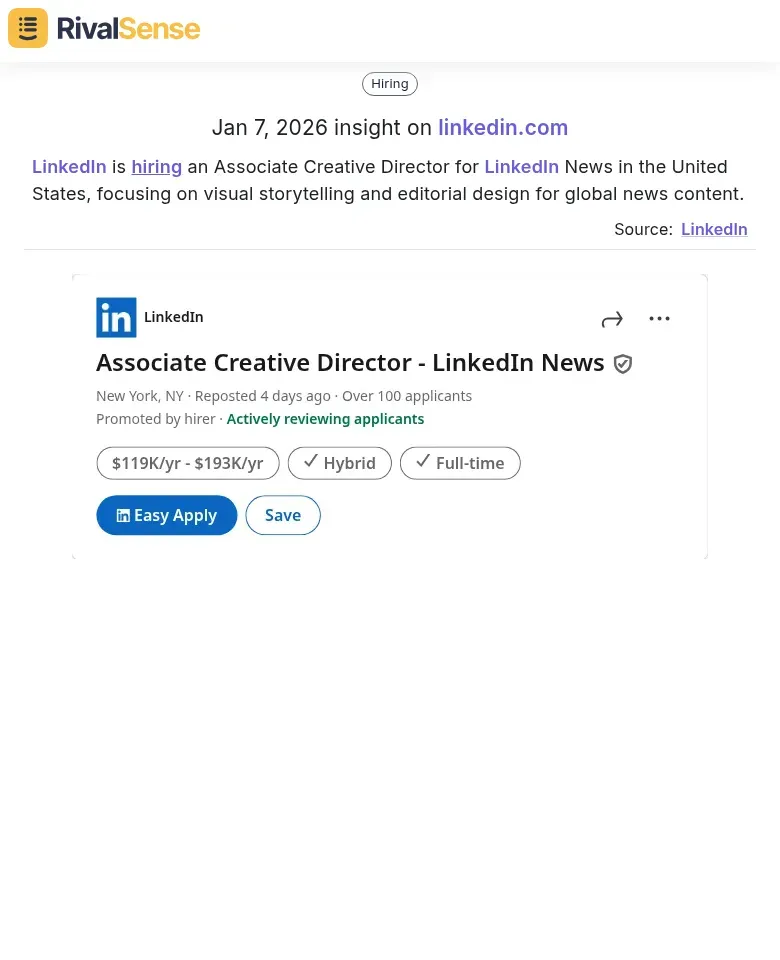

Similarly, hiring announcements can indicate strategic investments. RivalSense also captured this hiring insight:

Why this insight matters: When LinkedIn posts a role for an Associate Creative Director focusing on visual storytelling for global news, it highlights their investment in content and media services. Such insights help you anticipate competitor moves into new service areas like digital content consulting.

Practical Checklist:

- Monthly review of competitor leadership pages

- Track job postings for new role categories

- Note talent sources—where competitors hire from

- Document skill sets in job descriptions

- Compare hiring velocity across departments

Remember: Sudden hiring spikes in a department often precede major initiatives by 3-6 months. Use this lead time to prepare your competitive response.

Step 4: Decoding Product and Service Category Changes

Product and service category changes in regulatory filings are clear indicators of strategic pivots and market adaptation. 🔍 Focus on Item 101 disclosures in 10-K and 10-Q filings, where companies describe their principal offerings. Subtle additions or removals can signal shifts in business focus.

For example, RivalSense insights can highlight such changes effectively: