Carta News | Sep 09, 2024

Carta launched a free calculator to help startups size and value their option pools based on industry benchmarks and expected hires...

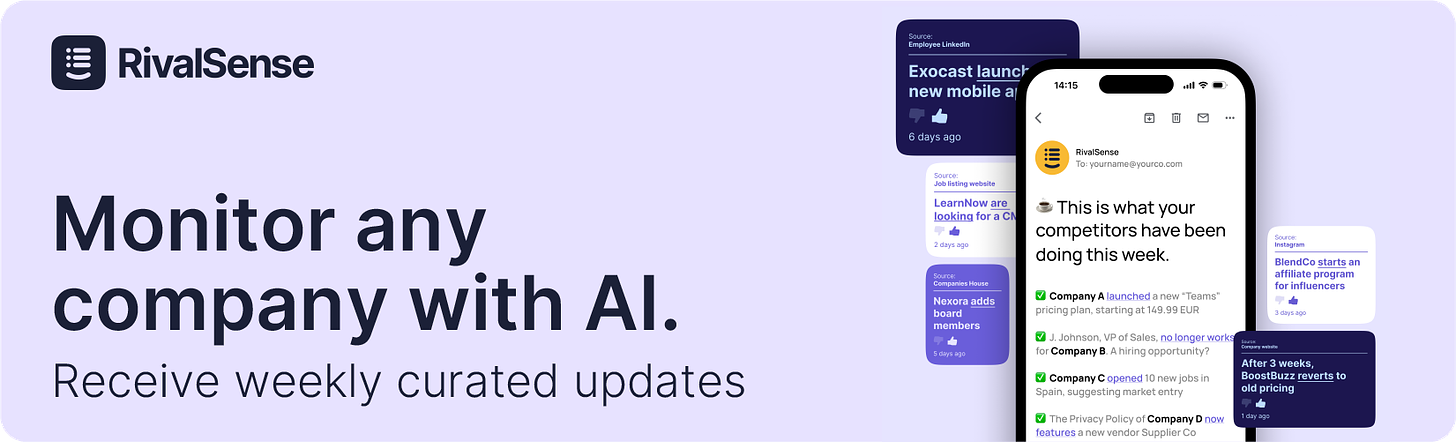

Brought to you by RivalSense - an AI tool for monitoring any company.

RivalSense tracks the most important product launches, fundraising news, partnerships, hiring activities, pricing changes, tech news, vendors, corporate filings, media mentions, and other developments of companies you're following 💡

Carta

🌎 carta.comCarta is an ownership and equity management platform trusted by thousands of founders, investors, and employees. They provide solutions for cap table management, equity management, valuations, and equity plans. Trusted by over 40,000 companies and 2 million users globally, Carta aims to unlock the power of equity ownership for more people.

Updates as of Sep 09, 2024

- Carta launched a free calculator to help startups size and value their option pools based on industry benchmarks and expected hires.

- Carta collaborated with Ramp to feature in Times Square, promoting the future of private markets.

- Stock-trading startup Public has acquired the brokerage accounts of Carta’s secondaries business.

- Carta is raising prices again.

- Carta introduced a Priced Round tool to manage fundraising and a pro forma tool to replace old sheets.

- Carta has launched a free calculator to help businesses model the impact of different fundraising scenarios and dilution terms on their cap table.

- Carta launched a free unpriced round modeling tool to help businesses understand the impact of various fundraising scenarios on their cap table.

- Carta introduced a new feature requiring dual approvers on payments for fund managers, enhancing financial control and audit adherence.

- Carta launched an ESOP Playbook in partnership with AC Ventures to help APAC startups with equity and compensation strategies.

- Carta introduced QSBS attestation to help investors maximize tax savings by providing adequate documentation for QSBS-eligible securities.

- Carta announced that investors can now refer their portfolio companies for QSBS attestation and start an eligibility review directly from the Carta dashboard.

- Carta has rebranded its offerings to focus on Equity Management and Fund Management, emphasizing automated compliance and detailed 409A valuations.

- Carta recently integrated with Sendoso to enhance their outbound motion.

- Dan Rosenberg has left Carta, where he was an Investor in London, to join Nordic Capital as an Investment Director.

- Ashley (Howard) Neville has joined Carta as Insights Director in the United States, previously serving as Sr Brand Strategist for Executive, ITDM, & Data Leader Audiences at Salesforce.

- Carta will host a panel on UK fundraising at TechBBQ in Copenhagen on September 11.

- Nicole Baer, Chief Marketing Officer at Carta, will speak about AI and marketing at SaaStr Annual on September 11.

- In Q2 2024, 88% of all pre-seed deals on Carta were SAFEs, marking the largest quarterly split to date.

- Carta shut down its private stock trading platform, Carta Liquidity, in January after allegations of a conflict of interest, and its brokerage accounts were acquired by Public.

- Carta's CFO Charly Kevers and Managing Director Bhavik Vashi will join an exclusive in-person event on September 3-4.

- Mito Health, a Pre-Series A Singapore startup, chose Carta to manage their cap table and ESOP, ensuring high operational standards and investor transparency, as confirmed by CEO Kenneth Lou.

- Carta will participate in the Fintech for Inclusion Global Summit announced by Accion Venture Lab.

- On September 4th, Henry Ward, CEO of Carta, will join Edward Norton and Katie Jacobs Stanton in a session on board management.

- Carta is hosting a session on board management skills on September 4th featuring CEO Henry Ward, Edward Norton from Zeck, and Katie Jacobs Stanton from Moxxie Ventures.

- Deirdre Ennis joined Carta as an Account Director in the United States, previously working as an Account Director in New York.

- Michael Karges joined Carta as Account Director, Venture Capital in the United States after leaving PitchBook Data where he served as Account Manager, SMB.

- Jayesh Sureshchandra, VP of Engineering at Carta, will be speaking at SF ELC 2024 about the Rule of 40, margins, and strategic engineering decisions.

- Carta's Fund Administration team helped a client's CFO find the exact amount of proceeds from a sale within 20 minutes to avoid potential breaches of their LPA, enabling the client to participate as a follow-on investor in a round that closed 3 days later.

- Thomas Schmorleiz returned to Carta as Director of Engineering, focusing on the fund admin business.

- Carta reported that Q1 had the lowest VC deal volume, but Q2 saw a slight rebound with steady growth in cash raised.

- Carta launched its first VC Fund Performance report aggregated from all funds on its platform.

- Carta released a Q1 VC report with insights on DPI expectations over 3 to 6 years.

- Base10 Partners switched to Carta for fund administration due to its real-time data transparency and efficiency, as highlighted by their Director of Finance, Jarred Morales-Mckinzie.

- Carta's latest VC benchmark report suggested that smaller funds did not outperform larger ones.

- Recent Carta research showed that 9% of 2021 venture funds had DPI after 3 years compared to 16% of 2020 funds and 24% of 2019 funds.

- Carta's new VC fund performance report analyzed benchmarks for over 1,800 funds, revealing that 2022 vintage funds deployed about 43% of their committed capital at the 24-month mark, the lowest share among recent vintages.

- Ray Shan, VP Product at Carta, offered to review YC F24 applications for free.

- Carta offered free application reviews for early-stage founders from their team of executives and YC alumni.

- Henry Ward, CEO of Carta, discussed the importance of guiding founders toward rational valuations in a recent podcast interview with Kison Patel, CEO of M&A Science and DealRoom.

- Kelly Kipkalov, Vice President of Product Marketing at Carta, announced upcoming hiring announcements.

- Carta's Public Policy team released a 2024 Election Outlook focusing on race dynamics and key issues like tax policy, private market access, crypto, AI regulation, and antitrust.

- Carta's CMO Nicole Baer will be speaking at SaaStr Annual 2024 on September 10-12 on considerations for marketers in the age of AI.

- Carta integrated with Valor VC's AI platform Vic to enhance value delivery for LPs and founders.

- Hamza Shad from Carta Insights released their Q2 2024 State of the Markets, featuring regional profiles of Austin, SF Bay Area, NYC, and LA.

- Total fundraising grew to $20.9 billion in Q2 across all US startups on Carta.

Did you find it useful?

If you liked this report, consider following your own companies of interest. Receive weekly insights directly to your inbox using RivalSense.