bunq | Competitive Intelligence Insights - Oct 25, 2024

bunq has introduced a new investment product aimed at digital nomads...

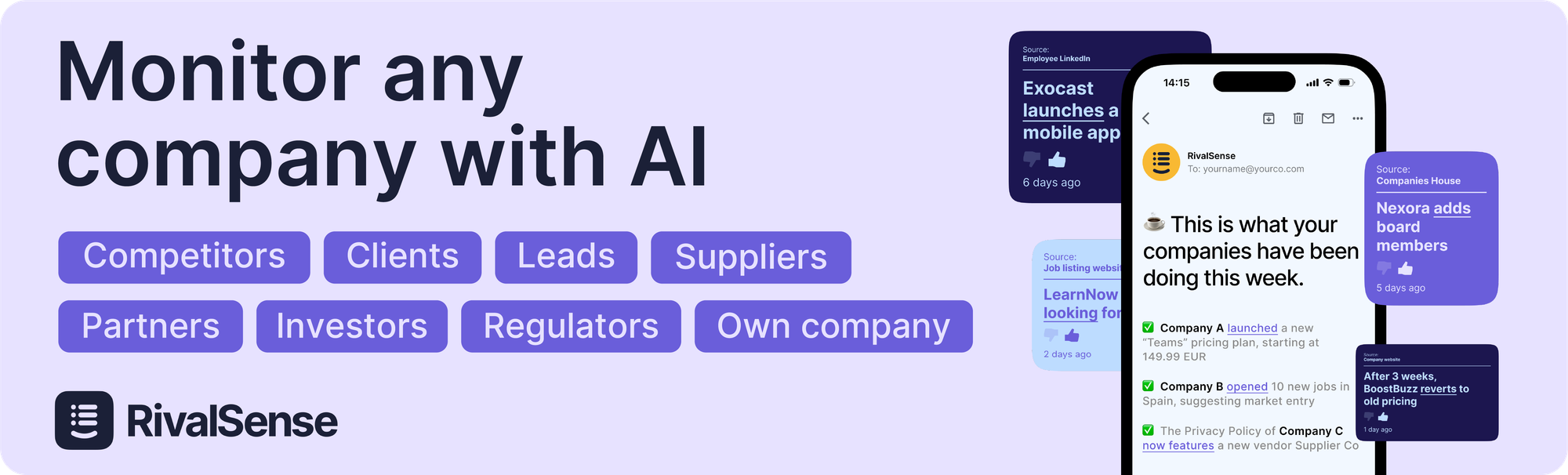

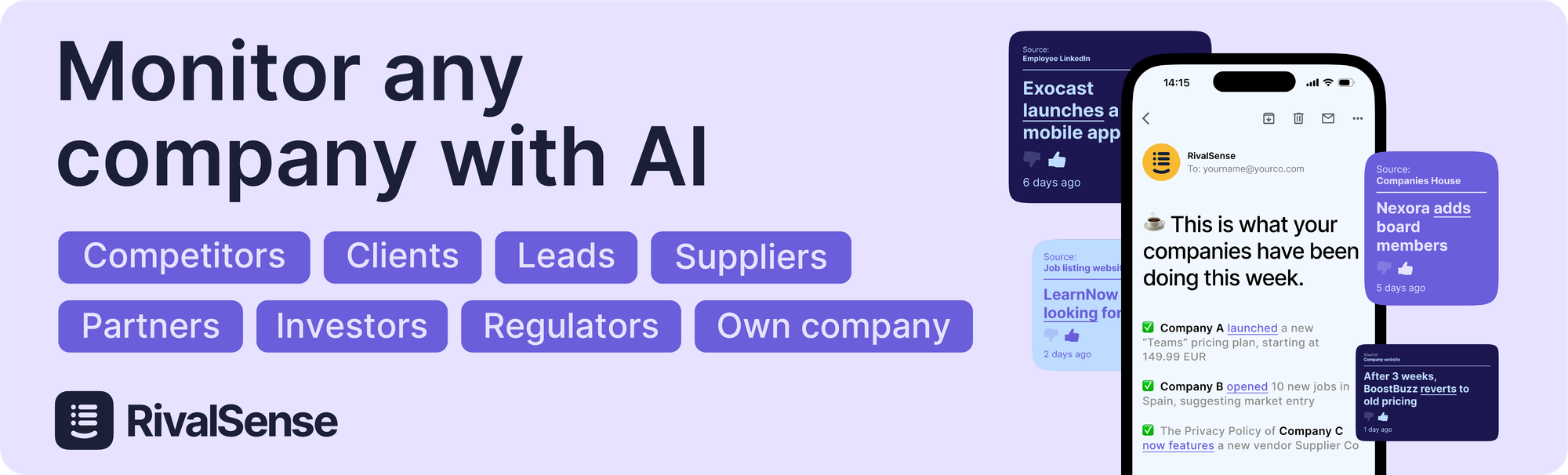

Brought to you by RivalSense - an AI tool for monitoring any company.

RivalSense tracks the most important product launches, fundraising news, partnerships, hiring activities, pricing changes, tech news, vendors, corporate filings, media mentions, and other developments of companies you're following 💡

bunq

🌎 bunq.combunq is a Dutch fintech and neobank that aims to revolutionize the traditional banking industry by providing mobile banking services that are easy, transparent, and fun. They offer personal and business bank accounts, as well as innovative features like virtual credit cards, free ATM withdrawals, and instant payments.

bunq - Latest News and Updates

- bunq has introduced a new investment product aimed at digital nomads.

- bunq now offers practical travel tips including eSIM options to save up to 90% on roaming costs and provides 4x2GB free data annually.

- bunq now offers 4 x 2GB of free worldwide data each year with the Easy Bank Pro XL plan.

- bunq offers expats and digital nomads in Ireland quick access to Irish bank accounts with features like Irish IBAN, multicurrency accounts, and zero foreign exchange fees.

- A court ruled against bunq customers seeking compensation for fraud losses, citing their negligence, despite bunq's extended goodwill policy covering 85% of damages.

- On October 21, 2024, a court ruled that bunq customers who lost money to fraudsters are not entitled to higher compensation as they shared their own data with criminals.

- Frédérique-Charlotte FLORENCE has joined bunq as Senior Compliance Manager (MLRO UK) in the United Kingdom, previously working as Senior Consultant - Financial Crime at Campion Willcocks Compliance.

- bunq's Working Abroad Index reveals that Dublin's average monthly expenses for digital nomads have increased to €2,633.78 in 2024, making it the second most expensive city in Europe after London.

- The Consumentenbond warns that court rulings often favor bunq over cyberfraud victims, leaving consumers dependent on banks' interpretation of their own leniency policies.

- Noel Hoxhaj, Product Owner - Cards at bunq, spoke at the Merchant Risk Council about bunq's market positioning and discussed PSD3, open banking, and tokenization on October 20.

Sign up to receive regular updates

If you liked the insights, consider following your own companies of interest. Receive weekly insights directly to your inbox using RivalSense.