Boost Productivity in Fraud Prevention with Competitor Tracking

In the fast-evolving landscape of fraud prevention, staying ahead of malicious actors requires not just robust internal strategies but also a keen eye on the competition. Competitor tracking emerges as a powerful tool to uncover gaps, trends, and innovative tactics that others in your industry are employing. By analyzing competitors' fraud prevention measures, businesses can identify vulnerabilities in their own systems and adopt best practices before fraudsters exploit them.

Competitor tracking provides actionable insights, such as new fraud detection technologies, response protocols, or customer verification methods being adopted by peers. For instance, if a competitor successfully reduces chargebacks by implementing a specific AI tool, your business can evaluate and potentially integrate similar solutions. This proactive approach not only enhances your fraud prevention framework but also boosts operational efficiency.

To get started, consider these practical steps:

- Identify Key Competitors: Focus on businesses with similar customer bases or fraud challenges.

- Monitor Publicly Available Data: Track competitors' blog posts, whitepapers, and case studies for insights.

- Leverage Tools: Use competitor tracking tools like RivalSense to automate data collection and analysis.

- Benchmark Performance: Compare your fraud metrics (e.g., false positives, resolution times) against competitors.

- Iterate and Improve: Continuously refine your strategies based on competitor insights.

Integrating competitor insights into your fraud prevention framework ensures you’re not just reacting to threats but anticipating them, giving your business a critical edge.

Leveraging Product Updates for Competitive Advantage

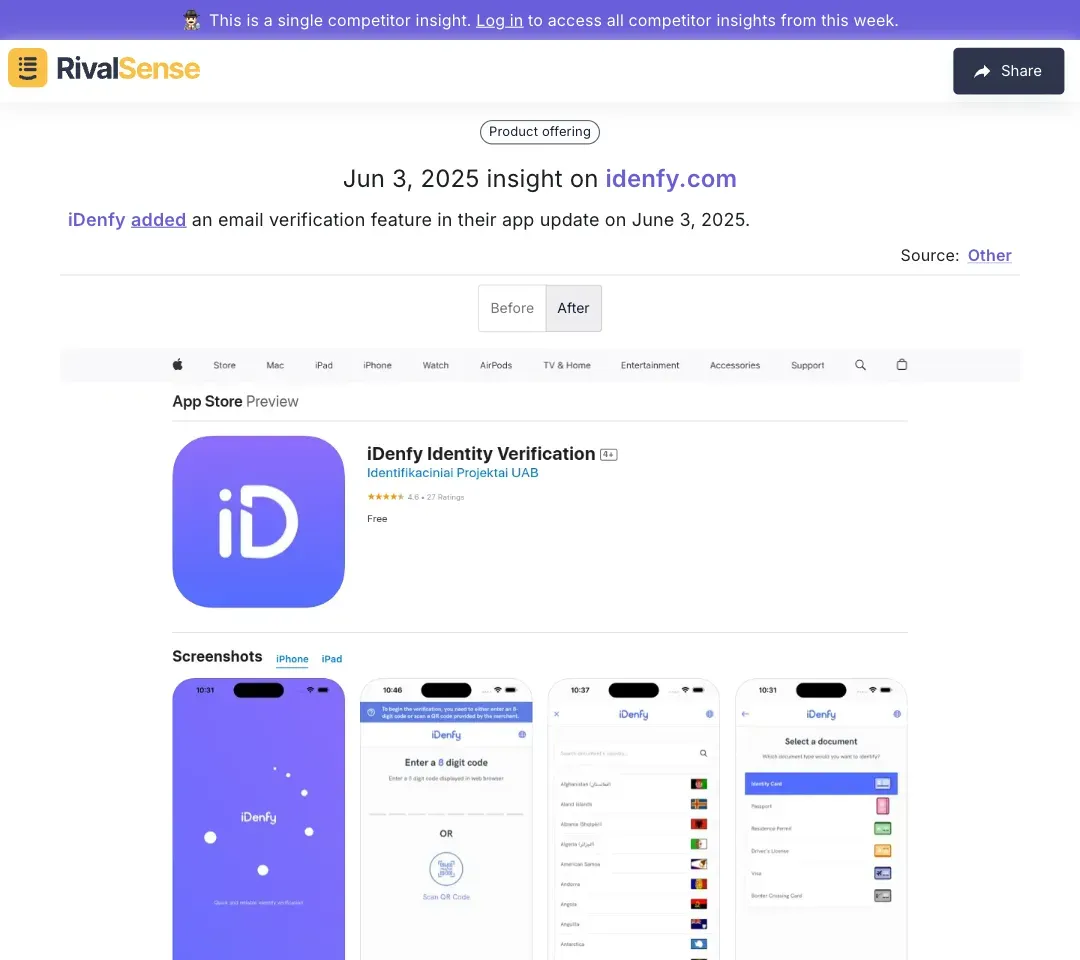

In the fast-evolving domain of fraud prevention, staying ahead means keeping a close eye on competitor product updates. Monitoring these updates, such as new email verification features, can spark innovation within your own team. Timely adoption of such features is crucial; delays can mean losing ground to more agile competitors.

Example Insight: RivalSense recently detected that iDenfy added an email verification feature in their June 3, 2025 update.

Tracking product updates like this helps you identify emerging verification standards and prioritize feature development to match market expectations. When you spot a competitor enhancing their toolset, it signals shifting customer demands and technological trends worth addressing in your roadmap.

Practical steps to turn competitor insights into action:

- Track Updates: Use tools like RivalSense to monitor competitor product changes.

- Analyze Impact: Assess how the update improves user experience or solves a problem.

- Benchmark: Compare the feature against your current offerings to identify gaps.

- Innovate: Brainstorm ways to not just match but surpass the competitor’s solution.

- Execute: Develop a roadmap for integrating the enhanced feature into your product.

By systematically analyzing and acting on competitor product enhancements, you can maintain a competitive edge while driving continuous innovation.

Adapting Pricing Strategies Based on Competitor Moves

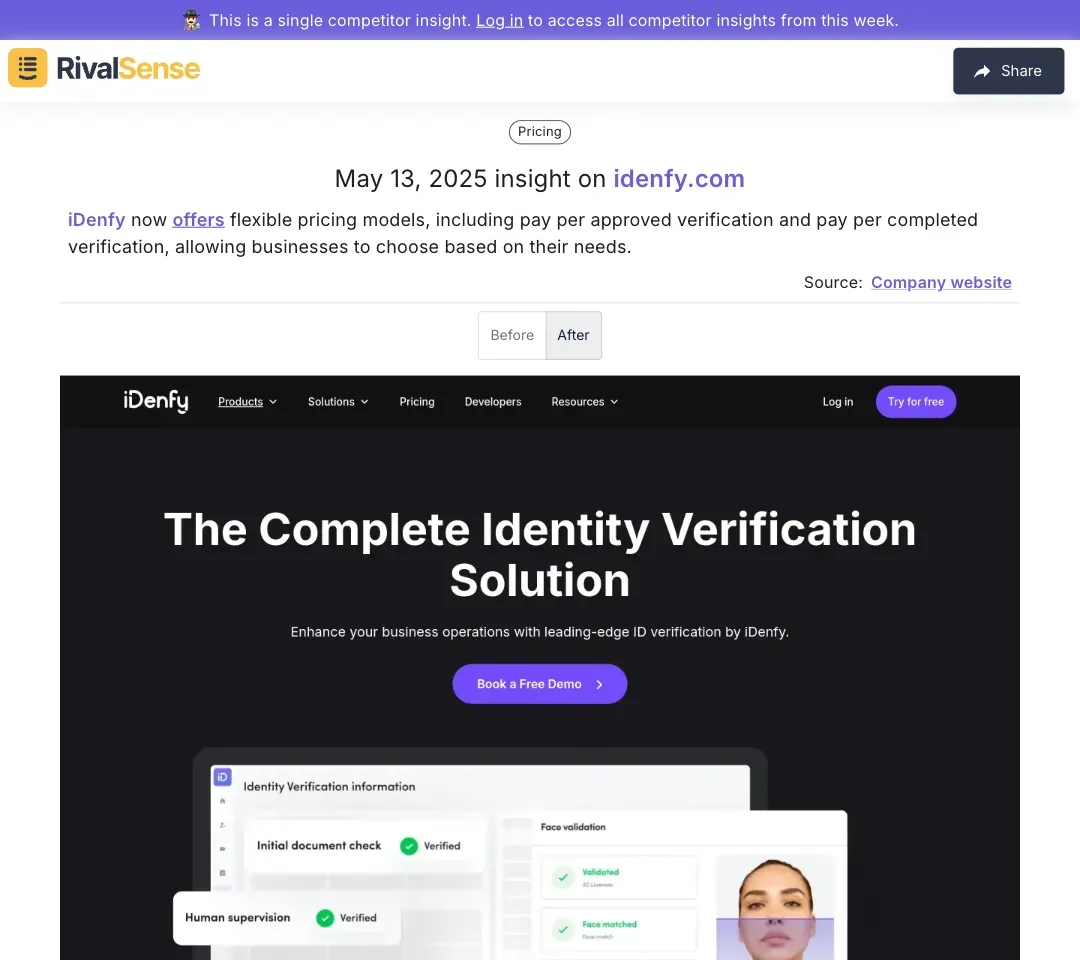

Adapting your pricing strategy in response to competitor moves is crucial in the fraud prevention sector, where market dynamics shift rapidly. Flexible pricing models, such as pay-per-use options, can significantly enhance your market positioning by catering to diverse customer needs. Ignoring these shifts risks losing price-sensitive clients to rivals offering more adaptable structures.

Example Insight: iDenfy now offers pay-per-approved and pay-per-completed verification models.

Monitoring pricing changes provides strategic intelligence about market elasticity and client preferences. When competitors introduce flexible options, it often indicates growing demand for cost-control measures—insights vital for refining your monetization approach.

Here’s how to stay ahead:

- Monitor Competitor Pricing: Use tracking tools to identify pricing patterns.

- Evaluate Your Model: Assess alignment with market demands; consider tiered/dynamic pricing.

- Implement Changes: Case studies show dynamic pricing boosts retention (e.g., usage-based adjustments).

- Test and Iterate: Pilot new strategies in small segments before full rollout.

✅ Practical Tips:

- A/B test pricing models

- Offer limited-time discounts to gauge response

- Highlight ROI to justify premium tiers

Exploring Strategic Partnerships for Enhanced Offerings

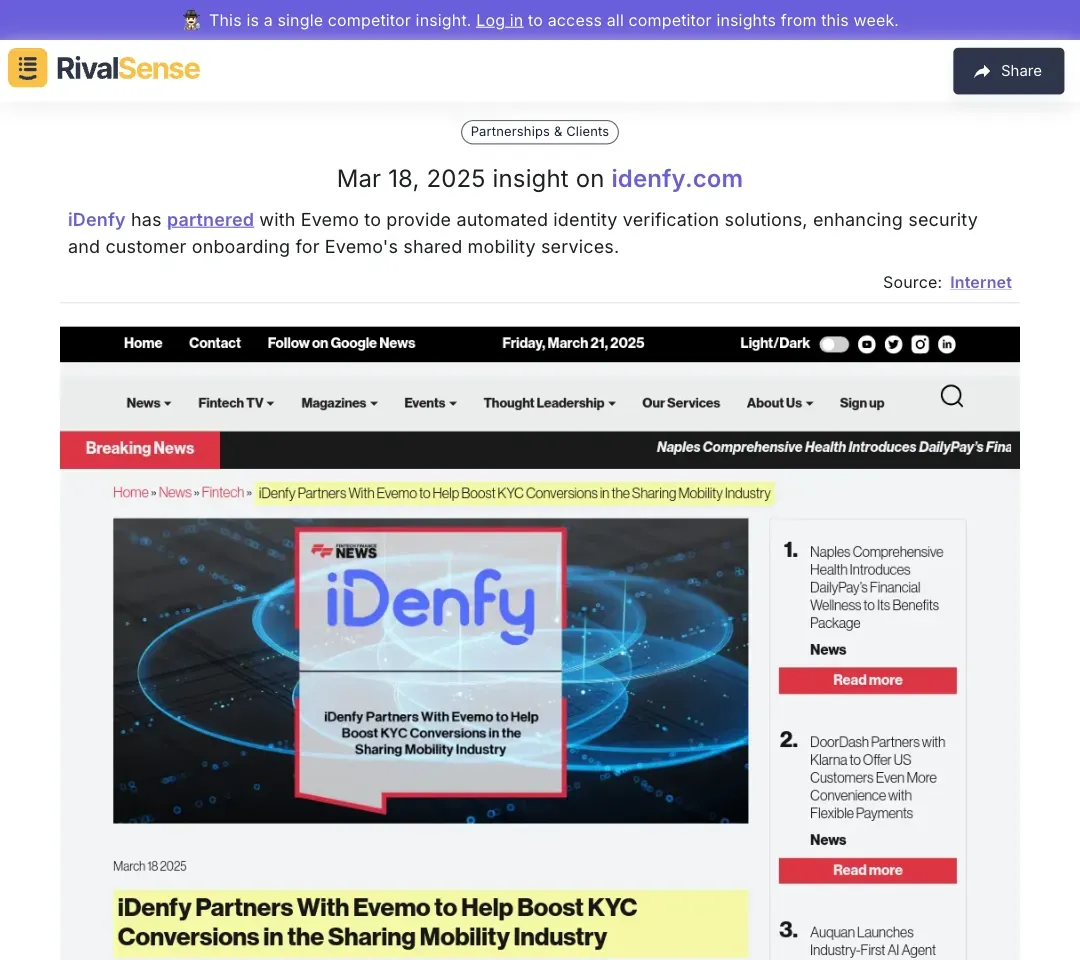

Strategic partnerships can exponentially expand your fraud prevention capabilities without heavy R&D investment. Collaborations with specialized providers allow you to offer comprehensive solutions while focusing on core competencies. These alliances often accelerate market penetration and enhance technical credibility.

Example Insight: iDenfy partnered with Evemo to automate identity verification for shared mobility services.

Tracking partnerships reveals integration trends and unmet market needs. When competitors form alliances, it highlights synergistic opportunities you might pursue to strengthen your ecosystem and address client pain points.

Best practices for forming alliances:

- Identify Partners: Monitor competitor collaborations via press releases or tools like RivalSense

- Evaluate Compatibility: Assess technology alignment, reputation, and added value

- Start Small: Run pilot projects before full integration

🔍 Partnership Evaluation Checklist:

| Criteria | Questions to Ask |

|---|---|

| Technology | Does their stack integrate smoothly with ours? |

| Reputation | What do client testimonials reveal? |

| Compliance | Do they meet data security regulations? |

| Scalability | Can the partnership grow with our needs? |

Implementing Competitor Insights into Your Business Strategy

Translating competitor intelligence into actionable fraud prevention upgrades requires a structured approach. Random reactions to rival moves waste resources; systematic adoption of proven tactics drives sustainable advantage. The key is filtering noise to focus on high-impact opportunities.

Integrate insights through this workflow:

- Identify Competitors: List top players using tools like RivalSense.

- Analyze Tactics: Study their fraud detection methods, tech stack, and customer communication.

- Benchmark Metrics: Compare false positive rates, detection times, and resolution efficiency.

- Adapt and Innovate: Implement best practices (e.g., AI-driven threat analysis).

- Monitor Continuously: Set alerts for strategy shifts.

🛠️ Optimization Tools:

- Competitor tracking: RivalSense, Kompyte

- Data analysis: Tableau, Google Analytics

- Monthly review checklists

📈 Measuring Impact:

- Track KPIs pre/post implementation

- Conduct A/B tests on new workflows

- Establish feedback loops for refinements

Conclusion: Staying Ahead in the Fraud Prevention Game

Competitor tracking transforms reactive fraud prevention into proactive defense. By systematically analyzing rival product updates, pricing shifts, and partnerships, you gain foresight into emerging threats and opportunities. This intelligence fuels innovation while closing security gaps before exploitation.

The fraud landscape demands constant vigilance. As threats evolve, competitor insights provide the radar to navigate changes—ensuring your solutions stay resilient, relevant, and aligned with market expectations.

Ready to streamline competitor intelligence?

RivalSense automates tracking of product launches, pricing changes, partnerships, and regulatory updates—delivering actionable insights in weekly reports.

👉 Try RivalSense Free and get your first competitor report today!

📚 Read more

👉 Decoding Competitor Event Moves: Boost Your Segmentation Strategy

👉 Game Theory in Competitor Analysis: Anticipate Moves and Strategize Like a Pro

👉 Real World Competitor Analysis Walkthrough

👉 Decoding WTW's Strategic Shift: From ESG to Sustainability Focus

👉 Decoding Competitor Moves: Guesty's Expansion and Strategic Hiring