Boost Key Account Win Rates with Competitor Product Intelligence

In today's hyper-competitive enterprise landscape, competitor product intelligence has evolved from passive monitoring into an active strategic weapon. Real-time tracking transforms reactive observation into proactive advantage, enabling sales teams to anticipate competitor moves, counter objections before they arise, and position your solution as the clear choice. This shift from defensive to offensive intelligence directly correlates with improved key account win rates—teams armed with comprehensive product insights consistently outperform those relying on outdated competitive information.

Practical steps to leverage this advantage:

- Implement continuous monitoring of competitor feature updates, pricing changes, and roadmap announcements.

- Create battle cards that address specific competitor weaknesses with your solution's strengths.

- Track customer sentiment and pain points across competitor reviews and social mentions.

- Develop win/loss analysis frameworks to identify patterns in competitive engagements.

Product intelligence creates competitive differentiation by revealing gaps in competitor offerings that align with your key accounts' strategic priorities. When you can demonstrate how your solution uniquely addresses specific enterprise challenges—while highlighting where competitors fall short—you transform sales conversations from feature comparisons to strategic partnerships. This intelligence-driven approach not only improves win rates but also accelerates sales cycles and increases deal sizes.

Decoding Product Expansion Strategies: Learning from SuperApp Transitions

SuperApp transitions reveal powerful lessons for key account strategy by showing how companies diversify into new verticals. Analyzing competitor vertical expansion helps you understand market trends and identify underserved customer needs. For instance, when competitors expand into healthcare or logistics, they're signaling opportunities you can leverage or counter.

Investment patterns are strategic signals. Monitor R&D spending, acquisitions, and hiring trends to gauge competitor priorities. When Uber invested in financial services for drivers, it signaled a shift from pure transportation to ecosystem monetization. Create a competitor investment dashboard tracking:

- Capital allocation by business unit

- M&A activity patterns

- Talent acquisition focus areas

- Partnership announcements

Real-world example: RivalSense tracked that inDrive expanded into groceries and ads in 2025 to transition toward a SuperApp, with Lee Chin Jian from Investments at inDrive stating they will continue investing in these verticals in 2026. This type of insight is valuable because it reveals competitor long-term strategies and potential market gaps you can exploit.

Translate these insights into key account positioning:

- Map competitor service expansion against your key accounts' pain points.

- Identify where competitors are overextending (creating service gaps).

- Develop counter-positioning narratives emphasizing your focused expertise.

- Create account-specific battle cards highlighting competitor weaknesses in newly expanded areas.

Remember: SuperApp success comes from deep integration, not just feature stacking. Your key account strategy should mirror this—offer integrated solutions that solve adjacent problems without diluting core value.

Product Release Intelligence: Turning Feature Updates into Competitive Advantages

Monitoring competitor platform updates reveals their technology roadmap and capability gaps. When a rival launches new features, analyze what problems they're solving and what they're still missing. This intelligence helps you position your solution for specific enterprise use cases where competitors fall short, giving you a competitive edge in key account discussions.

Practical Checklist:

- Set up automated alerts for competitor product announcements, release notes, and changelogs.

- Analyze each update for underlying technology trends and strategic direction.

- Identify gaps where your solution can better address enterprise needs.

- Map competitor integrations to spot partnership opportunities.

- Use hardware/software enhancements to target specific vertical use cases.

Real-world example: RivalSense captured that Neat released NeatOS 25.4.2 in preview on January 17, 2026, adding Android 13, Google Meet as a native platform, and support for up to three Neat Centers for better coverage in large meeting spaces. This insight is valuable because it shows competitor focus on integration and scalability, helping you anticipate their moves and highlight your own strengths.

Key Action Steps:

- Create a competitor integration matrix tracking all their API connections.

- Identify underserved integration opportunities in your target market.

- Position your solution as the bridge between systems competitors haven't connected.

- Use competitor hardware limitations to highlight your scalability advantages.

Turn every competitor release into a competitive advantage by understanding not just what they're adding, but what they're revealing about their strategy and limitations.

Pricing and Feature Strategy Insights: Learning from Monetization Shifts

Tracking competitor freemium expansions and pricing changes helps you understand their customer acquisition playbook and market segmentation. When rivals adjust their tiers or move features, they're targeting specific user segments, which you can use to refine your own strategy and better position for key accounts.

Analyze feature tiering decisions to identify market segmentation opportunities. Create a feature matrix comparing all competitor tiers. Look for gaps where certain customer needs aren't addressed. Practical checklist:

- Map features across all competitor tiers.

- Identify which features are premium-only vs. standard.

- Note usage limits at each tier.

- Track feature additions/removals quarterly.

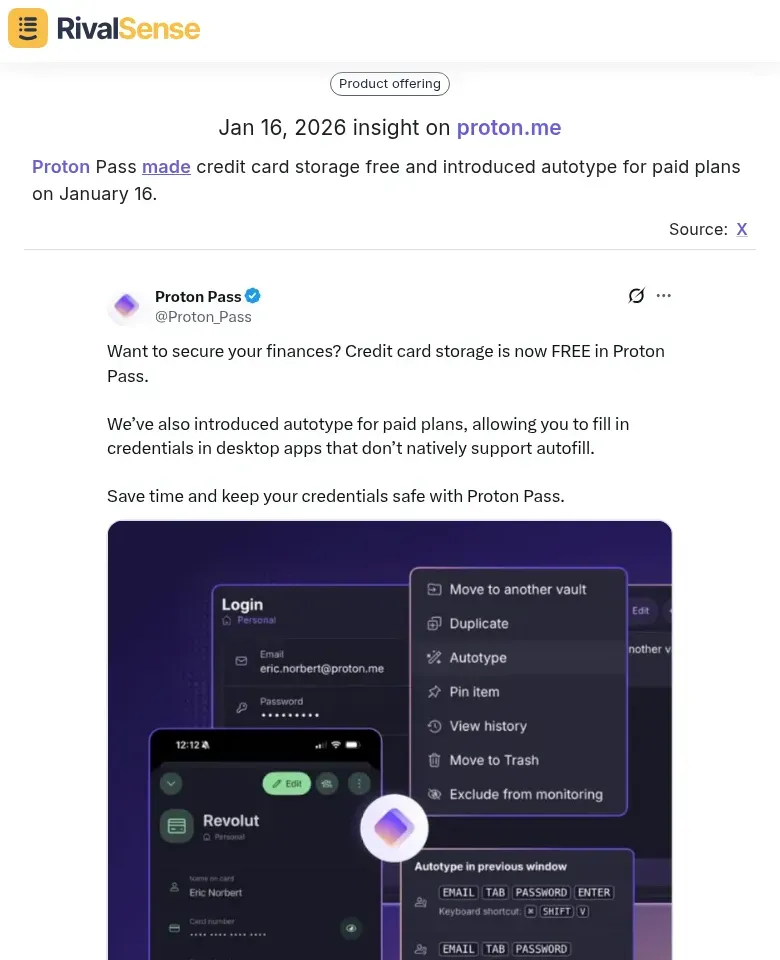

Real-world example: RivalSense noted that Proton Pass made credit card storage free and introduced autotype for paid plans on January 16. This insight is valuable because it highlights competitor monetization shifts, helping you anticipate pricing trends and adjust your value proposition accordingly.

Use competitor pricing changes to develop value-based positioning for key accounts. Steps:

- Document all competitor pricing changes for the past 12 months.

- Correlate price increases with feature additions.

- Calculate value-per-dollar ratios.

- Identify where your solution offers better ROI.

For key accounts, position your solution as delivering 20-30% better value based on competitor pricing benchmarks. Pro tip: Set up automated alerts for competitor pricing page changes and feature announcements to stay ahead.

Building Your Competitor Product Intelligence Framework

Building a robust competitor product intelligence framework requires systematic processes and consistent tracking. Start by establishing automated monitoring for product launches, updates, and pricing changes to ensure you never miss a critical shift in the competitive landscape.

Create standardized templates for tracking competitor capabilities. Develop a feature comparison matrix with columns for each competitor and rows for key features. Include columns for launch dates, adoption rates, and customer feedback. Use a scoring system (1-5 scale) to rate feature maturity and market impact. This creates a consistent framework for analysis across your team.

Develop response playbooks for common scenarios. For competitor feature launches, create a 3-step response:

- Immediate assessment of competitive threat.

- Internal capability review within 48 hours.

- Customer communication strategy.

Practical checklist:

- Set up weekly competitor monitoring cadence

- Maintain updated feature comparison documents

- Conduct quarterly competitive landscape reviews

- Train sales teams on competitor positioning

- Document win/loss analysis for product decisions

Tip: Focus on 3-5 key competitors initially to avoid analysis paralysis. Prioritize monitoring based on market share and strategic threat level.

Implementation: Turning Product Intelligence into Key Account Wins

To implement product intelligence for key account wins, start by creating a competitor weakness matrix that maps each competitor's product gaps to specific pain points of your target accounts. This actionable approach ensures your sales team can directly address client concerns with data-backed insights.

Develop tailored messaging using this intelligence. Create battle cards that contrast your solution's strengths against competitor weaknesses. For accounts prioritizing security, emphasize your superior encryption features while noting Competitor Y's recent vulnerabilities.

Measure impact through three key metrics:

- Track win rate improvements (aim for 15-20% increase).

- Monitor deal size growth (target 25-30% uplift).

- Document competitive displacement cases.

Use CRM data to attribute wins directly to your intelligence-driven approach. Practical checklist:

- Audit 3-5 key competitors' product limitations.

- Match weaknesses to 10+ target account pain points.

- Create 5-7 tailored messaging templates.

- Set baseline metrics before implementation.

- Review results quarterly and refine strategy.

Ready to Transform Your Key Account Strategy?

Competitor product intelligence is no longer optional—it's essential for staying ahead in today's market. By leveraging real-time insights into product expansions, releases, and pricing shifts, you can proactively position your solution and secure more key account wins.

Try out RivalSense for free to start building your competitive advantage. RivalSense tracks competitor product launches, pricing updates, event participations, and more across websites, social media, and registries, delivering all in a weekly email report. Get your first competitor report today at https://rivalsense.co/ and see how actionable intelligence can boost your win rates.

📚 Read more

👉 Turning Competitor Management Changes into Strategic Advantages: A Real-World Example

👉 How to Conduct Competitor Research in 2026: A Step-by-Step Guide

👉 Beginner's Guide to Key Account Health Dashboards for Commercial Laundry Services

👉 How Bentley Systems Accelerated BIM Adoption by Learning from Autodesk's Content Catalog

👉 Competitor Benchmarking Mastery: Track Funding Signals for Strategic Insights