Beyond Data Overload: Building a Market Intelligence Framework That Predicts Shifts

You’re in your usual Monday strategy meeting when someone drops a bomb: your biggest competitor just moved into one of your key markets. The CEO is hopping mad. “We pay all this money for competitive intelligence and I had to find out about this on LinkedIn!?”

We’ve all been there when big market moves seem to come out of nowhere—except they don’t. Signals build for months through patent filings, hiring patterns, or supplier chatter. The solution lies in a structured market intelligence framework that transforms raw data into predictive insights.

KEY POINTS

- Why most market intelligence efforts fail to predict what matters

- Strategic approaches to the 5 essential intelligence methods

- How global source coverage creates temporal competitive advantages

- Transform intelligence gathering from cost center to profit driver

- Real frameworks executives use to spot market shifts first

THE MARKET INTELLIGENCE PARADOX: EVERYONE’S DROWNING IN DATA

Intelligence teams today face a frustrating reality: working harder than ever yet still getting blindsided. Why? Because collecting data isn’t the same as deriving actionable foresight.

A global chemical company discovered they spent €1 million annually on redundant intelligence sources—like subscribing to multiple weather apps for identical forecasts. The core issue isn’t information scarcity; it’s the lack of systems that connect dots before competitors notice them.

“The companies winning aren’t collecting more intelligence—they’re architecting systems that spot patterns while others gather data.”

Market research answers specific questions (e.g., “How satisfied are customers?”). A true market intelligence framework reveals patterns that reshape strategy (e.g., “Regulatory shifts in three markets will alter price sensitivity—here’s how to adapt”). One reflects the past; the other illuminates the future.

TYPES OF MARKET INTELLIGENCE THAT DRIVE STRATEGIC ADVANTAGE

Effective frameworks prioritize intelligence categories that directly influence executive decisions. These four types consistently deliver high-impact insights.

-

Customer intelligence captures behavioral shifts that predict market evolution. Tracking preference changes or emerging needs creates an early-warning system for disruptions.

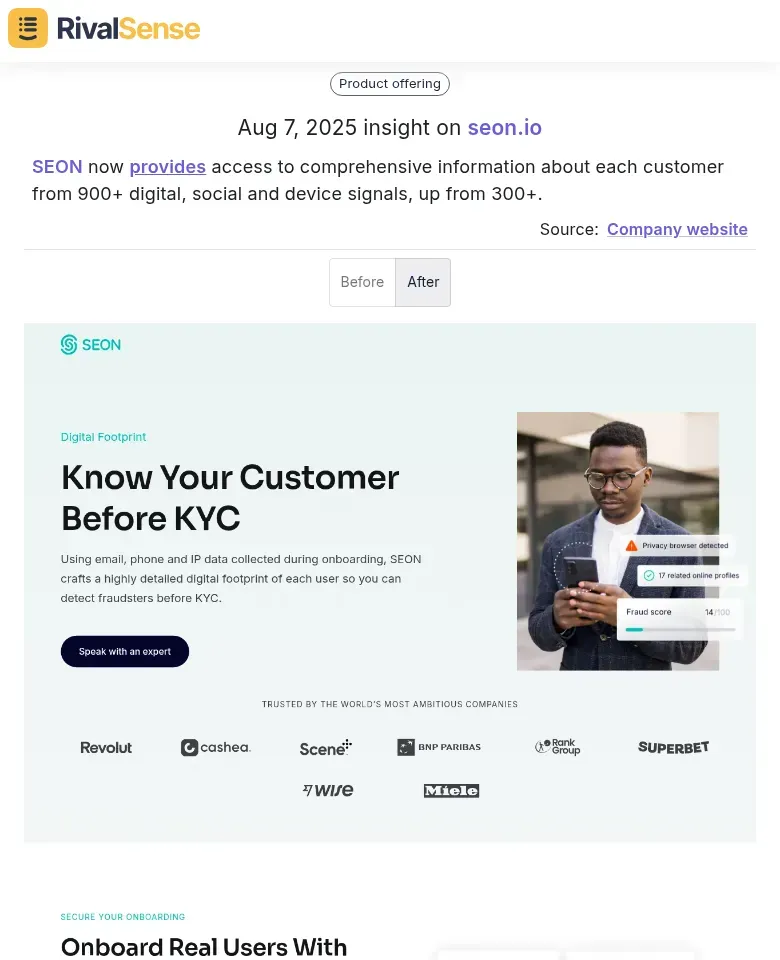

Example: SEON now analyzes 900+ digital signals per customer (up from 300+). Why it matters: This expansion signals investment in hyper-personalized risk assessment—crucial for anticipating B2B fraud prevention trends. -

Competitive intelligence monitors signals competitors can’t mask: hiring surges, patent filings, or supply chain shifts. Tools like RivalSense track these across 80+ sources, delivering weekly reports to surface strategic pivots early.

-

Market trend intelligence analyzes external forces like regulatory changes or tech disruptions that redefine your landscape.

-

Operational intelligence leverages overlooked internal signals—supply chain hiccups or inventory fluctuations—that often foreshadow market conditions.

“Competitive advantage emerges when internal operational signals align with external patterns—spotting opportunities others miss.”

SOURCES THAT PROVIDE TEMPORAL COMPETITIVE ADVANTAGE

Your framework’s power lies in sources offering unique or time-sensitive insights competitors overlook.

- Internal company data is your most defensible advantage. Sales conversations or service logs contain unreplicable market signals.

- Cross-language intelligence reveals critical signals weeks earlier. Regulatory discussions in Chinese forums or German trade journals provide 3-6 month head starts over English-only monitoring.

- Real-time competitive monitoring focuses on uncontrolled signals like patent applications or hiring sprees.

HOW TO BUILD YOUR MARKET INTELLIGENCE FRAMEWORK: 5 STRATEGIC METHODS

#1: CUSTOMER INTELLIGENCE THAT PREDICTS

Move beyond satisfaction surveys. Ask: “What problems are you solving now that didn’t exist six months ago?” This reveals market evolution.

✅ Actionable tactics:

- Interview eccentric customers first—their “bizarre” requests often foreshadow trends

- Track linguistic shifts in customer feedback

- Analyze changes in purchase motivations

#2: COMPETITIVE INTELLIGENCE BEYOND PRESS RELEASES

Press releases show what competitors want you to know. True intelligence comes from their actions.

✅ Actionable tactics:

-

Decode job postings (e.g., 15 AI hires = strategic pivot)

-

Monitor patent filings across jurisdictions

-

Track supplier relationship changes

Example: Scrive added ‘Sign in with Microsoft’ and updated its system version. Why it matters: Such micro-updates signal UX investments targeting enterprise clients—revealing competitive positioning shifts.

#3: FUTURE-FOCUSED PUBLIC DATA ANALYSIS

Regulatory documents aren’t just historical records—they’re crystal balls.

✅ Actionable tactics:

- Track policy proposals 12-18 months pre-implementation

- Focus on industry-specific economic indicators

- Identify regional regulatory patterns as early-adoption signals

#4: BEHAVIORAL INTELLIGENCE BEYOND ANALYTICS

Predictive behavioral signals include:

- Usage pattern evolution (how interactions change)

- Purchase sequence shifts (new product combinations/timing)

- Engagement preference changes (e.g., chat vs. email)

#5: GLOBAL SIGNAL MONITORING

Expand beyond English social media:

✅ Actionable tactics:

-

Monitor supply-chain languages (e.g., Vietnamese for manufacturing)

-

Track niche industry forums

-

Identify regional pattern emergence

Example: Optum uses AI to simplify healthcare claims processing. Why it matters: Tracking such product updates exposes efficiency plays that could redefine industry standards—allowing preemptive strategy adjustments.

TRANSFORM INTELLIGENCE INTO COMPETITIVE ADVANTAGE

Leading companies don’t just collect data—they architect frameworks connecting the right dots at the right time.

🚀 Proven framework elements:

- Merge internal signals (e.g., service complaints) with external validation (e.g., regulatory changes)

- Prioritize multi-language monitoring for 3-6 month head starts

- Focus exclusively on change-predictive signals

- Synthesize behavioral, competitive, and regulatory patterns

Companies that outmaneuver competitors build systems spotting opportunities/threats months before they’re obvious.

Ready to operationalize your market intelligence framework? Try RivalSense free to automate competitor tracking across 80+ sources—from product updates to regulatory filings. Get your first competitor report today and turn intelligence into action.

FAQ

What makes this framework better than traditional market intelligence?

It prioritizes predictive signals (cross-language sources, behavioral shifts) over backward-looking data, creating 3-6 month temporal advantages.

How to avoid information overload?

Adopt strategic source architecture: map critical decisions to relevant intelligence streams. Most teams find 80% of insights come from 20% of sources.

Why emphasize cross-language monitoring?

Local-language sources (e.g., regulatory forums) reveal signals months before English translations—making it indispensable for global strategy.

How to measure a source’s strategic value?

Assess decision impact: “Did this source change a key strategy?” If not, it’s noise—not intelligence.

Market research vs. strategic intelligence?

Research answers specific questions; intelligence is an ongoing system revealing patterns across competitors, customers, and markets to enable predictive strategy.

📚 Read more

👉 Pharmacy Competitor Value Chain Analysis Template

👉 How Workday's AI Shift Inspired Competitors to Innovate

👉 Leverage Instagram for Competitive Intelligence: A Strategic Guide for Business Leaders

👉 Boost AI Efficiency: Productivity Hacks for Competitive Edge

👉 Advanced Tactics: Decoding Competitor Product Lobbying Insights