Best Practices for Tracking Key Account Lifecycle in Mobility

Key account lifecycle tracking in the mobility sector is essential for maintaining strong customer relationships and staying ahead of the competition. By systematically monitoring each stage from acquisition to retention, you can proactively address client needs and mitigate risks. The typical stages include: prospecting (identifying potential fleet operators or mobility service providers), onboarding (integrating them with your platform), growth (expanding service usage), maturity (optimizing partnership value), and renewal/expansion. Tracking this lifecycle is crucial for competitive advantage—it helps you anticipate client needs before competitors do, personalize engagement strategies, and identify churn risks early. For instance, if a major rideshare partner shows declining API usage, proactive intervention can prevent defection to rivals. Lifecycle insights directly inform business strategy by revealing which acquisition channels yield the most valuable accounts, where service gaps exist, and how to allocate resources for maximum ROI.

Practical Steps:

- Map each account to its lifecycle stage using CRM data

- Set KPIs like usage frequency and support ticket volume per stage

- Conduct quarterly reviews to adjust strategies based on trends

Tips:

- Automate alerts for stage transitions (e.g., usage spikes signaling growth)

- Benchmark against industry averages to spot outliers

Leveraging Leadership Changes for Strategic Insights

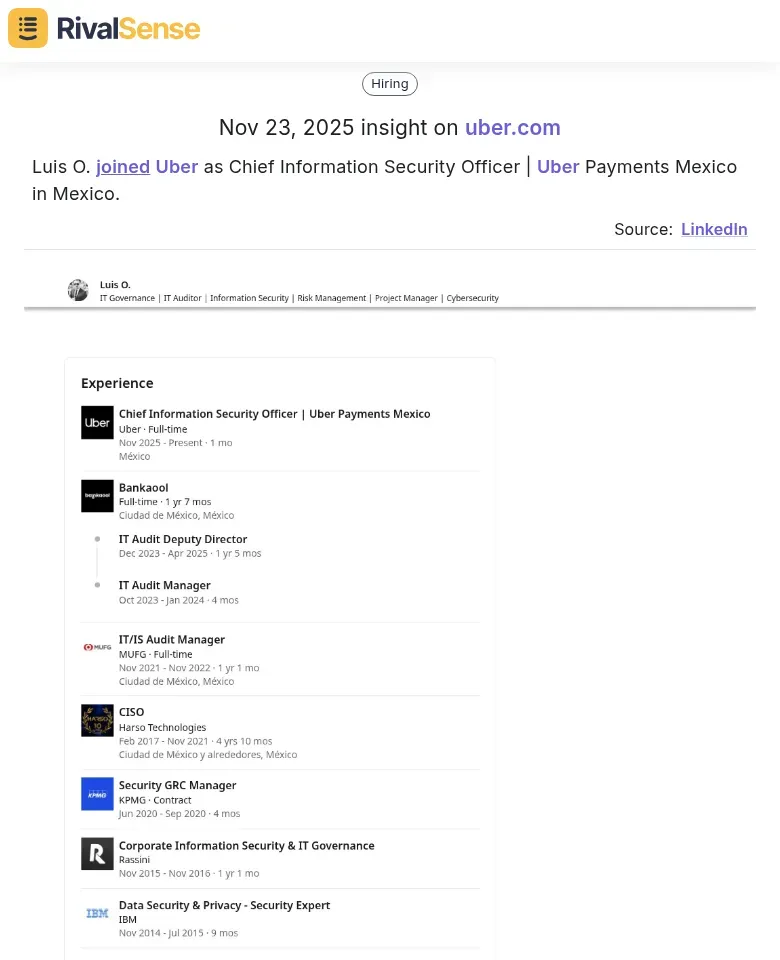

Tracking leadership changes at key mobility accounts provides invaluable strategic intelligence for anticipating market shifts. When new executives join, they often bring fresh perspectives and signal strategic pivots that can impact your business. For example, RivalSense detected that Luis O. joined Uber as Chief Information Security Officer | Uber Payments Mexico in Mexico. This type of insight is valuable because it reveals a company's enhanced focus on security and payments, allowing you to anticipate new regulatory compliance measures or payment innovations that could affect your accounts.

Monitor executive hires through LinkedIn, press releases, and competitor tracking tools to stay informed. Analyze role changes too: if a Head of Product moves to lead 'Autonomous Mobility', it highlights market prioritization. Use this data to predict trends—multiple fintech hires across competitors likely indicate payments disruption is imminent.

Practical Steps:

- Set up alerts for C-suite changes at top 10 accounts

- Map new executives' past roles to infer strategic direction

- Correlate leadership data with product launches to validate predictions

This approach turns personnel moves into actionable competitive insights, helping you stay ahead in mobility's evolving landscape.

Tracking Product Expansions and Seasonal Offerings

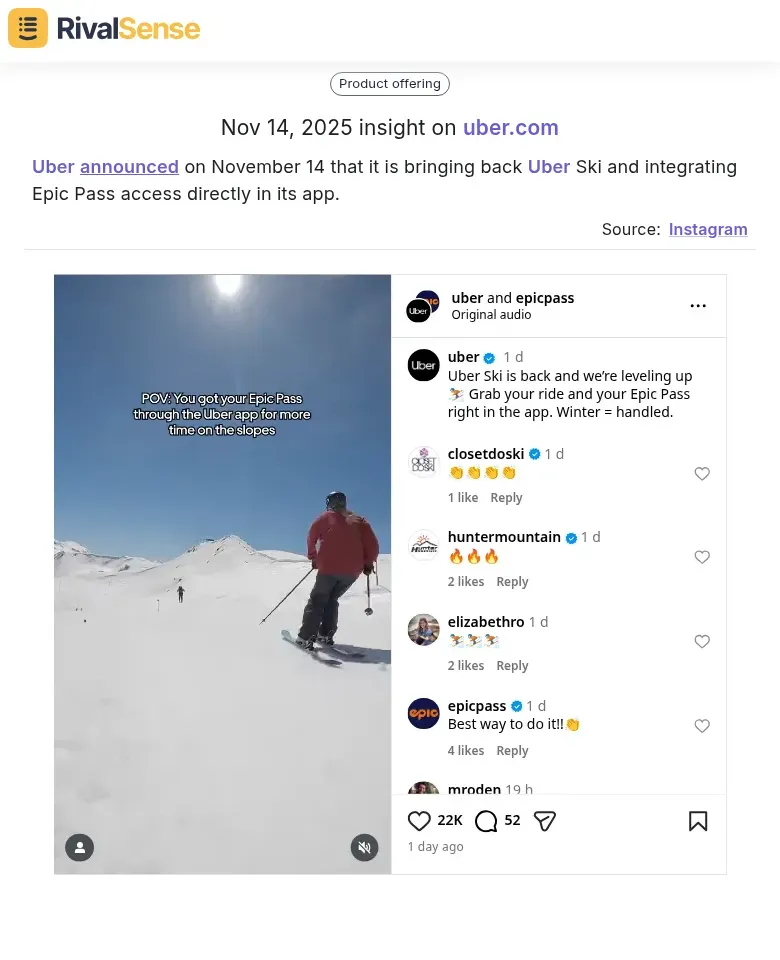

Keeping a close watch on product expansions and seasonal offerings is vital for adapting to market dynamics in mobility. These moves often reveal competitor priorities and customer engagement strategies that you can leverage. For instance, RivalSense reported that Uber announced on November 14 that it is bringing back Uber Ski and integrating Epic Pass access directly in its app. Insights like this are valuable as they highlight seasonal targeting and partnership integrations, enabling you to align your offerings and timing to capture similar opportunities.

Identify Seasonal Trends: Monitor competitor product relaunches during peak mobility seasons (summer travel, winter holidays). Create a seasonal calendar tracking when competitors launch new features or promotions. Use this data to anticipate market movements and time your own offerings strategically.

Analyze Partnerships: Track competitor partnerships with ride-sharing apps, public transit systems, or EV charging networks. These ecosystem expansions reveal growth strategies. Create a partnership matrix to identify gaps in your own ecosystem and potential collaboration opportunities.

Learn from Integrations: Study how competitors integrate with payment systems, navigation apps, or loyalty programs. Analyze user reviews to understand which integrations drive retention. Implement the most successful integration patterns while adding unique value to differentiate your offering.

Practical Checklist:

- ✅ Set up alerts for competitor product announcements

- ✅ Map seasonal patterns using historical launch data

- ✅ Evaluate partnership ROI through customer acquisition metrics

- ✅ Test competitor integrations to identify UX improvements

- ✅ Benchmark your integration performance against industry leaders

By systematically tracking these elements, you can anticipate market shifts, identify expansion opportunities, and enhance user experience to improve account retention.

Analyzing Geographic and Investment Moves for Growth

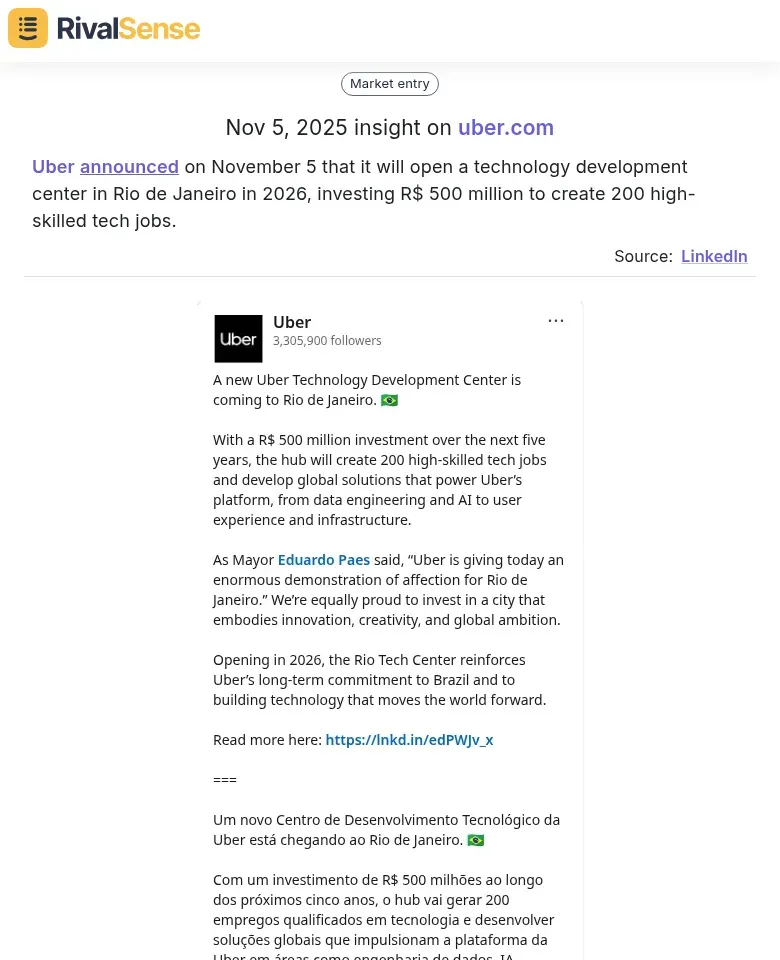

Understanding geographic and investment moves is key to predicting competitor expansion and securing your market position in mobility. These strategies often indicate where competitors are allocating resources and targeting growth. For example, RivalSense captured that Uber announced on November 5 that it will open a technology development center in Rio de Janeiro in 2026, investing R$ 500 million to create 200 high-skilled tech jobs. This insight is valuable as it signals long-term investment in emerging markets, helping you anticipate talent competition and potential product innovations in those regions.

Monitor emerging tech hubs like Austin, Miami, and Bangalore—these signal talent acquisition strategies as companies tap into specialized pools. A rival opening an R&D center in a new hub often precedes product launches. Analyze investment patterns by tracking venture capital flows and public funding announcements; a sudden spike in Series B rounds for autonomous vehicle startups may indicate market entry.

Practical Steps:

- Create a checklist of top 10 global tech hubs and update it quarterly

- Subscribe to investment newsletters for real-time alerts

- Map competitor locations against your own to identify overlap risks

This proactive approach helps you stay ahead in the fast-evolving mobility landscape.

Integrating Competitor Insights into Lifecycle Management

Integrating competitor insights into key account lifecycle management transforms reactive tracking into proactive strategy that drives business growth. By combining data from various sources, you can create a comprehensive view of the competitive landscape. Start by using tools like RivalSense to gather leadership changes, product launches, and geographic expansion data, then build holistic competitor profiles. For example, when a competitor's CRO departs, you can anticipate account disruption and target their vulnerable clients.

Practical Steps:

- Map competitor account lifecycles: Identify acquisition, growth, and retention patterns

- Set alerts for leadership changes, product updates, and market entries

- Cross-reference with your own account data to spot opportunities

Apply insights to refine your tactics: When competitors launch new mobility solutions, enhance your value proposition. If they're expanding geographically, strengthen relationships in those regions before they gain footholds. Use competitor retention struggles to improve your own customer success programs.

Develop proactive strategies by analyzing competitor lifecycle stages. If they're in aggressive acquisition mode, focus on retention and upselling your existing accounts. When they're consolidating, target their dissatisfied customers. Create a quarterly competitor lifecycle review to anticipate market shifts and adjust your account strategy accordingly.

Best Practices and Tools for Effective Tracking

Effective key account lifecycle tracking in mobility requires a structured approach and the right tools to streamline data collection and analysis. Automating competitor monitoring can save time and ensure you never miss critical updates. Tools like RivalSense track competitor product launches, pricing updates, event participations, and more, delivering insights in a weekly email report to keep you informed.

Establish clear KPIs to measure the impact of competitor insights on your business outcomes. Track metrics like win/loss rates against specific competitors, customer churn to competitors, and market share changes. Use these KPIs to quantify how competitive intelligence influences decision-making and revenue growth.

Foster a culture of continuous competitive intelligence by embedding it into daily operations. Create a centralized dashboard where teams can easily access competitor data. Hold regular competitive review meetings to discuss findings and adjust strategies. Encourage employees to share competitor insights they encounter in the field.

Practical Checklist:

- ✅ Set up automated alerts for competitor news

- ✅ Define 3-5 key competitor KPIs

- ✅ Create a shared competitor intelligence repository

- ✅ Schedule monthly competitive strategy sessions

- ✅ Train teams on interpreting competitor data

This approach ensures you stay ahead in the fast-evolving mobility sector by turning competitor tracking into actionable business intelligence.

Ready to take your competitor tracking to the next level? Try out RivalSense for free at https://rivalsense.co/ to get your first competitor report today and start gaining actionable insights to boost your strategy!

📚 Read more

👉 Media Monitoring: Benchmark Competitor Content & Key Account Tracking

👉 How Competitor Milestones Like Apify's 10-Year Anniversary Can Shape Your Strategy

👉 How to Conduct Competitor Research: A Practical Guide for Business Leaders

👉 Solving Healthcare IT's Key Account Management Challenges Proactively

👉 How AU10TIX's Microsoft Partnership Drove Competitor Action