Beginner's Guide to Strategic Account Tracking in Music Streaming

Strategic account tracking is a fundamental practice for any business in the music streaming industry. In the fiercely competitive $46.7 billion market, it isn't just helpful—it's essential for survival. With streaming accounting for 84% of US music industry revenue, monitoring key competitor accounts provides critical intelligence that traditional metrics miss. By systematically tracking platforms like Spotify, Apple Music, and emerging players, you can identify market trends before they become mainstream, spot emerging opportunities in untapped regions, and detect potential threats from new features or pricing strategies.

Practical steps to implement strategic account tracking:

- Identify 5-7 key competitor accounts to monitor regularly

- Track subscriber growth patterns and churn indicators

- Monitor feature launches and pricing changes

- Analyze regional expansion strategies

- Watch for partnership announcements and content deals

This data-driven approach transforms reactive decision-making into proactive strategy. When you notice a competitor's successful playlist feature or regional pricing model, you can adapt quickly rather than playing catch-up. By connecting account tracking insights with business intelligence, you'll make informed decisions about content acquisition, feature development, and market expansion—turning competitive intelligence into sustainable growth in the crowded streaming landscape.

Identifying and Prioritizing Key Accounts to Monitor

Effective competitor tracking begins with identifying and prioritizing the right accounts. Without a clear focus, you risk drowning in data while missing actionable insights. Start by establishing clear criteria: track accounts with significant market influence (Spotify, Apple Music), strategic importance (platforms with unique features like Tidal's high-fidelity audio), and those signaling market expansion (YouTube Music's integration with video).

Categorize accounts into three tiers for focused monitoring:

- Strategic Tier: Major platforms (Spotify, Apple Music) - monitor daily for pricing changes, feature launches, and partnership announcements

- Emerging Tier: Growing platforms (Tidal, Deezer) - track weekly for user growth, content deals, and market entry strategies

- Peripheral Tier: Niche players (Bandcamp, SoundCloud) - review monthly for innovation signals and community trends

Practical Checklist:

- Use RivalSense to automate tracking across 80+ sources 🚀

- Set alerts for competitor job postings (signals expansion)

- Monitor regulatory filings for new market entries

- Track social media for feature announcements

- Analyze quarterly reports for strategic direction changes

Pro Tip: Focus on accounts launching in emerging markets or introducing new business models (like live streaming integration) - these often signal industry shifts before mainstream adoption.

Tracking Product and Feature Development Initiatives

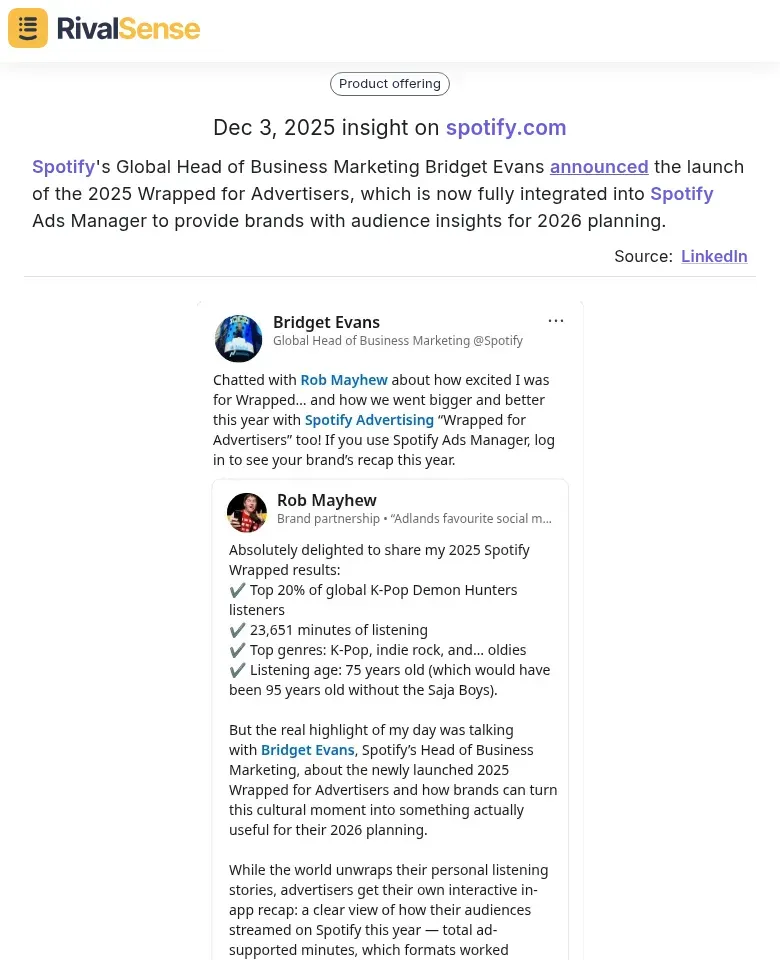

Staying ahead of product innovations is key to maintaining competitive relevance. Tracking product and feature development initiatives requires systematic monitoring of how competitors integrate new capabilities into their platforms. For example, when Spotify's Global Head of Business Marketing Bridget Evans announced the launch of the 2025 Wrapped for Advertisers, it signaled a deeper integration of analytics tools for brands. This insight, captured by RivalSense, shows how tracking feature launches can reveal competitors' focus on advertiser services and data-driven planning.

Why it matters: Monitoring such feature launches helps you anticipate market trends and adjust your own product roadmap to meet evolving customer expectations.

Start by creating a competitive intelligence dashboard that tracks Spotify, Apple Music, Tidal, and YouTube Music's feature announcements. Monitor their official blogs, press releases, and app store updates weekly.

Practical steps:

- Set up Google Alerts for competitor names + "new feature" or "update"

- Subscribe to competitor newsletters and follow their social media accounts

- Create a spreadsheet tracking feature rollout dates, adoption rates, and user feedback

- Analyze how features like Spotify's AI DJ or Apple Music's spatial audio enhance user experience

- Note market positioning shifts—when Tidal emphasizes audiophile quality or YouTube Music leverages video integration

Key insight: Watch for patterns. When multiple platforms introduce similar features (like collaborative playlists or podcast integration), it signals market trends. Learn from competitor rollouts to anticipate customer expectations—if Spotify's personalized year-end wrap-ups drive engagement, consider similar timeline features. Track not just what features launch, but how they're integrated into the overall user journey to understand strategic direction.

Monitoring Leadership and Talent Acquisition Moves

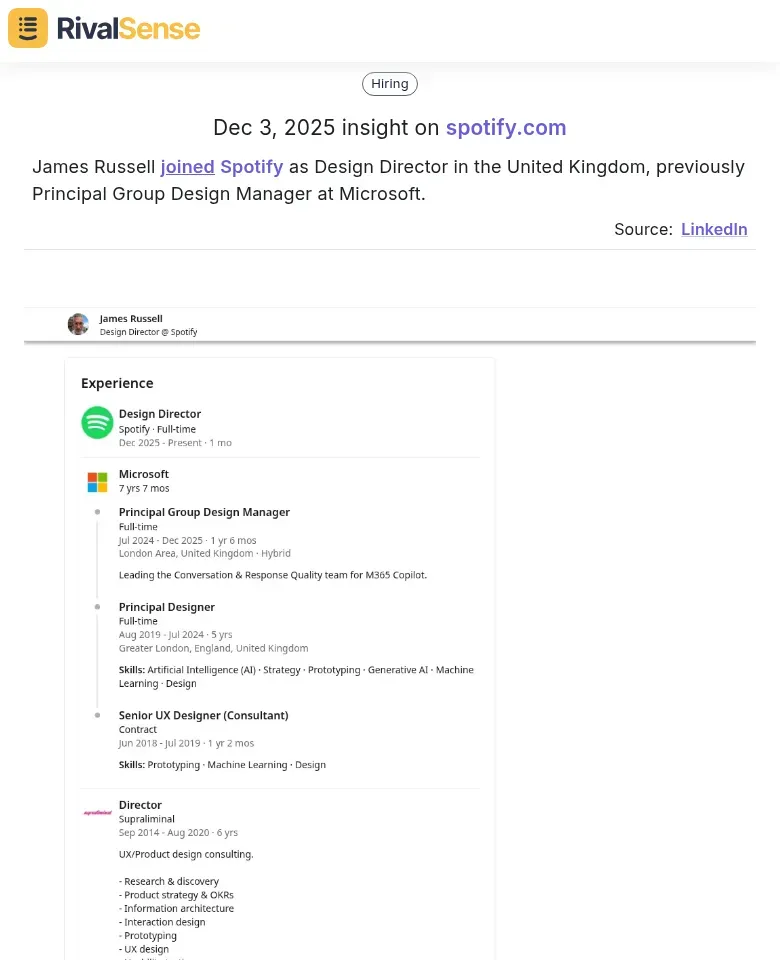

Executive appointments and hiring sprees often foreshadow strategic pivots. Tracking leadership appointments in music streaming reveals strategic priorities, as these moves can indicate new focus areas or expansion plans. For instance, when James Russell joined Spotify as Design Director in the United Kingdom, it highlighted the company's investment in design talent, possibly for enhancing user experience in key markets.

Why it matters: Leadership changes provide early warnings of organizational shifts, allowing you to anticipate competitor strategies in areas like product design or regional focus.

Analyze talent acquisition patterns to understand competitor investments. If Apple Music aggressively hires audio engineers in Latin America, they're likely expanding regional content. Track job postings for data scientists (algorithm investment) or A&R scouts (artist development).

Use leadership changes to predict organizational shifts. When a new Head of Partnerships joins, expect more label deals. A Chief Revenue Officer from ad-tech suggests monetization changes.

Practical steps:

- Set up alerts for executive appointments at major platforms

- Monitor LinkedIn for talent movement patterns

- Track job board postings by function and region

- Analyze press releases about new leadership roles

- Cross-reference hires with recent product launches

Key insight: Leadership moves often precede strategic announcements by 3-6 months, giving you predictive intelligence.

Analyzing Market Expansion and Regional Strategy

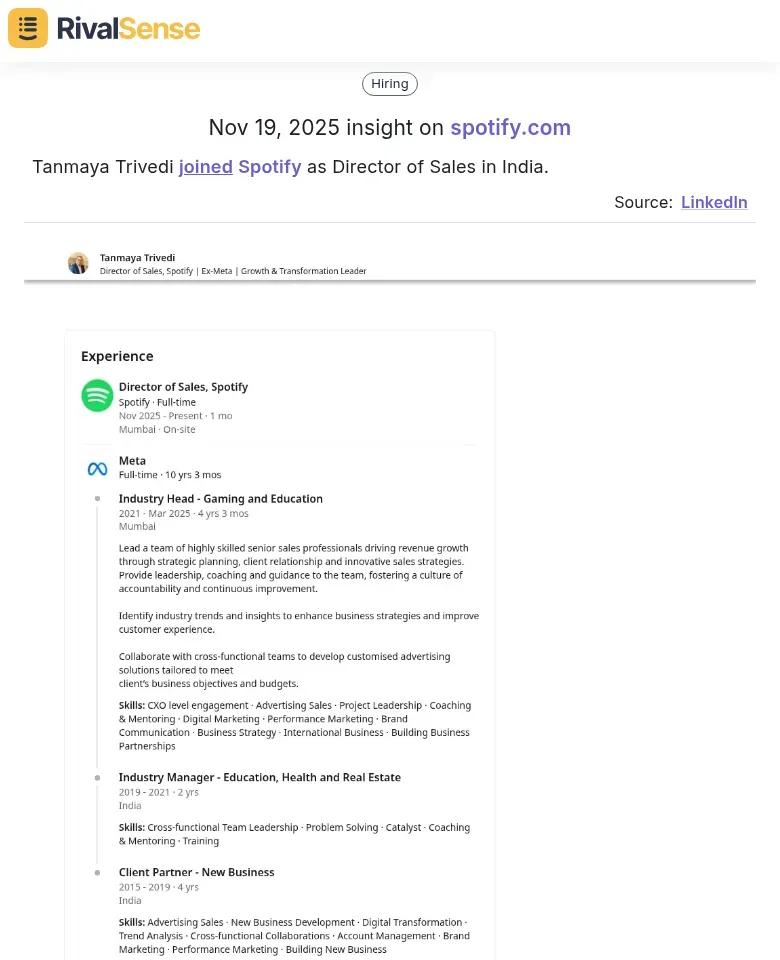

Regional expansion is a critical growth lever in the global music streaming arena. When analyzing market expansion, track how competitors establish leadership positions in new geographic markets. Spotify's appointment of Tanmaya Trivedi as Director of Sales in India, as tracked by RivalSense, clearly signals a reinforced focus on capturing the burgeoning Indian market.

Why it matters: Tracking regional hires and partnerships helps you identify which markets competitors are prioritizing, enabling you to strategize your own entry or defense.

Practical steps for tracking regional strategy:

- Monitor licensing announcements - New market entries often follow major label deals

- Track local content partnerships - Spotify's collaborations with artists like Bad Bunny (Latin America) or BTS (Asia) signal regional focus

- Analyze hiring patterns - Look for regional manager positions and local content curation teams being established

- Watch payment method adaptations - Competitors often add local payment options before major launches

- Follow telecom partnerships - Bundled subscriptions with local carriers indicate serious market commitment

Key indicators of expansion priorities:

- Sudden increase in job postings for specific regions

- Localized marketing campaigns featuring regional artists

- Partnerships with local music festivals or events

- Introduction of region-specific pricing tiers

- Content acquisition of local music catalogs

Pro tip: Set up alerts for competitor press releases mentioning specific countries or regions, and track their app store rankings in target markets - sudden spikes often precede official announcements.

Implementing a Systematic Account Tracking Framework

A structured framework turns scattered data into a strategic asset. Implementing a systematic account tracking framework ensures consistency and actionable insights. Start by establishing a consistent monitoring system using tools like Chartmetric, Soundcharts, and RivalSense for comprehensive coverage.

Create a weekly tracking checklist: monitor playlist placements, follower growth, streaming numbers, and competitor releases. Use dashboards to visualize trends across platforms.

Transform raw data into actionable insights by identifying patterns: Which playlists drive the most streams? When do competitors launch campaigns? What content formats engage listeners? Create monthly reports highlighting opportunities and threats.

Integrate findings into business planning cycles: Use competitor analysis to time your releases. Adjust marketing budgets based on what's working for rivals. Schedule quarterly competitive intelligence reviews to update strategies. Set up automated alerts for competitor moves to stay agile.

Practical tip: Start with 3-5 key metrics and expand as you master the system. Assign team members specific tracking responsibilities and establish a shared knowledge base for findings.

Take Action with RivalSense

Navigating the competitive landscape of music streaming requires timely and accurate intelligence. Instead of manually scouring dozens of sources, let RivalSense do the heavy lifting. It tracks competitor product launches, pricing updates, event participations, partnerships, regulatory changes, management moves, and media mentions across company websites, social media, and various registries—delivering a concise weekly email report directly to you.

Ready to transform your competitor tracking? Try RivalSense for free today and get your first competitor report to start making data-driven decisions with confidence. Sign up at https://rivalsense.co/

📚 Read more

👉 Competitor Partnership & Client Analysis Framework: Strategic Templates

👉 Leveraging Competitor Insights: OpenAI's Model Tests and Your Strategy

👉 The Ultimate Guide to Competitor Target Audience Analysis: 7 Steps to Uncover Hidden Opportunities

👉 Strategic Visioning Trends: How Dedicated Key Account Managers Drive Project Governance

👉 How RivalSense Alerted Competitors to Folksam's 2026 Pension and Premium Strategy