Advanced Tactics: Uncover Your Competitors' Aviation Edge

In the high-stakes aviation industry, competitor analysis isn't just about tracking prices—it's the strategic compass guiding market positioning and operational excellence. Aviation leaders leverage competitive intelligence to anticipate industry disruptions, from regulatory changes to technological shifts, turning potential threats into opportunities. By understanding competitors' fleet expansions, route optimizations, and service innovations, airlines can make data-driven decisions that enhance efficiency and customer satisfaction. Real-time data on competitor pricing, on-time performance, and passenger feedback allows for agile responses, maintaining a competitive edge in a dynamic market.

Practical steps include:

- 🛠️ Monitor competitor announcements and financial reports for expansion plans

- 🛠️ Use tracking tools to analyze route networks and frequency changes

- 🛠️ Benchmark service quality metrics like baggage handling and delays

- 🛠️ Stay alert to industry trends through alerts and news feeds

This proactive approach ensures you're not just reacting but leading in an ever-evolving landscape.

Analyzing Public Statements for Strategic Intent

Executive communications during aviation crises reveal critical strategic intent and can signal broader market shifts. By closely monitoring what competitors' leaders say, you gain insights into their confidence levels and future plans. Analyzing CEO statements for market confidence signals—phrases like 'strong fundamentals' or 'accelerated recovery' indicate bullish positioning, while cautious language suggests defensive strategies. Track recovery timelines by parsing leadership announcements about fleet reactivation, route restoration, and hiring plans to gauge operational resilience.

For instance, RivalSense captured this insight: Delta Air Lines CEO Ed Bastian said on CBS Mornings that air travel should return to normal by this weekend after the government shutdown ended.  This type of insight is valuable because CEO statements often reflect strategic intent, helping you anticipate market recoveries and adjust your own messaging and operations accordingly.

This type of insight is valuable because CEO statements often reflect strategic intent, helping you anticipate market recoveries and adjust your own messaging and operations accordingly.

Practical steps:

- 📊 Monitor quarterly earnings calls and investor presentations for recovery narratives

- 📊 Create a crisis communication tracker comparing competitors' messaging timelines

- 📊 Analyze tone shifts between pre-crisis and crisis communications

- 📊 Map announced operational restorations against actual implementation

During industry disruptions, position your brand by:

- 🎯 Emphasizing stability if competitors show uncertainty

- 🎯 Highlighting innovation when others focus on cutbacks

- 🎯 Timing market re-entry announcements based on competitor confidence levels

- 🎯 Using competitor recovery timelines to benchmark your own strategic planning

Example: When a major carrier announces 'phased route restoration over 18 months,' position your airline as offering 'immediate connectivity on key corridors' to capture market share.

Decoding Customer Communication Strategies

Customer communications are a window into competitors' operational and financial strategies, especially during disruptions. They reveal how companies balance cost management with customer satisfaction and regulatory compliance. Analyze service disruption notifications to understand cost management policies—do they offer full refunds, vouchers, or minimal compensation? This exposes their financial risk tolerance and operational efficiency. Regulatory compliance boundaries become clear when examining how competitors communicate delays, cancellations, or safety issues.

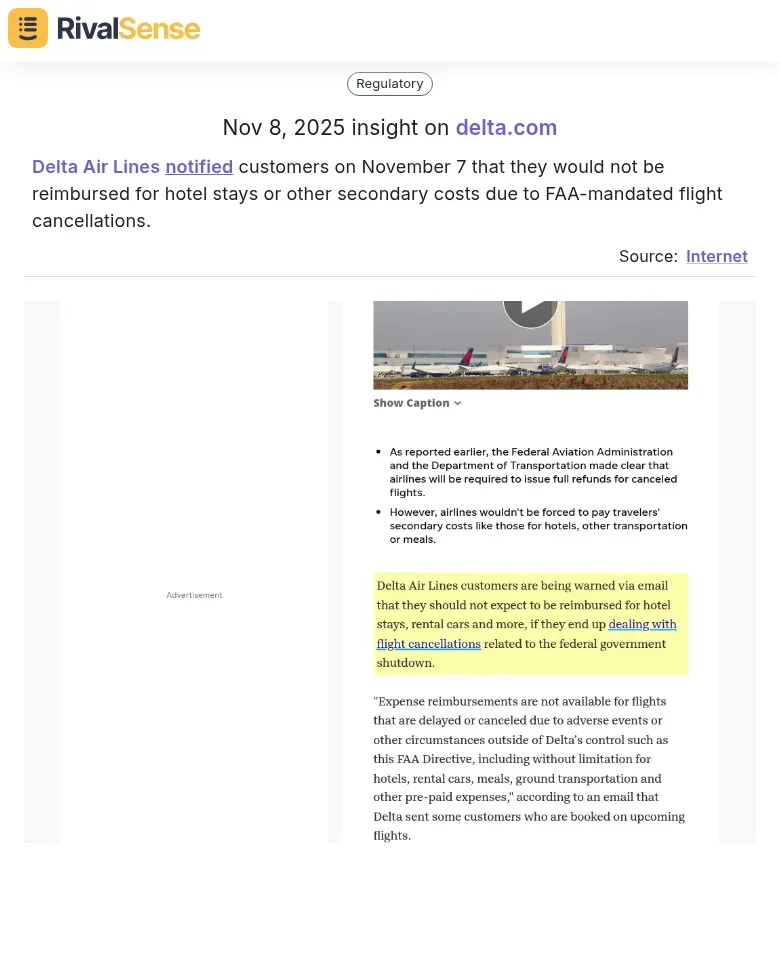

RivalSense provided this example: Delta Air Lines notified customers on November 7 that they would not be reimbursed for hotel stays or other secondary costs due to FAA-mandated flight cancellations.  Insights from customer communications are valuable as they highlight cost-control measures and compliance approaches, enabling you to refine your own policies to stay competitive without overspending.

Insights from customer communications are valuable as they highlight cost-control measures and compliance approaches, enabling you to refine your own policies to stay competitive without overspending.

To balance expectations with financial realities, study their tiered communication approaches: premium passengers receive personalized updates, while economy classes get standardized messages.

Practical steps:

- 📝 Monitor competitor email/SMS alerts during disruptions

- 📝 Track compensation patterns across different scenarios

- 📝 Note language that manages expectations (e.g., 'weather-related' vs. 'operational issues')

This analysis helps you refine your own policies, ensuring compliance while optimizing costs.

Leveraging Technology and Innovation Insights

Tracking competitors' involvement in technology and innovation forums can uncover their digital transformation priorities and future directions. By analyzing which events they attend and what they share, you can identify emerging trends and potential partnerships. To extract digital transformation strategies, analyze competitors' conference participation patterns. Track which aviation tech conferences they attend, what topics their leaders speak on, and which partnerships they announce.

For example, RivalSense highlighted: Eric Phillips, Senior Vice President and Chief Digital Officer at Delta Air Lines, attended the 2025 INFORMS Annual Meeting and shared how the company uses data, technology, and innovation to shape the future of travel.  This type of insight is valuable because it reveals innovation priorities and investment areas, allowing you to anticipate shifts in technology adoption and align your R&D efforts.

This type of insight is valuable because it reveals innovation priorities and investment areas, allowing you to anticipate shifts in technology adoption and align your R&D efforts.

Create a conference matrix:

| Conference | Attendance Frequency | Key Topics | Post-Event Announcements |

|---|---|---|---|

| Aviation Festival | High | AI, Passenger Experience | New partnerships |

| Future Travel Experience | Medium | Sustainability, Biometrics | Pilot projects |

Understanding data analytics' role requires monitoring how competitors use passenger data and operational metrics. Look for case studies on personalized travel experiences, predictive maintenance, or revenue optimization. Tools like flight tracking APIs and customer sentiment analysis can uncover patterns in on-time performance, route optimization, and service enhancements that shape future travel.

Learn innovation priorities by examining technology leadership engagements. Follow CTOs and innovation heads on LinkedIn and industry forums. Note their public statements about R&D focus areas, partnerships with tech startups, and patent filings. Create a quarterly review of their tech team expansions, acquisitions, and pilot projects to anticipate their next moves in areas like biometric boarding or sustainable aviation fuels.

Building a Comprehensive Competitor Intelligence Framework

A robust competitor intelligence framework integrates diverse data sources to provide a holistic view of the competitive landscape. This approach minimizes blind spots and supports informed decision-making in fast-paced aviation markets. To uncover your competitors' aviation edge, combine public data (e.g., SEC filings, press releases), industry reports, and real-time flight tracking tools. For example, monitor competitors' fleet expansions or route changes using ADS-B data and airline schedules.

Develop systematic monitoring processes for continuous intelligence gathering. Set up automated alerts for key metrics like on-time performance, fuel efficiency, and customer reviews. Use tools like RivalSense to track competitors' pricing strategies and promotional campaigns. Establish a regular cadence—weekly reviews for tactical moves and quarterly deep dives for strategic shifts. Assign team members to specific competitors to ensure accountability.

Create actionable insights that drive strategic decision-making. Transform raw data into intelligence by analyzing trends, such as a rival's shift to more fuel-efficient aircraft, and assess its impact on your operations. Use SWOT analysis to identify opportunities and threats.

Practical checklist for building your framework:

- ✅ Identify key data sources (e.g., financial reports, social media, flight data)

- ✅ Automate data collection with tools and alerts

- ✅ Analyze patterns and trends regularly

- ✅ Report findings to leadership in digestible formats

- ✅ Update strategies based on new insights

This framework ensures you stay ahead in the competitive aviation landscape.

Conclusion: Turning Insights into Competitive Advantage

Transforming competitor insights into actionable strategies is crucial for maintaining a leadership position in aviation. It requires prioritizing findings and embedding intelligence into daily operations. Start by prioritizing insights: identify 2-3 high-impact opportunities (e.g., a competitor's pricing gap or service weakness) and assign clear owners and deadlines. For example, if a rival excels in route optimization, launch a pilot project to test similar algorithms within 60 days.

Maintain agility through ongoing monitoring: set up automated alerts for competitor announcements, financial reports, and customer reviews. Use a monthly 'competitive intelligence review' with your team to adapt strategies swiftly. Build sustainable edges by embedding insights into decision-making: create a 'competitor playbook' that outlines counter-moves for common scenarios, and tie KPIs to competitive metrics like market share growth.

Remember, the goal isn't just to catch up—it's to leapfrog with informed, data-driven actions that keep you ahead.

Ready to implement these tactics? Try out RivalSense for free at https://rivalsense.co/ to get your first competitor report today and gain a clear edge in the aviation industry!

📚 Read more

👉 Mastering Market Entry with Competitor Win-Loss Analysis

👉 Real-World Competitor Analysis: Tracking Leadership Changes

👉 The Ultimate Guide to Setting Up Key Account Tracking: A Practical Playbook for B2B Leaders

👉 Engineering Consulting Competitor Webinar Analysis Guide

👉 How Glean's Snowflake Partnership Drove Competitive Intelligence Wins