Advanced Competitor Intelligence: Uncover Why Customers Choose Competitors

Traditional social media monitoring often misses the forest for the trees. While tracking mentions and engagement metrics provides surface-level data, it fails to reveal why customers choose competitors over your brand. This is where Facebook competitor intelligence becomes transformative. Facebook's unique ecosystem offers unparalleled insights into customer decision-making, but to gain a complete picture, you must integrate these findings with broader competitor tracking.

When users publicly discuss their purchasing choices, share experiences with competitors, or ask for recommendations in groups, they reveal the underlying motivations driving their decisions. These social signals expose competitor strengths you may have overlooked and highlight your own weaknesses through customer feedback. For founders and CEOs, this approach shifts strategy from reactive to proactive, enabling data-driven decisions that address market gaps.

To leverage this strategic advantage:

- Monitor competitor Facebook pages for recurring customer praise patterns

- Track industry-specific groups where users discuss vendor choices

- Analyze comment threads on competitor posts for pain points and preferences

- Use Facebook's search function to find discussions about "[competitor] vs [your brand]"

Practical tip: Create a spreadsheet to categorize competitor strengths mentioned by customers (price, features, support, etc.) and track frequency over time. This reveals shifting market preferences before they impact your sales. By understanding not just what competitors are doing, but why customers respond positively, you gain actionable intelligence to refine your value proposition.

Decoding Strategic Moves: Analyzing Competitor Announcements

Competitor announcements on Facebook and beyond reveal strategic intent beyond surface-level news. Decoding these moves allows you to anticipate market shifts and align your strategy accordingly. For B2B leaders, tracking partnerships and service expansions is crucial for understanding competitor positioning and ecosystem development.

Market Expansion Patterns: Track partnership announcements to map expansion trajectories. When competitors announce partnerships in specific regions or verticals, they're signaling market entry strategies. Create a timeline of these announcements to identify geographic or sectoral patterns. For example, if a SaaS competitor announces three partnerships in the APAC region within six months, they're likely prioritizing that market.

Example from RivalSense: Lyft expanded its MODE service for Santa Monica residents aged 65+ and those with disabilities to operate from 8am to 6pm daily through a partnership with Big Blue Bus.

Why this insight is valuable: Tracking such partnerships reveals how competitors target niche customer segments and leverage local alliances to enhance service offerings. For your business, this can highlight underserved markets or partnership opportunities to boost competitive advantage.

Product Release Timing & Features: Analyze product launch announcements for strategic timing and feature prioritization. Note when competitors release major updates relative to industry events, fiscal quarters, or your own releases. Pay attention to which features they highlight—these indicate their perceived competitive advantages and target customer pain points.

Practical Checklist:

- Monitor competitor press releases, blog posts, and social media for announcements

- Categorize announcements by type (partnerships, product releases, operations)

- Map announcements geographically and temporally

- Note resource commitments (people, facilities, equipment)

- Compare announcement timing against market events and your own roadmap

- Identify patterns across 6-12 months for strategic insights

Track these announcements systematically to anticipate competitor moves before they impact your market position. 🔍

Customer-Centric Insights: What Facebook Reveals About Buyer Decisions

Facebook reveals invaluable customer-centric insights when you analyze competitor activity through a strategic lens. By examining how competitors address customer needs, you can identify gaps in your own offerings and refine your messaging. For entrepreneurs, this direct feedback loop is essential for staying customer-focused in a competitive landscape.

Mapping Customer Pain Points: Track competitor service enhancements to identify what customers complain about. When a competitor adds 24/7 support, customers likely expressed frustration with response times. Monitor feature rollouts - each new capability addresses a specific customer need. Create a pain point map by correlating competitor updates with customer feedback in their comments.

Example from RivalSense: Ubiquiti released UniFi Protect 6.2 on December 31, 2025, introducing real-time system status, granular camera permissions, cleaner audit logs, Shopify POS integration, and smarter timelines for enhanced video security.

Why this insight is valuable: Product updates like this show how competitors innovate to meet evolving customer demands, such as integration capabilities and security features. For B2B companies, this intelligence helps benchmark product roadmaps and prioritize development efforts to match market expectations.

Identifying Underserved Segments: Analyze targeted service expansions to spot market gaps. When competitors launch specialized offerings for specific industries or regions, they're revealing underserved segments. Look for patterns in their localized content, industry-specific case studies, or tailored pricing tiers.

Practical Checklist:

- Monitor competitor Facebook pages for service announcements

- Track customer comments on competitor posts for recurring themes

- Analyze competitor's targeted ad campaigns for segment insights

- Document integration partnerships and how they're positioned

- Create a quarterly report comparing competitor enhancements to customer feedback patterns

Pro Tip: Use Facebook's Ad Library to see which customer segments competitors target most aggressively - this reveals their perceived high-value markets. 🎯

Timing and Positioning: Competitive Advantage Through Strategic Timing

Strategic timing separates market leaders from followers in the digital arena. Analyzing competitor announcement patterns on Facebook can uncover when they launch campaigns to maximize impact. For business owners, aligning your moves with these insights can help capture attention and outmaneuver rivals.

Analyze competitor announcement patterns: Do they launch major features before industry conferences or during slow news cycles? Track their phased rollouts—some competitors test with small user segments before full deployment, revealing their risk tolerance and market validation approach.

Practical Checklist:

- Map competitor announcements against industry events and seasonal trends

- Document rollout phases (beta → limited release → full launch)

- Identify timing patterns (Q4 holiday pushes, back-to-school campaigns)

- Monitor social media sentiment during each phase

Key Insight: Competitors often time major announcements to coincide with market downturns when attention is cheaper, or during peak seasons when adoption is highest. Notice if they consistently launch before earnings calls or after competitor missteps.

Actionable Tip: Use tools like RivalSense to track announcement-to-implementation timelines. If competitors consistently announce features 30 days before full rollout, you can anticipate market shifts and position your response accordingly. Seasonal patterns (like Q4 holiday campaign launches in September) reveal when competitors allocate maximum resources—time your counter-moves strategically. ⏰

Operational Intelligence: Learning From Competitor Resource Allocation

Operational intelligence reveals why customers choose competitors through their resource allocation patterns, which can be gleaned from Facebook posts, job ads, and public records. For CEOs, understanding these moves helps optimize your own investments and anticipate industry shifts.

Start by decoding fleet and asset management decisions: monitor competitor vehicle registrations, warehouse expansions, or equipment purchases. For example, if a competitor invests in electric delivery vehicles, they're likely targeting eco-conscious customers or preparing for urban delivery restrictions.

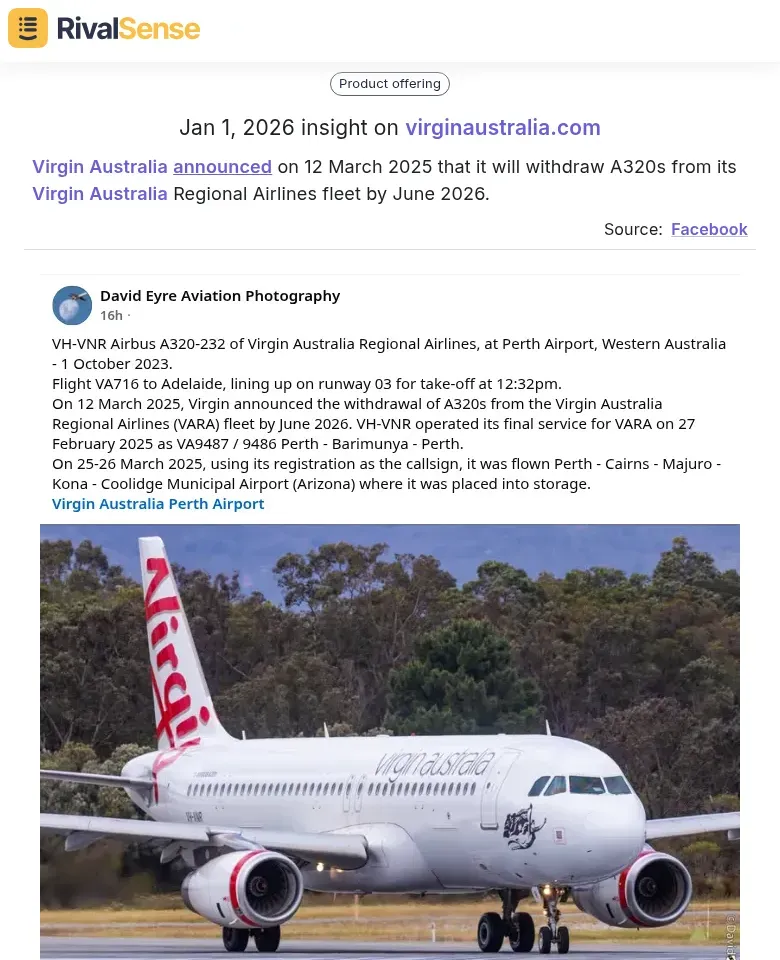

Example from RivalSense: Virgin Australia announced on 12 March 2025 that it will withdraw A320s from its Virgin Australia Regional Airlines fleet by June 2026.

Why this insight is valuable: Operational changes like fleet withdrawals signal strategic resource reallocation, cost-saving measures, or shifts in service focus. For B2B businesses, this can indicate competitor priorities, such as streamlining operations or pivoting to more profitable segments, allowing you to adjust your strategy accordingly.

Next, analyze partnership strategies to understand ecosystem development. Track which companies they collaborate with - are they partnering with logistics providers, payment processors, or complementary service providers? These alliances reveal market positioning and customer acquisition channels.

Key steps for operational intelligence:

- Monitor public records for asset acquisitions and facility expansions

- Track job postings for operational roles and new departments

- Analyze partnership announcements and ecosystem development

- Watch for resource reallocation from declining to emerging business areas

Practical tip: Create a quarterly resource allocation dashboard comparing your operational investments against competitors. Look for patterns where competitors consistently out-invest you in specific areas - these likely represent their strategic priorities and customer value propositions. When you notice resource shifts (like moving budget from traditional marketing to logistics technology), ask: What customer pain points are they addressing that we're missing? 💼

Actionable Framework: Turning Insights Into Competitive Strategy

To build a systematic competitor monitoring framework, integrate Facebook insights with broader data sources for a holistic view. For founders, this approach ensures you're not just reacting to competitors but proactively shaping your market position based on comprehensive intelligence.

Start by identifying 3-5 key competitors and create a tracking spreadsheet with these columns: Competitor Name, Page URL, Post Frequency, Engagement Rate, Content Themes, and Key Campaigns. Use Facebook's native tools like Page Transparency and Ads Library to gather data, then supplement with social listening tools for deeper analysis.

Translate social insights into actionable strategies by analyzing competitor content performance. For example, if a competitor's video tutorials consistently outperform other formats, consider developing your own educational video series. Monitor customer comments on competitor posts to identify pain points you can address in your offerings.

Create an early warning system by setting up Google Alerts for competitor mentions and tracking their Facebook ad spend fluctuations. When you notice a competitor increasing ad spend for a specific product category, investigate whether they're launching something new or responding to market demand. Establish a monthly review cadence where you analyze competitor Facebook activity against your own performance metrics.

Practical checklist:

- Document competitor posting times and engagement patterns

- Track their top-performing content formats and topics

- Monitor customer sentiment in their comment sections

- Set alerts for competitor job postings (indicates expansion)

- Compare your Facebook ad performance against theirs weekly

Tip: Look beyond direct competitors - analyze complementary businesses in your ecosystem to spot emerging trends before they reach your immediate market. By combining Facebook intelligence with automated tracking tools, you can stay ahead of the curve. 🚀

Put These Tactics Into Practice with RivalSense

Manually tracking competitor moves across Facebook and other channels can be time-consuming. To streamline this process and gain actionable insights faster, consider using a dedicated competitor tracking tool. RivalSense monitors competitor product launches, pricing updates, event participations, partnerships, regulatory aspects, management changes, and media mentions across company websites, social media, and various registries, delivering all in a weekly email report.

By leveraging such tools, you can focus on strategy rather than data collection, ensuring you never miss a critical competitor move. Ready to uncover why customers choose competitors and refine your approach? Try out RivalSense for free at https://rivalsense.co/ and get your first competitor report today! 📈

📚 Read more

👉 Workflow Automation CRM Benchmarking: Key Account Tracking Insights

👉 Regulatory Competitor Insights: 5 Common Mistakes Key Account Managers Must Avoid

👉 Mastering Competitor Analysis: Insights from Hiring Trends

👉 The Ultimate Guide to Tracking Key Account History: Practical Strategies for Competitive Advantage

👉 Key Account Management Podcasts: Productivity Tips for Medical Equipment Distribution