Actionable Strategies for Healthcare Joint Venture Compliance: A Practical Guide

Navigating healthcare joint ventures requires more than just business acumen—it demands rigorous compliance awareness. The regulatory landscape is complex, but with the right strategic approach, you can build successful partnerships while avoiding costly penalties.

Understanding Healthcare Joint Venture Compliance Landscape

Healthcare joint ventures operate within a complex regulatory environment where missteps can lead to severe consequences. Three key frameworks dominate this space: Stark Law prohibits physician self-referrals for designated health services unless exceptions apply, Anti-Kickback Statute bans remuneration for referrals to federal programs, and antitrust laws prevent anti-competitive practices.

🚨 Common compliance challenges include:

- Structuring financial relationships to avoid referral-based compensation

- Ensuring fair market value in all transactions

- Navigating antitrust scrutiny for market concentration

✅ Strategic compliance checklist:

- Conduct thorough due diligence on partners

- Document all arrangements in writing with clear terms

- Obtain independent fair market value opinions

- Implement regular compliance audits

- Train staff on regulatory requirements

Failure can lead to penalties exceeding $200 million, as seen in cases like Tuomey Healthcare. Proactive risk management is essential for joint venture success.

Key Regulatory Requirements and Legal Considerations

Navigating healthcare joint venture compliance requires strategic attention to three critical regulatory frameworks. Stark Law prohibits physician self-referrals with strict liability regardless of intent, while the Anti-Kickback Statute criminalizes remuneration intended to induce referrals. Antitrust considerations demand careful market analysis to avoid anti-competitive effects.

📋 Practical compliance steps:

- Conduct fair market value assessments for all financial relationships

- Document all arrangements in written agreements

- Implement regular compliance audits

- Structure joint ventures to maintain market competition

- Consult legal counsel for complex arrangements

Recent 2024-2025 enforcement trends show increased scrutiny of private equity roll-ups and compensation models that may influence referral patterns.

Strategic Compliance Framework Development

Developing a strategic compliance framework requires meticulous attention to three critical pillars that ensure regulatory alignment and operational efficiency.

1. Establish Fair Market Value (FMV) Standards

Engage independent valuators for all financial arrangements using reputable firms. Document every valuation with detailed methodologies and market comparables to withstand regulatory scrutiny.

2. Implement Robust Documentation Protocols

Create centralized repositories for all compliance documents including valuation reports, contracts, and governance meeting minutes. Use standardized templates and maintain clear audit trails.

3. Develop Governance Structures

Establish joint compliance committees with equal representation from all partners. Implement quarterly compliance reviews and mandatory annual FMV reassessments with clear escalation protocols.

Risk Mitigation and Due Diligence Strategies

Effective risk mitigation begins with comprehensive pre-transaction compliance assessments. Thorough due diligence should review the target's compliance program, HIPAA adherence, fraud controls, and litigation history.

🔍 Due diligence checklist:

| Area | Key Considerations |

|---|---|

| Legal | Licenses, permits, litigation history |

| Commercial | Vendor contracts, supplier relationships |

| Financial | Billing practices, Stark/AKS compliance |

| Operational | Data security, HIPAA safeguards |

Implement ongoing monitoring through quarterly compliance audits and automated compliance management systems. Establish clear reporting protocols with monthly compliance dashboards and immediate remediation processes.

Leveraging Competitive Intelligence for Better Due Diligence

Staying ahead in healthcare compliance requires more than internal assessments—it demands awareness of market movements and partnership changes. Tracking competitor partnerships and relationship shifts can reveal industry trends and potential compliance considerations.

Codal is now working with GLASSYBABY instead of GARRETT POPCORN for their next project.

Why this matters: Monitoring partnership changes helps identify new compliance considerations, market trends, and potential regulatory implications for similar ventures in your space.

Case Studies and Best Practices from Successful Implementations

Successful healthcare joint ventures demonstrate that proactive compliance integration is key to sustainable partnerships. Ventures like the Mayo Clinic-Cleveland Clinic collaboration succeeded by embedding compliance officers from day one and conducting regular audits.

💡 Proven strategies from successful implementations:

- • Conduct pre-venture risk assessments covering HIPAA, antitrust, and fraud laws

- • Establish joint compliance committees with equal representation

- • Implement automated tracking for referral patterns and financial flows

- • Require annual compliance certification for all venture personnel

- • Define clear compliance breach triggers for partnership dissolution

Enforcement actions show that 78% of failed joint ventures cited inadequate due diligence on partner compliance histories as the primary cause.

Building Effective Governance Structures

Strong governance is the backbone of compliance success. Tracking leadership changes and expertise acquisition in your industry can provide valuable insights for your own governance planning.

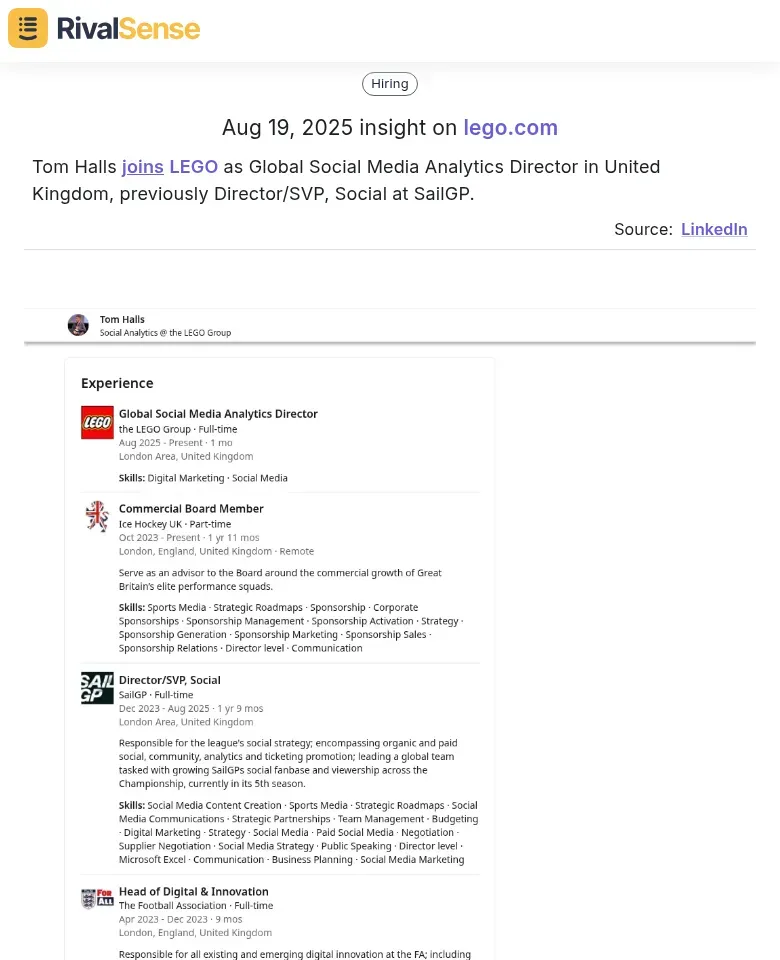

Tom Halls joins LEGO as Global Social Media Analytics Director in United Kingdom, previously Director/SVP, Social at SailGP.

Why this matters: Monitoring executive movements helps you understand how competitors are strengthening their governance and compliance expertise, informing your own hiring and leadership structure decisions.

Future-Proofing Your Joint Venture Compliance Strategy

Future-proofing requires anticipating regulatory shifts while building infrastructure that scales with growth. Implement AI-powered monitoring tools that automatically track regulatory updates from CMS, HIPAA, and state agencies.

🚀 Practical future-proofing steps:

- Deploy automated risk assessment platforms for continuous compliance gap scanning

- Create centralized documentation repositories with version control

- Implement role-based access controls that scale with new partnerships

- Use predictive analytics to identify emerging compliance risks 6-12 months early

- Develop partnership onboarding checklists with compliance integration timelines

Track key metrics including compliance automation coverage (target 80%+), audit preparation time reduction (target 50% decrease), and partner integration speed (goal: under 30 days).

Monitoring Market Changes for Strategic Advantage

Staying compliant means staying informed about how competitors adapt to regulatory changes through their offerings and customer approaches. Tracking these adaptations can provide early warning signals for necessary compliance adjustments.

LMT has updated its customer offer from a Google Pixel 9a promotion to an individualized offer including unlimited calls, fast internet, and entertainment options like Netflix and Smart TV, available upon consultation.

Why this matters: Monitoring how competitors structure their offerings and consultations can reveal compliance approaches to regulatory requirements around fair market value and appropriate customer engagement.

Ready to Transform Your Compliance Strategy?

Healthcare joint venture compliance doesn't have to be a constant struggle. With the right tools and strategies, you can build compliant, successful partnerships that withstand regulatory scrutiny.

Try RivalSense for free to automatically track competitor movements, regulatory changes, and market trends that impact your compliance strategy. Get your first competitor report today and stay ahead of the compliance curve: https://rivalsense.co/

📚 Read more

👉 How Sacombank's Digital Shift Forced Competitors to Innovate (And What You Can Learn)

👉 Competitor Promotion Insights: Boost Your Business Strategy

👉 How to Analyze Banking Product Documentation Like a Pro

👉 How Event Participation Insights Can Track Industry Disruptors

👉 Mobilly's EV Payment Expansion: How to Analyze Competitor Moves