A Step-by-Step Framework for Analyzing Competitors’ Market Entry Strategies

👀 Did you know that 78% of marketers credit subscriber segmentation as their most effective email marketing strategy? While segmentation drives results, understanding how competitors enter new markets can help you stay ahead. In this guide, we’ll break down a step-by-step framework to dissect competitors’ market entry moves—and turn those insights into actionable strategies.

🎯 Step 1: Identify Competitors (Direct, Indirect & Aspirational)

Start by categorizing competitors into three buckets:

- Direct: Companies offering identical/similar products.

- Indirect: Businesses solving the same problem with different solutions.

- Aspirational: Industry leaders you aim to emulate.

Example: When cybersecurity firm Cyberint expanded to Australia (its first client in the region), local cybersecurity providers suddenly faced a new direct competitor with global credibility.

Checklist for Identification:

- ✅ Monitor industry news and regulatory filings.

- ✅ Track social media for geo-targeted campaigns.

- ✅ Analyze patent registrations for new market hints.

🔍 Step 2: Gather Data Across Key Channels

Collect granular data on competitors’:

| Channel | Metrics to Track |

|---|---|

| Website | Pricing pages, localization, job postings |

| Social Media | Audience demographics, engagement trends |

| Registries | New trademarks, patents, subsidiaries |

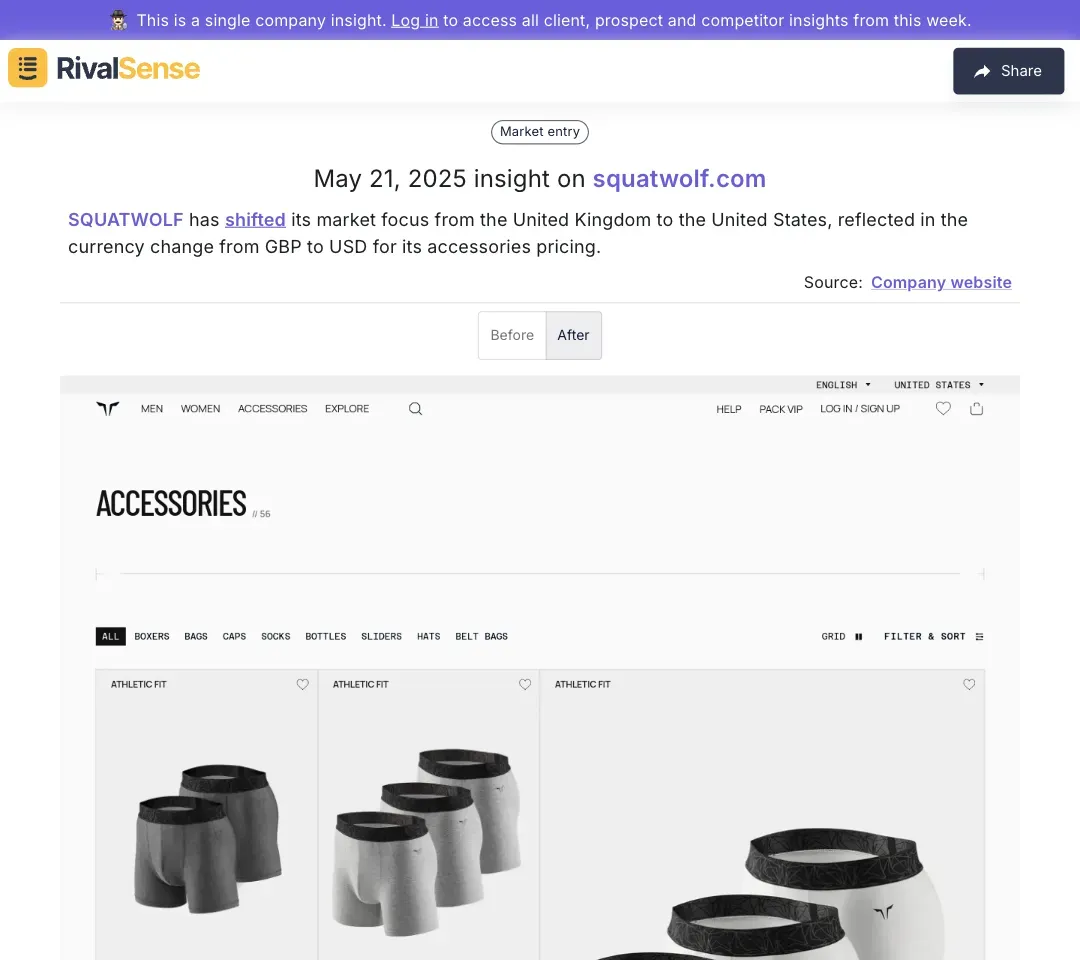

Example: Fitness apparel brand SQUATWOLF shifted focus from the UK to the US, reflected in its pricing currency switch from GBP to USD. Tracking website updates and payment gateways revealed this pivot.

🥊 Step 3: Analyze Strengths & Weaknesses (SWOT Framework)

Use SWOT to map competitors’:

| Strengths | Weaknesses | Opportunities | Threats |

|---|---|---|---|

| Global infrastructure | High pricing | Untapped markets | Regulatory hurdles |

Example: Zurich Insurance’s expansion into Argentina, Australia, and Japan highlights strengths in scaling commercial insurance. However, managing compliance across diverse regions could expose weaknesses in regulatory agility.

🛤️ Step 4: Funnel Hack Their Customer Journey

Map their funnel stages to identify gaps:

- Awareness: Are they dominating LinkedIn thought leadership?

- Consideration: Do they offer free trials or demos?

- Conversion: Is their checkout process frictionless?

Pro Tip: Borrow from the 78% segmentation statistic—analyze if competitors personalize email campaigns based on user behavior (e.g., abandoned cart triggers).

🚀 Step 5: Implement Findings into Your Strategy

Turn insights into action:

- Counter New Entrants: If a competitor enters your region, highlight local expertise in your messaging.

- Leverage Gaps: If their pricing is opaque, emphasize transparency in your campaigns.

- Adapt Quickly: Mirror successful tactics (e.g., localized pricing) while differentiating.

Ready to Decode Competitors’ Moves?

RivalSense automates competitor tracking across websites, social media, and registries—delivering actionable insights weekly. Try RivalSense Free and get your first report today. 📈

Competitor moves are inevitable. Your response shouldn’t be.

📚 Read more

👉 5 Common Pricing Strategy Mistakes Exposed by Competitor Tracking (And How to Avoid Them)

👉 How to Leverage Competitor Product Insights to Enhance Your Own Strategy: 5 Actionable Steps

👉 How Strategic Partnerships Reveal Hidden Market Opportunities: A Competitor Analysis Case Study

👉 Regulatory Compliance Oversights in Competitor Analysis That Could Cost Your Business