A Practical Competitor Sales Tracking Framework for Commercial Insurance Brokers

The commercial insurance brokerage landscape is undergoing unprecedented volatility, with 847 M&A transactions in 2024 alone—a 5% increase from 2023—creating intense market consolidation pressures. In this environment, traditional reactive monitoring fails to provide the real-time intelligence needed to compete effectively. Instead of reacting to market changes, competitor sales tracking transforms this dynamic by providing actionable intelligence for strategic decision-making.

Practical steps to implement effective tracking include:

- Identify Key Competitors: Focus on 5-10 primary rivals in your geographic and specialty markets.

- Monitor Sales Activity: Track new client wins, policy renewals, and team expansions.

- Analyze Pricing Trends: Document competitor rate changes and coverage adjustments.

- Map Client Movements: Identify which clients are switching brokers and why.

This framework enables you to anticipate market shifts, adjust your value proposition, and make data-driven decisions about resource allocation, specialization, and growth strategies. 🎯

Key Competitor Sales Metrics Every Broker Should Monitor

Tracking the right metrics is essential for turning data into actionable strategies. Understanding what to monitor helps you stay ahead of market trends. To effectively track competitor sales, commercial insurance brokers should focus on three critical metrics.

First, monitor pricing strategies and premium rate changes across specialty lines like cyber liability, D&O, and professional liability. Track how competitors adjust rates quarterly, identify which lines they're discounting to gain market share, and note any bundling strategies. Create a rate comparison spreadsheet with columns for competitor, line of business, base rate, discounts offered, and renewal rate changes.

Second, analyze market share shifts and client acquisition patterns in your target segments. Track which competitors are winning mid-market vs. enterprise clients, their industry specialization trends, and client retention rates. Use public filings, industry reports, and LinkedIn to identify new client wins. Create a quarterly dashboard showing competitor market share by segment and their win/loss patterns.

Third, monitor sales team expansion and territory coverage developments. Track new hires, territory realignments, and office openings. Follow key sales leaders on LinkedIn, monitor job postings for sales roles, and note when competitors enter new geographic markets or industry verticals. Maintain a competitor sales org chart with team sizes, territories covered, and key personnel changes.

Practical tip: Set up Google Alerts for competitor names plus terms like 'hiring,' 'expansion,' 'new office,' and 'client win.' Review competitor websites quarterly for team updates and service area changes. 📊

Data Sources and Collection Methods for Effective Sales Intelligence

Gathering intelligence from diverse sources ensures a comprehensive view of competitor activities. Effective sales intelligence requires systematic data collection from multiple sources. Here’s a practical framework for commercial insurance brokers:

-

Regulatory Intelligence: Access state DOI filings and SERFF rate approval databases to analyze competitor pricing strategies. Monitor rate change approvals and form filings to anticipate market shifts. Tip: Set up alerts for key competitors in your target states.

-

Digital Footprint Analysis: Track competitor websites, social media, and digital advertising. Use tools to monitor their content marketing, lead magnets, and webinar schedules. Checklist: Review their LinkedIn activity, Google Ads keywords, and content download offers weekly.

-

Industry Network Intelligence: Join broker associations and attend virtual events. Participate in LinkedIn groups where commercial clients discuss insurance needs. Practical step: Create a spreadsheet to log competitor mentions from client conversations and industry forums.

-

Client Feedback Channels: Implement systematic client debriefs after lost deals. Ask specific questions about competitor proposals, pricing, and service differentiators. Hint: Use anonymous surveys to gather intelligence on why clients chose competitors.

-

Real-time Monitoring: Set up Google Alerts for competitor news and leadership changes. Follow key executives on social media for strategic insights. Actionable advice: Dedicate 30 minutes weekly to review all intelligence sources and update your competitive dashboard.

Remember: Cross-reference data from multiple sources to validate intelligence and identify patterns in competitor sales approaches. 🔍

Leveraging Competitor Insights for Strategic Advantage

Real-world examples from other industries can illustrate how competitor insights drive business strategy. For instance, tracking product launches can reveal a competitor's focus on innovation and market expansion.

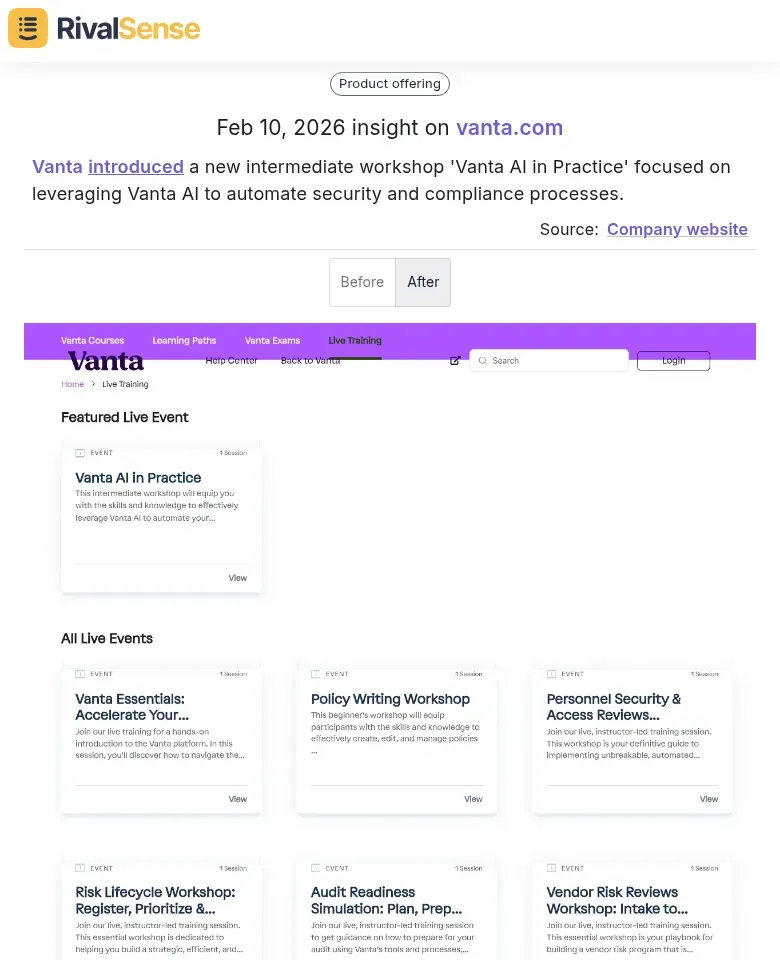

Vanta introduced a new intermediate workshop 'Vanta AI in Practice' focused on leveraging Vanta AI to automate security and compliance processes. This type of insight is valuable because it signals where competitors are investing in education and product enhancement, helping you anticipate shifts in service offerings or client expectations in your own market.

Partnerships and new module announcements often indicate strategic expansions into new compliance areas or marketing synergies.

Decision Focus announced a new Data Privacy module for global compliance and extended their sponsorship partnership with Danish racing talent Alba Larsen for data-driven performance. Monitoring such partnerships can provide clues about brand positioning and target audiences, useful for refining your own marketing and partnership strategies.

Insights into AI adoption highlight how competitors are leveraging technology for operational efficiency, which can prompt you to evaluate similar investments.

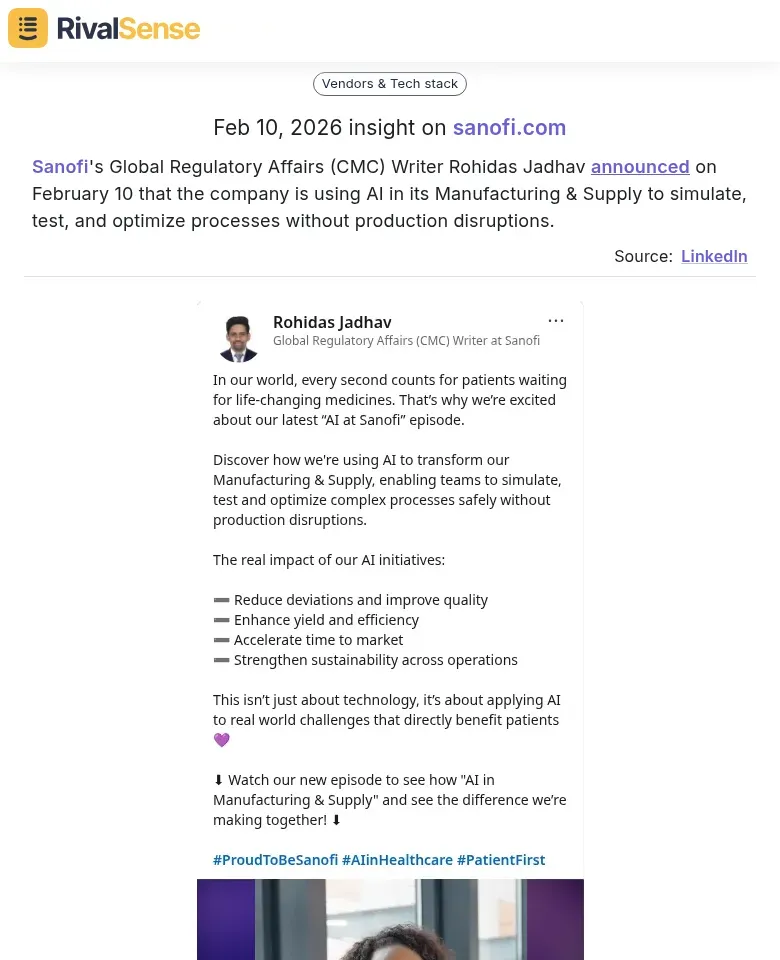

Sanofi's Global Regulatory Affairs (CMC) Writer Rohidas Jadhav announced on February 10 that the company is using AI in its Manufacturing & Supply to simulate, test, and optimize processes without production disruptions. This demonstrates the value of tracking technological advancements, as it can reveal industry trends that may impact service delivery or cost structures in commercial insurance.

Building Your Competitor Sales Tracking Framework: A Step-by-Step Guide

Implementing a structured framework ensures consistency and effectiveness in your tracking efforts. By following a step-by-step approach, you can build a system that integrates seamlessly into your business operations.

Step 1: Technology Stack Selection

Start with a competitor tracking platform like RivalSense that monitors insurance marketplaces, broker websites, and LinkedIn Sales Navigator. Add web scraping tools for pricing pages and Google Alerts for news mentions. Use CRM integrations (Salesforce/HubSpot) to automatically log competitor mentions from sales calls. Pro tip: Create a centralized dashboard in Google Sheets or Airtable where all data flows.

Step 2: Establish KPIs & Benchmarks

Track these metrics monthly:

- Quote-to-close ratios (compare to industry average of 15-25%)

- Average policy premium changes

- New product/service launch frequency

- Client retention rates

- Digital marketing spend (SEMrush for ad tracking)

Set benchmarks against top 3 competitors and industry leaders like Marsh or Aon.

Step 3: Cross-Functional Workflows

Create a weekly intelligence digest for sales teams highlighting competitor pricing changes. Establish a monthly competitive review meeting with underwriting, marketing, and sales leadership. Use a simple RAG (Red-Amber-Green) system to prioritize threats: Red = immediate response needed (competitor undercutting rates by >10%), Amber = monitor closely, Green = no action required.

Checklist:

☐ Implement automated monitoring tools

☐ Define 5-7 key competitor metrics

☐ Schedule regular cross-departmental reviews

☐ Create action templates for common scenarios

☐ Measure ROI quarterly (sales won against tracked competitors) 📈

Case Studies: Successful Sales Tracking Implementation in Insurance Brokerages

Learning from real-world applications can accelerate your own implementation. These case studies show how systematic tracking leads to tangible business outcomes.

Case Study 1: Predictive Monitoring Identifies Competitor Expansion 6 Months Early

A mid-sized commercial insurance brokerage implemented predictive monitoring of competitor job postings, LinkedIn activity, and office expansion filings. By tracking a regional competitor's hiring patterns for specialized underwriters in cybersecurity insurance, they identified expansion plans 6 months before the competitor officially entered their market. This early warning allowed them to:

• Strengthen client relationships in the cybersecurity sector

• Develop targeted retention strategies

• Launch a preemptive marketing campaign

Case Study 2: Pricing Strategy Adjustments Based on Real-Time Intelligence

A national brokerage used systematic tracking of competitor rate sheets and policy terms across 12 major markets. When they detected a competitor offering 15% lower premiums for manufacturing clients with specific safety certifications, they:

• Analyzed the competitor's loss ratios in that segment

• Developed a tiered pricing model that matched rates while maintaining profitability

• Implemented the adjustment within 2 weeks, retaining 92% of at-risk clients

Quantifiable Results from Systematic Frameworks:

• 28% reduction in client churn through early competitive threat detection

• 19% increase in win rates for new business proposals

• 42% faster response time to competitive pricing moves

• ROI of 3.5x within first year of implementation ✅

Future-Proofing Your Competitive Advantage: Advanced Tracking Strategies

Staying ahead requires evolving your tracking methods to anticipate future moves. To future-proof your competitive advantage, move beyond reactive tracking to predictive intelligence. AI-powered analytics can forecast competitor sales initiatives by analyzing historical patterns, market signals, and behavioral data.

Integrate sales tracking into a broader competitive intelligence ecosystem by connecting data from multiple sources: social media monitoring, job postings, client reviews, regulatory filings, and industry events. This holistic view reveals strategic patterns invisible in isolated data. Use tools that centralize this intelligence for cross-functional access across sales, marketing, and leadership teams.

Practical steps:

- Implement AI tools that analyze competitor website changes, pricing adjustments, and marketing campaigns.

- Create automated alerts for key competitor activities (new hires, office expansions, client wins).

- Establish regular competitive intelligence review meetings to adapt strategies.

- Develop competitor response playbooks for common scenarios.

- Continuously refine tracking metrics based on market feedback. 🚀

Take Action with Competitor Intelligence

By implementing this framework, you can transform raw data into strategic insights that drive growth. To streamline your competitor tracking, consider using specialized tools that automate monitoring and reporting.

Ready to get started? Try out RivalSense for free to automate tracking of competitor product launches, pricing updates, partnerships, and more—delivered in a weekly email report. Get your first competitor report today and gain the edge you need in the competitive commercial insurance market!

📚 Read more

👉 How Pfizer's Oncology Guide Reveals Patient Accessibility Gaps: A Competitive Intelligence Blueprint

👉 Mastering Competitor Differentiation: A Guide to Internet Intelligence for B2B Leaders

👉 Predictive Sales Forecasting: Outmaneuver Competitors in Organizational Consulting

👉 How Competitor Insights Solve Market Entry Challenges for Key Account Growth