5 Actionable Strategies to Leverage Competitor Insights from Events

In the fast-paced world of B2B business, staying ahead requires more than just monitoring digital footprints. Industry events—virtual or in-person—are strategic goldmines revealing competitor priorities, market positioning, and innovation roadmaps. Tracking competitor participation provides actionable intelligence for refining your own strategy, identifying market gaps, and anticipating industry shifts.

For example, when a competitor emphasizes specific technologies at trade shows, it signals emerging trends worth your attention. By systematically analyzing their event activities—from speaking topics to partnership announcements—you gain insights to sharpen your competitive edge. Let's explore five practical strategies to transform these observations into growth opportunities.

Strategy 1: Analyze Competitor Speaking Engagements for Market Trends

Speaking engagements reveal competitors' strategic priorities and market focus areas. When executives present at conferences, they often disclose roadmap directions or highlight emerging technologies. Analyzing these appearances helps you benchmark your innovation pace and anticipate industry shifts.

Real-World Insight:

Erica Anderson, CRO at Notion, participated in a panel during NYC TECH WEEK discussing scalable software solutions. Tracking such engagements exposes thought leadership focus and R&D priorities—critical for adjusting your product narrative.

Actionable Steps:

- 📅 Monitor competitor event schedules via their websites/LinkedIn

- 🔍 Note recurring presentation themes (e.g., AI, sustainability)

- 📊 Compare their focus areas against your strategy using a SWOT table:

| Competitor Theme | Your Position | Strategic Action |

|---|---|---|

| AI Integration | Leading | Accelerate marketing |

| Blockchain | Lagging | Research investment |

- 🎥 Watch session recordings for messaging cues

- ✨ Identify gaps where you can differentiate offerings

Strategy 2: Evaluate Sponsorship Choices for Brand Positioning

Sponsorship decisions reflect where competitors allocate marketing budgets and which audiences they prioritize. High-profile sponsorships signal market confidence, while niche events reveal targeted segment plays. Decoding these choices helps optimize your own event ROI.

Real-World Insight:

Neat sponsored Microsoft's BeConnected event to showcase AI audio solutions. Observing such sponsorships reveals technological partnerships and audience targeting—vital for repositioning your brand.

Action Plan:

- ✅ Create an event tracking matrix:

| Competitor | Event Tier | Key Message | Audience |

|---|---|---|---|

| Company A | Global | Cloud AI | Enterprises |

| Company B | Regional | Data Security | SMBs |

- 🎯 Identify underserved events/audiences

- 💡 Reverse-engineer their booth themes to improve your exhibits

- 🔄 Allocate budget to counter their visibility in strategic venues

Strategy 3: Monitor Competitor Networking and Partnerships

Event networking uncovers covert alliances and expansion plans. Competitors often test partnership waters at conferences before official announcements. Tracking their connections helps predict market moves and identifies potential collaborators for your business.

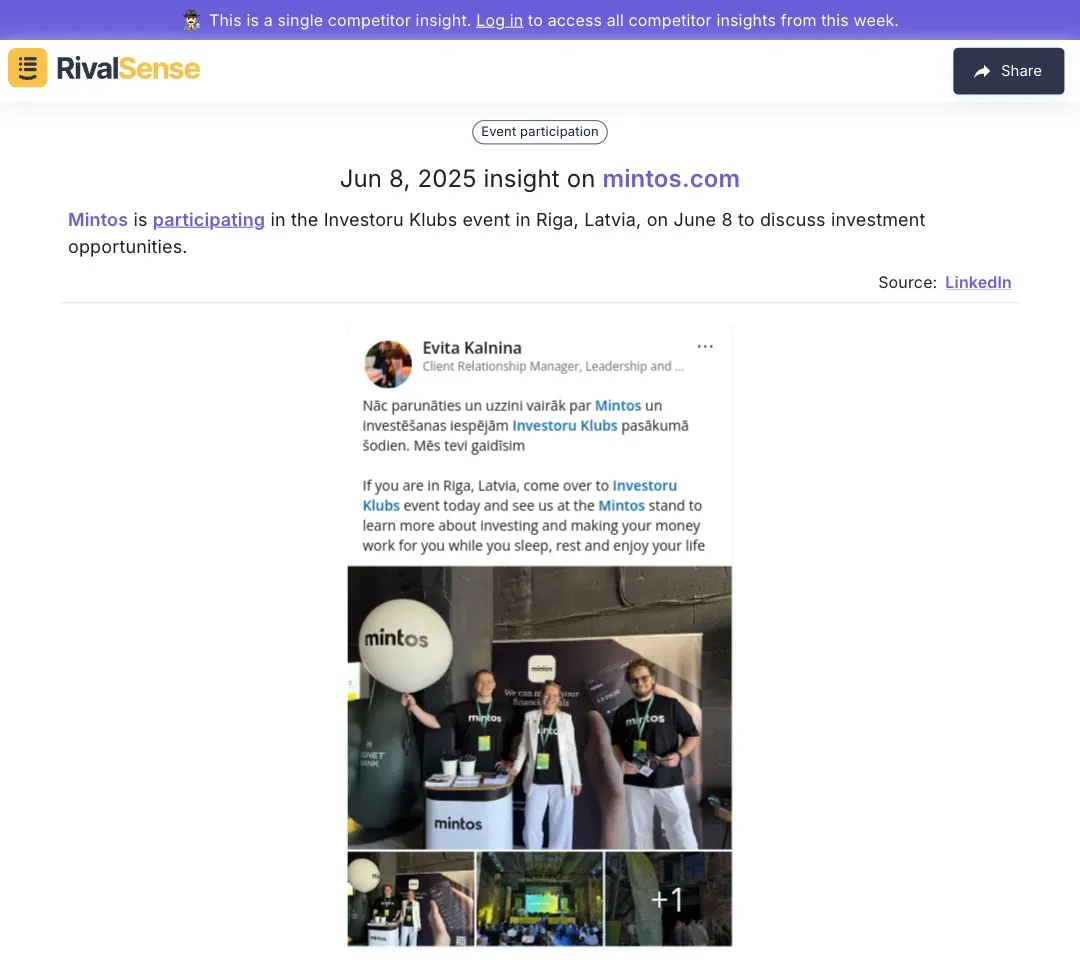

Real-World Insight:

Mintos participated in Investoru Klubs to discuss investment opportunities. Such participation highlights market prioritization and networking intent—essential for anticipating regional expansions.

Execution Checklist:

- 👥 Track LinkedIn connections of competitor execs post-events

- 🤝 Document frequent interaction patterns (e.g., vendor types)

- 🌐 Attend same events to:

- Identify their "must-meet" contacts

- Discover unaffiliated potential partners

- 📈 Log observations quarterly to spot relationship trends

Strategy 4: Gather Intelligence from Event Content and Materials

Presentation decks, whitepapers, and demos reveal technical capabilities and positioning nuances. Analyzing these materials helps benchmark your offerings and exposes competitive vulnerabilities to exploit.

Practical Approach:

- 🗂️ Archive competitor event materials (slide decks, brochures)

- 🧩 Deconstruct their messaging pillars:

- Pain points emphasized

- Solution differentiators

- Pricing hints

- ⚖️ Conduct feature-by-feature comparisons

- 🎯 Identify 2-3 actionable improvements for your:

- Product roadmap

- Sales collateral

- Demo sequences

Strategy 5: Implement Insights into Your Business Strategy

Raw intelligence only creates value when operationalized. Systematically convert findings into tactical plans across departments—from R&D to marketing—ensuring insights drive measurable outcomes.

Implementation Framework:

- 🗓️ Hold monthly "competitor insight syncs" with leadership

- 🎯 Assign ownership for each strategic adjustment:

| Insight Type | Owner | Timeline |

|---|---|---|

| Feature Gap | Product VP | Q3 |

| Underserved Audience | Marketing | Immediate |

- 📊 Measure impact through:

- Win/loss analysis

- Market share shifts

- Lead quality improvements

- 🔁 Establish feedback loops between sales and product teams

Accelerate Your Event Intelligence with RivalSense

Manually tracking competitor events across websites, registries, and social media drains resources. RivalSense automates this process—monitoring product launches, pricing changes, partnerships, and event participations to deliver actionable insights weekly.

Why founders choose RivalSense:

- 🚀 Save 10+ hours/week on competitive research

- 🔔 Get alerts on critical moves like leadership changes or regulatory shifts

- 📈 Spot trends before they impact your market position

👉 Try RivalSense free today at https://rivalsense.co/ and receive your first competitor report!

📚 Read more

👉 Navigating Tariff Uncertainty: How Competitive Intelligence Becomes Your Strategic Compass

👉 Decoding Executive Moves: How Stephen Kruger's Transition Impacts Competitive Landscapes

👉 How Trend Micro's Android Botnet Research Reveals Critical Competitive Shifts

👉 Practical Competitive Intelligence for Leadership: A Step-by-Step Guide

👉 Step-by-Step Guide to Strategic AR/VR Competitive Research