2026 Warehousing Financial Trends: Competitor Analysis for Distribution Leaders

As we enter 2026, warehousing and distribution leaders face unprecedented financial pressures alongside transformative opportunities. Rising energy costs, labor shortages, and supply chain volatility are squeezing margins, while automation investments and sustainability initiatives demand significant capital. Simultaneously, e-commerce growth and nearshoring trends create expansion opportunities for agile operators.

In this complex landscape, competitor financial analysis becomes non-negotiable for strategic decision-making. Understanding how rivals are allocating capital, managing costs, and funding growth provides critical intelligence for your own financial planning. Leaders who track competitor financial moves gain early warning of market shifts and can benchmark their performance against industry standards.

Key financial metrics will define competitive advantage in 2026:

- Operating margin trends and cost structure analysis

- Capital expenditure patterns for automation vs. expansion

- Working capital efficiency and inventory turnover rates

- Sustainability investment ROI and green financing strategies

- Debt-to-equity ratios and financing mix comparisons

💡 Practical tip: Create a quarterly competitor financial dashboard tracking these metrics. Start by analyzing public financial statements, then supplement with industry reports and market intelligence. Look beyond raw numbers to understand the strategic intent behind financial decisions—are competitors prioritizing efficiency over growth, or vice versa?

🕵️ Competitive Intelligence in Action: Real-World Insights

Beyond financial metrics, tracking real-time competitor activities can unveil strategic shifts that impact your business. Here are examples from RivalSense, showing how different insights inform strategy:

-

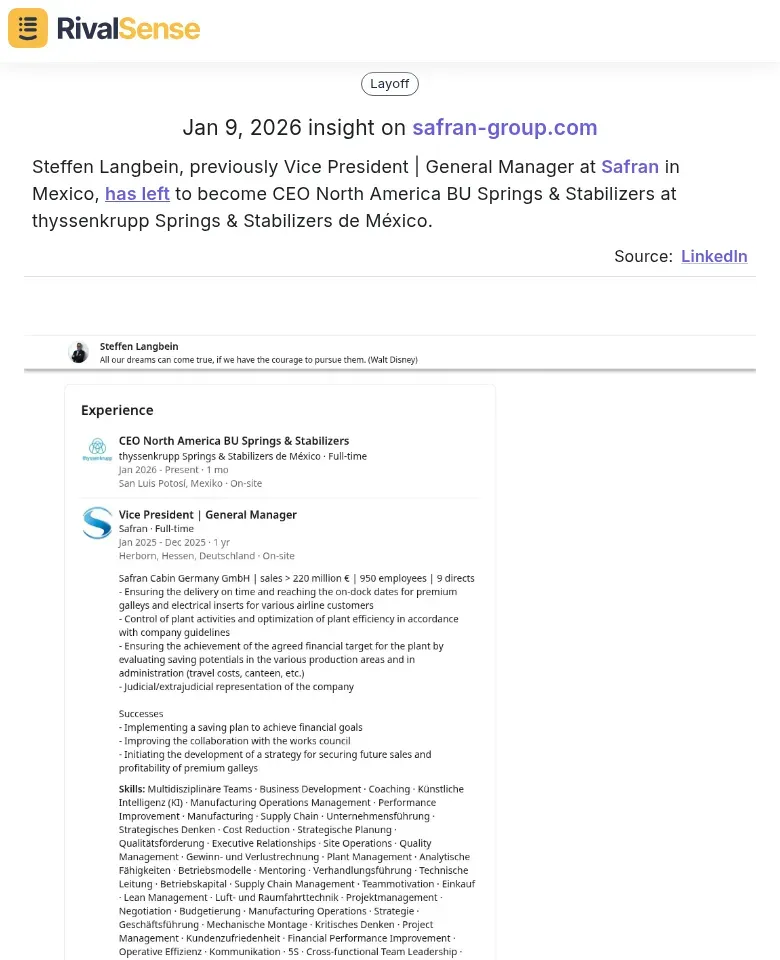

Management Changes Signal Strategic Priorities

Steffen Langbein, previously Vice President | General Manager at Safran in Mexico, has left to become CEO North America BU Springs & Stabilizers at thyssenkrupp Springs & Stabilizers de México.

Why it matters: Executive moves often precede new market focuses or operational restructuring. In warehousing, such changes can hint at geographic expansions or efficiency drives, helping you anticipate competitive moves. -

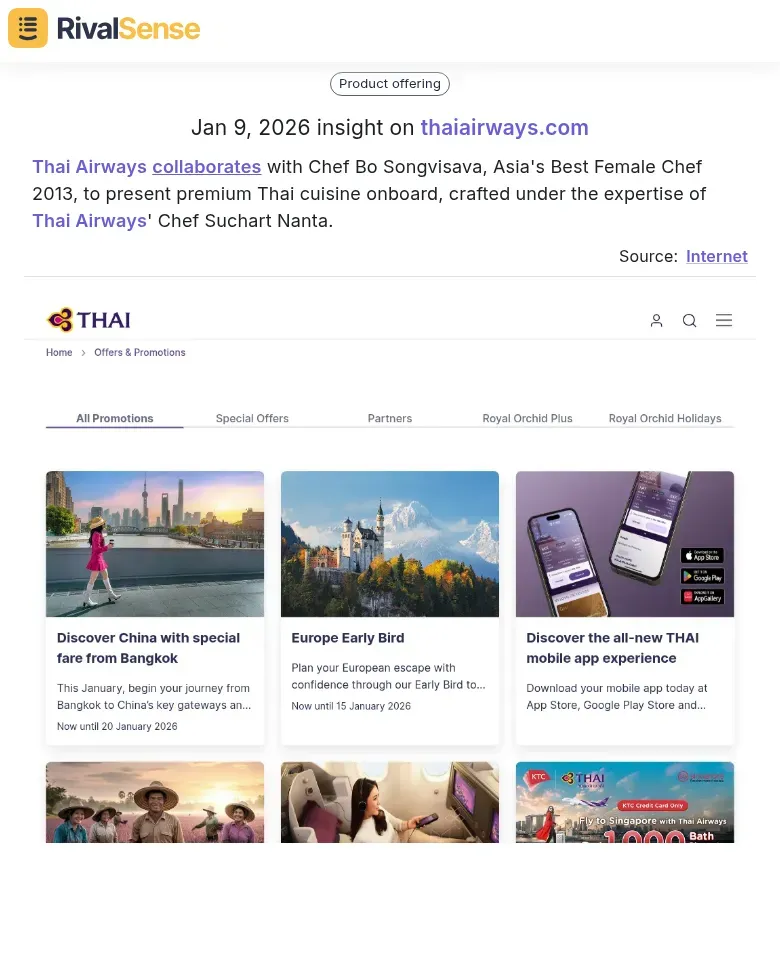

Partnerships Drive Revenue Innovation

Thai Airways collaborates with Chef Bo Songvisava, Asia's Best Female Chef 2013, to present premium Thai cuisine onboard, crafted under the expertise of Thai Airways' Chef Suchart Nanta.

Why it matters: Strategic partnerships can lead to service enhancements or new revenue streams. For distribution leaders, monitoring collaborations reveals trends in value-added services, guiding your own bundling strategies. -

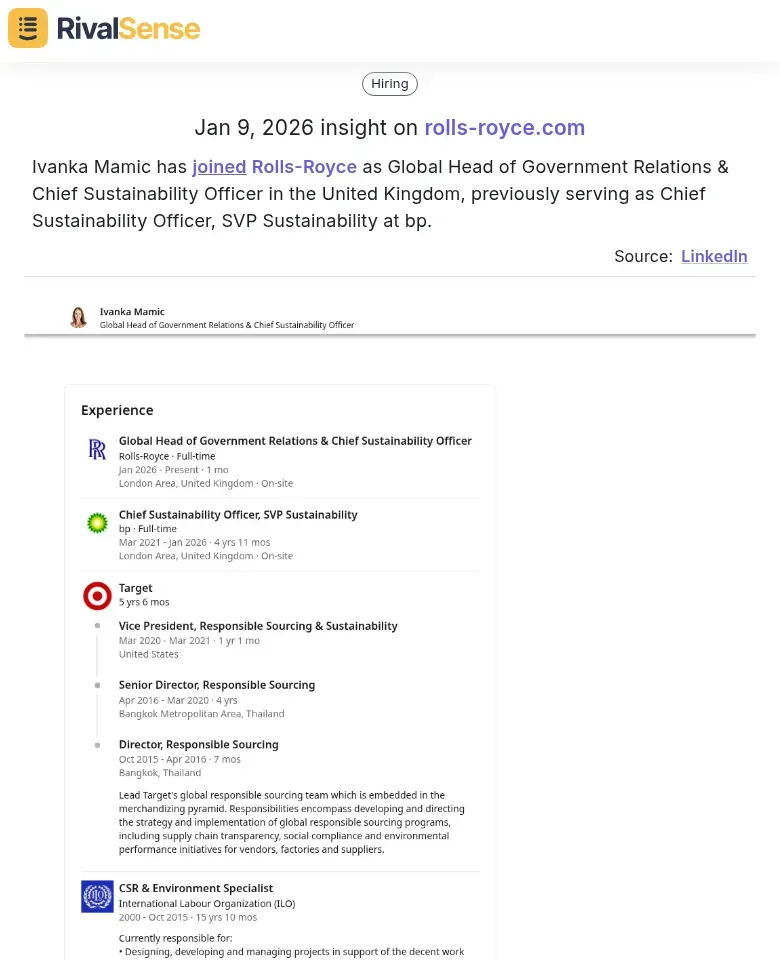

Sustainability Leadership Appointments

Ivanka Mamic has joined Rolls-Royce as Global Head of Government Relations & Chief Sustainability Officer in the United Kingdom, previously serving as Chief Sustainability Officer, SVP Sustainability at bp.

Why it matters: Hiring for sustainability roles reflects commitment to ESG goals, which influence financial strategies, investor relations, and operational costs. In warehousing, this can signal upcoming green investments or regulatory compliance shifts.

💰 Capital Investment Trends: Where Competitors Are Placing Their Bets

In 2026, distribution leaders are strategically allocating capital between infrastructure and operational technology. Analyzing competitor investments reveals patterns that can guide your own financial planning. Leading companies are shifting from traditional warehouse infrastructure toward flexible automation solutions, with 38% increasing automation budgets and average materials-handling equipment spend reaching $1.46 million.

🤖 Automation Investment Patterns:

- Robotics-as-a-Service (RaaS) adoption is accelerating, allowing companies to deploy robotic fleets under subscription models instead of large upfront capital investments.

- Software-first approach: Warehouse Execution Systems (WES) are becoming central nervous systems, with software investments outpacing hardware as companies prioritize orchestration platforms.

- Inbound automation focus: After years of outbound fulfillment focus, competitors are now investing heavily in robotic de-palletizing, AI vision inspection, and autonomous mobile robots for inbound operations.

📊 Capital Expenditure Strategy Comparison:

- Infrastructure vs. Technology: Leading companies allocate 25% of capital spending to automation, with modular solutions replacing traditional racking and conveyors.

- Regional variations: APAC leads in flexible automation models, Europe prioritizes sustainable automation for energy efficiency, while North America focuses on end-to-end integration across multi-site networks.

📈 ROI Expectations & Payback Periods:

| Metric | Typical Range |

|---|---|

| Payback Period | 6-24 months |

| Travel Time Reduction | 30-40% |

| Throughput Increase | 40% |

| Inventory Accuracy | 99.99% |

✅ Practical ROI Checklist:

- Start with single-zone pilots targeting highest-volume areas.

- Calculate labor savings (20-30% reduction in manual costs).

- Model error avoidance costs from mis-shipments.

- Include soft benefits: safety improvements and employee satisfaction.

- Use phased roll-outs with 4-6 week sprints between zones.

🔍 Competitor Intelligence Tip: Track competitors adopting RaaS models and WES platforms—these indicate strategic shifts toward operational flexibility rather than fixed infrastructure investments. Monitor quarterly performance metrics to benchmark your payback periods against industry leaders achieving 6-month ROI on targeted automation initiatives.

⚙️ Operational Cost Structures: Benchmarking Efficiency Against Competitors

Mastering operational cost optimization is critical for maintaining margins in 2026. Top-performing distribution companies excel in three key areas, and benchmarking against them can reveal efficiency gaps. First, labor cost strategies have evolved beyond simple headcount reduction. Leaders are implementing AI-powered workforce management systems that predict demand spikes and optimize scheduling, reducing overtime by 15-25%.

Second, energy and sustainability costs are now strategic advantages. Companies are installing smart energy management systems that automatically adjust lighting, heating, and cooling based on real-time occupancy. Solar panel installations with battery storage provide 30-40% of facility energy needs, with ROI periods under 3 years.

Third, technology-driven initiatives deliver measurable ROI. Autonomous mobile robots (AMRs) reduce picking costs by 35-50%, while predictive maintenance systems cut equipment downtime by 40%. IoT sensors optimize space utilization, increasing storage density by 15-20%.

✅ Practical Checklist:

- Audit labor costs with AI analytics tools.

- Implement cross-training for 30% of workforce.

- Install smart energy monitoring systems.

- Evaluate solar/battery ROI for your region.

- Pilot AMRs in high-volume picking zones.

- Deploy predictive maintenance sensors on critical equipment.

- Measure space utilization monthly with IoT sensors.

📈 Revenue Models and Pricing Strategies: Learning from Market Leaders

Revenue models in warehousing are evolving rapidly, with leaders leveraging value-added services and technology integration. Understanding competitor approaches helps you identify opportunities for premium pricing and reduced churn. Successful competitors now bundle services like kitting, labeling, and returns management into tiered pricing structures, creating predictable recurring revenue streams.

Technology-enabled revenue streams are accelerating, with competitors developing IoT monitoring subscriptions, AI-powered inventory optimization tools, and blockchain-based supply chain visibility platforms. These digital offerings generate 30-40% margins compared to traditional warehousing services.

🚀 Practical Steps to Implement:

- Audit competitors' service bundles and identify gaps in your offerings.

- Pilot 2-3 technology add-ons with existing clients before full rollout.

- Implement dynamic pricing algorithms that adjust rates based on demand signals, fuel costs, and capacity utilization.

- Create flexible contract structures with minimum commitments plus variable pricing tiers.

💡 Key Insight: Market leaders are shifting from square-footage pricing to outcome-based models where clients pay for throughput efficiency and inventory accuracy rather than just space. This requires sophisticated tracking systems but commands 20-30% price premiums while reducing client churn.

🛡️ Financial Risk Management: How Competitors Are Navigating Uncertainty

Financial risk management has become a cornerstone of strategic planning in 2026. Distribution leaders are adopting sophisticated strategies to mitigate disruptions and ensure resilience. Leading companies implement multi-layered supply chain disruption mitigation by diversifying supplier networks across 3+ regions and maintaining 30-45 days of critical inventory buffers.

Top performers use structured technology investment risk assessment frameworks. The 4-Pillar Evaluation Model assesses: 1) ROI timeline (target: <18 months), 2) integration complexity, 3) scalability potential, and 4) competitive advantage duration. Companies scoring above 80% on this framework achieve 35% higher technology ROI.

✅ Practical Financial Contingency Planning:

- Maintain 6-9 months of operating cash reserves.

- Establish flexible credit facilities equal to 25% of annual revenue.

- Implement scenario-based budgeting with 3 financial models (optimistic, realistic, conservative).

- Conduct quarterly stress tests on key financial metrics.

- Develop rapid response protocols for 15%+ market volatility events.

📊 Insight: Leading competitors allocate 5-7% of revenue to risk management initiatives, with those implementing comprehensive frameworks reporting 50% faster recovery from economic shocks.

🎯 Strategic Recommendations: Applying Competitor Insights to Your Financial Strategy

Building a data-driven competitor monitoring framework is essential for informed decision-making. Start by identifying 3-5 key competitors and tracking their quarterly financial metrics: revenue growth, operating margins, capital expenditures, and debt ratios. Use automated tools to monitor their SEC filings, earnings calls, and investor presentations.

Prioritize investments by analyzing competitor success patterns. Look for correlations between specific investments (automation, sustainability initiatives, geographic expansion) and financial outcomes. Identify market gaps where competitors are underinvesting but customer demand is growing. For example, if competitors cut back on cold chain infrastructure but e-commerce grocery demand rises 15% annually, that's a strategic opportunity.

Create a flexible financial strategy with quarterly review cycles. Establish trigger points for strategy adjustments: if 2+ competitors shift to variable cost models, reassess your fixed cost structure. Maintain a 15-20% 'strategic flexibility fund' for opportunistic investments when competitors face financial constraints.

✅ Checklist for Implementation:

- Set up automated competitor financial data collection.

- Identify 3 key success patterns from top performers.

- Map 2 market gaps with growth potential.

- Establish quarterly strategy review process.

- Create contingency plans for 3 competitive scenarios.

🔮 Conclusion: Stay Ahead with Continuous Competitor Intelligence

In 2026, financial success in warehousing and distribution hinges on proactive competitor analysis. By benchmarking against industry leaders, you can optimize capital allocation, control costs, innovate revenue models, and manage risks effectively. Regularly updating your insights ensures you adapt to market shifts swiftly.

To streamline this process, consider leveraging tools like RivalSense, which tracks competitor product launches, pricing updates, partnerships, management changes, and more across websites, social media, and registries. It delivers weekly email reports with actionable intelligence.

👉 Try RivalSense for free today at https://rivalsense.co/ and get your first competitor report to start making data-driven financial decisions!

📚 Read more

👉 Twitter Competitor Intelligence: A Step-by-Step Guide for B2B Key Account Success

👉 Data-Driven Key Account Strategies: Actionable Competitive Intelligence

👉 Competitor Ad Analysis: Transforming Regulatory Compliance into Strategic Advantage

👉 Decoding Competitor Moves: Scrapingdog's API Enhancements and What They Mean